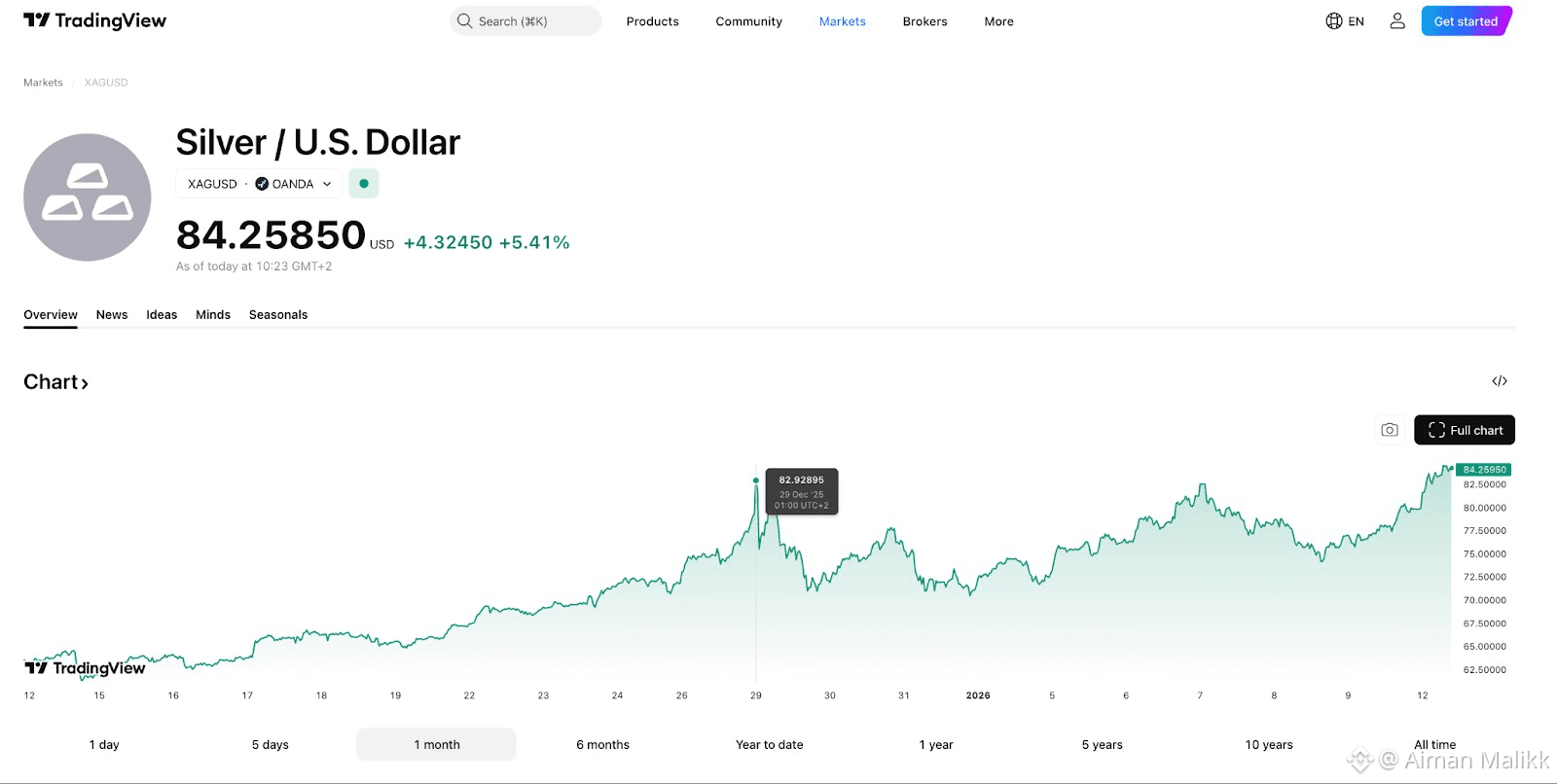

On January 23, 2026 silver did something it’s never done before it shot past $100 an ounce. This wasn’t a slow steady climb. It was a lightning-fast rally that took just weeks. Early in January silver traded in the low $70s. Suddenly prices soared. Within days, silver hovered between $100 and $103.

What grabs attention isn’t just the new high. It’s the way silver got there, with a 43% surge in a single month. No other major asset class kept up. Bitcoin for example barely budged in comparison. Investors clearly shifted gears, pouring into precious metals.

Why is silver leading the charge? The mood in markets has changed. With economic and geopolitical uncertainty everywhere investors want safe havens. Precious metals shine in these moments, and silver is right at the center.

But silver isn’t just gold’s understudy. It’s a workhorse for industry, too. Over half of silver demand comes from things like solar panels, electric vehicles, electronics, and renewable energy projects. As the world doubles down on clean energy, silver demand keeps breaking records. Supply, on the other hand, can’t keep up. Most silver comes as a byproduct from mining other metals, so it’s not easy to ramp up production when demand spikes. That tight supply only amplifies price moves.

For investors, breaking $100 isn’t just psychological. It proves that in an anxious market, people want real, tangible assets. Sure, silver’s reputation for volatility hasn’t changed prices can still drop as quickly as they rise. But this leap shows silver’s staying power. It’s not just for collectors or speculators; it belongs in modern portfolios, especially when things look uncertain.

Where does silver go from here? The answer will depend on industrial demand, central bank policy, and whether global tensions cool off. But this moment makes one thing clear: silver isn’t just a relic. It’s becoming central to the future of energy, technology, and economic security.

Silver move past $100 isn’t just a headline it’s a turning point reminding everyone why precious metals still matter when markets get shaky.