One early answer to blockchain strain came in the form of Plasma - among the first systems aiming to ease mainnet load. When transactions pile up, networks often stall, costing users time and money. Sluggish processing and steep costs tend to push people away. Instead of handling every step on the chain, Plasma shifts operations outward, yet keeps trust anchored below. Within the XPL environment, such separation makes expansion feel less abstract, bringing down delays and expenses across transfers.

A single idea drives Plasma: build layered chains beside one big ledger. Transactions mostly move across these offshoots instead of the primary system. Security ties back through snapshots saved now and then on the root level. Trouble triggers escape routes - people return to safety by showing proof of wrongdoing captured earlier.

Unlike sidechains, Plasma operates without needing its own security framework. Funds remain accessible, since users can always withdraw them independently. In contrast to rollups, it reduces how much information must be stored directly on-chain - cutting expenses yet complicating access to certain data. Benefits stand out plainly. Throughput improves under Plasma, fee amounts drop sharply, while confirmations happen almost immediately, turning blockchain usage into something more usable day by day.

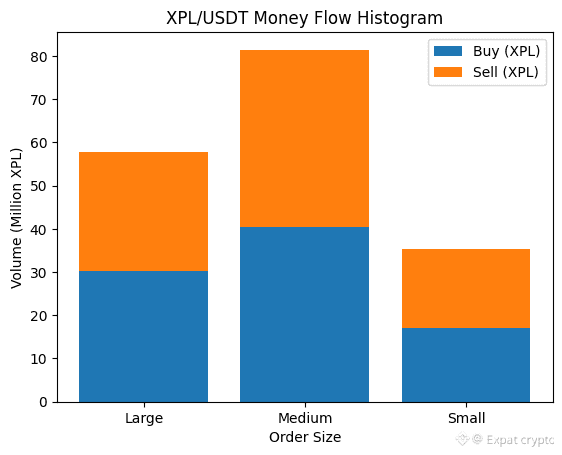

Off the main network, XPL activity gains speed through Plasma. Because it uses child chains, transaction load shifts away from congestion. Settlements happen faster while costs drop sharply. When users trade often, high fees on the base chain become less of a barrier. Efficiency improves without relying solely on the primary ledger.

A straightforward example involves tiny financial exchanges. When transferring small quantities of XPL takes little time and costs almost nothing, actions like rewarding creators, buying digital items inside apps, or earning through engagement start making sense. Apps based on decentralization gain advantages too - imagine game environments tracking countless player decisions or trading hubs managing streams of transactions smoothly. For people using it, Plasma gives XPL a quicker, more approachable nature instead of feeling sluggish and costly. Current efforts, along with future plans resembling Plasma within the XPL development path, show an emphasis on practical functionality and broader usage.

With plasma-powered XPL transfers, practical benefits emerge in diverse fields. Gaming sees asset trades and reward payouts freed from fee concerns. Creators gain access to immediate micropayments when fans support their work. Settlements speed up for online sellers who adopt XPL, facing steadier expenses.

Even so, Plasma faces notable hurdles. New ways of doing business - such as usage-based pricing or continuous micro-payments - are made possible through these functions. Problems around access to data and complicated withdrawal processes still demand attention. Success depends on thoughtful design that protects both confidence and safety. Yet trust cannot form unless safeguards are clear.

Off the main chain, plasma handles value transfers - security stays intact. Speed rises for XPL transactions because of this shift. Fees drop at the same time. Users feel the difference right away. Not merely upgrades under the hood, these changes pull more people in. Growth follows naturally when apps respond to better conditions. Innovation spreads quietly through the network. With each step forward in design, Plasma systems grow more central to handling large-scale blockchain needs. Those focused on real-world uses of distributed ledgers may find value in examining XPL today, especially as it deepens ties with Plasma frameworks.