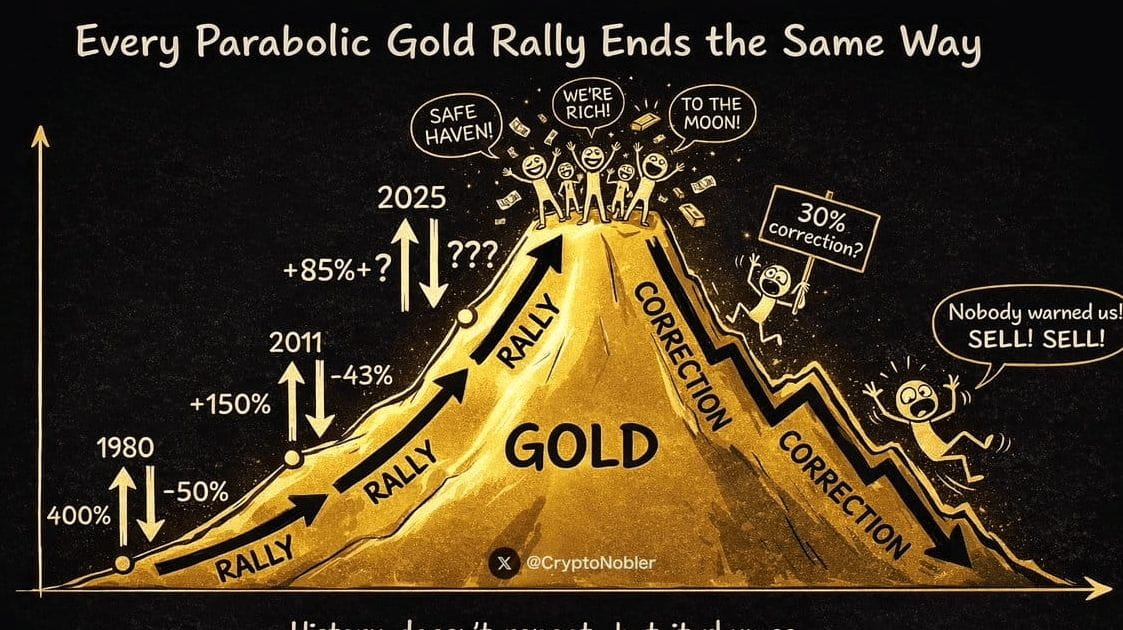

#GOLD has skyrocketed 85% in the past year.

It feels unstoppable. Permanent. Different this time.

But history tells a warning: parabolic rallies eventually pay the price.

1️⃣ 1980 – The Classic Blow-Off

→ Gold hit ~$850/oz.

→ Euphoria everywhere.

→ Result: 40%-60% crash over several years, wiping out late buyers.

2️⃣ 2011 – “Once in a Generation”

→ Peaked near $1,920/oz.

→ Multi-year run fueled by debt fears & money printing.

→ Result: ~43% decline over 4 years. Sentiment swung from mania to despair.

3️⃣ 2020 – Slow Burn Correction

→ Topped ~$2,075/oz.

→ Dropped 20%-25% into 2022, but long consolidation caused opportunity cost to mount.

THE LESSON:

After 60%-85% rallies, gold usually:

→ Pulls back 20%-40%

→ Moves sideways for years

→ Digests gains slowly

Parabolic rallies feel permanent, invite FOMO, and often end with sharp resets.

Gold is a wealth protector—but not a straight-line winner. Understanding history isn’t bearish—it’s realistic.

📢 Major tops and bottoms repeat. 2026 could be another turning point. Stay alert.