In the race to bring real-world assets on-chain, the blockchain world has hit a seemingly impossible wall. Traditional finance demands compliance—knowing who is involved and ensuring every trade follows the law. Meanwhile, blockchain's promise is rooted in privacy and decentralization. For years, these two worlds have been at odds, stalling the tokenization of everything from stocks to real estate. That is, until now.

Enter DUSK Network. While other privacy coins face regulatory uncertainty, DUSK is engineered from the ground up with a different philosophy: "Private by default, accountable when required.". It’s not just another privacy token; it's the first Layer-1 blockchain built specifically for the compliant tokenization of regulated assets. As 2026 unfolds as the "Year of Asset Tokenization," DUSK has emerged not merely as a participant, but as the definitive core infrastructure making it all possible.

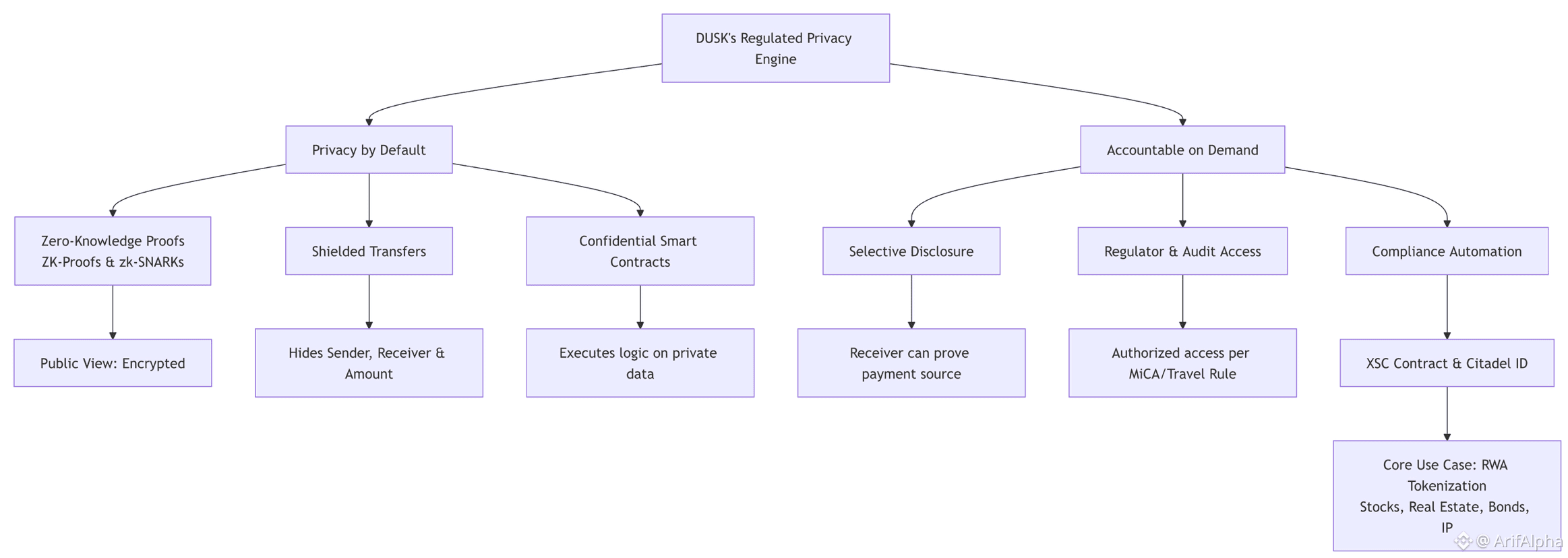

The Architecture of Trust: Privacy Meets Regulation

DUSK’s innovation isn't a single feature, but a holistic system designed to resolve the compliance paradox. Its technical stack acts like a precision-engineered compliance engine, where every component ensures privacy without sacrificing auditability.

Imagine the flow of a tokenized stock trade on DUSK. The entire process is shielded by zero-knowledge proofs (ZK-Proofs), keeping transaction amounts and participant identities encrypted from the public eye. However, unlike fully anonymous chains, a critical back channel exists. Authorized regulators can be granted access to necessary data, ensuring the network aligns perfectly with frameworks like the EU’s MiCA regulation.

This is powered by two groundbreaking pieces of technology:

The Confidential Security Token (XSC) Contract: This is the backbone of asset tokenization on DUSK. It automates the entire asset lifecycle—issuance, dividend distributions, and voting rights—on-chain while maintaining end-user privacy.

Citadel (Self-Sovereign Identity): This protocol revolutionizes KYC. Instead of repeatedly handing over your passport, you cryptographically prove you meet criteria (e.g., "over 18," "accredited investor") without revealing the underlying document. It gives users control and institutions a verifiable, compliant seal of approval.

The following mind-map illustrates how these components work together to create DUSK's unique "regulated privacy" environment:

From Theory to Reality: Real-World Assets in Action

This technology isn't just theoretical. DUSK is already enabling tangible use cases that bridge traditional finance and decentralized innovation.

*Tokenizing Stocks for SMEs**: Small and medium-sized enterprises have long been locked out of public markets by cost and complexity. On DUSK, a company can tokenize its equity through the XSC contract. This creates a liquid, transparent, and compliant digital stock that can be traded 24/7, opening capital access while automating shareholder rights and dividends.

Democratizing Real Estate Investment: By tokenizing property ownership, DUSK enables fractional investment in real estate assets. This transforms a typically illiquid, high-barrier market into one where smaller investors can participate, increasing liquidity and making markets more efficient.

Unlocking Intellectual Property Value: Patents, copyrights, and trademarks are incredibly valuable but notoriously difficult to trade. Tokenizing IP on DUSK creates a new, liquid asset class. Inventors and artists can monetize their work more efficiently, while investors gain access to a previously untapped market with high growth potential.

The Market Takes Notice: More Than a Narrative

The market has begun to recognize DUSK’s foundational value. In early 2026, as broader markets experienced volatility, DUSK’s price saw a significant surge, outperforming established privacy coins like Dash and Zcash. Analysts point to this as a narrative rotation—capital moving from generic privacy concepts to projects with tangible utility and a viable regulatory path.

The launch of the DuskEVM has been a major catalyst, allowing developers familiar with Ethereum’s Solidity language to seamlessly build privacy-preserving applications. Furthermore, partnerships with licensed entities like the Dutch Multilateral Trading Facility (MTF) NPEX provide a clear, compliant bridge for securities to enter the blockchain space.

Joining the New Financial Frontier

DUSK Network represents a fundamental shift. It moves blockchain from a rebellious experiment to responsible financial infrastructure. It proves that we don’t have to choose between privacy and progress; we can engineer systems that respect individual sovereignty while meeting the legitimate needs of a global, regulated economy.

For developers, it offers a familiar playground (EVM) with superpowers (native privacy). For investors, it provides exposure to the multi-trillion-dollar RWA tokenization trend through its essential utility token. For institutions, it finally delivers a blockchain they can trust and use.

The future of finance is being built on layers of code that value both your privacy and the rule of law. DUSK Network is laying that foundation, block by verified block.

What's the first real-world asset you believe will be revolutionized by tokenization, and why? Share your vision in the comments below—let's discuss the future we're building together.