When I first tried using Dusk for a small tokenized bond test, I wasn’t expecting fireworks. I just wanted to see if the privacy layer actually behaved the way it’s supposed to. Hide positions. Keep things compliant. No drama.

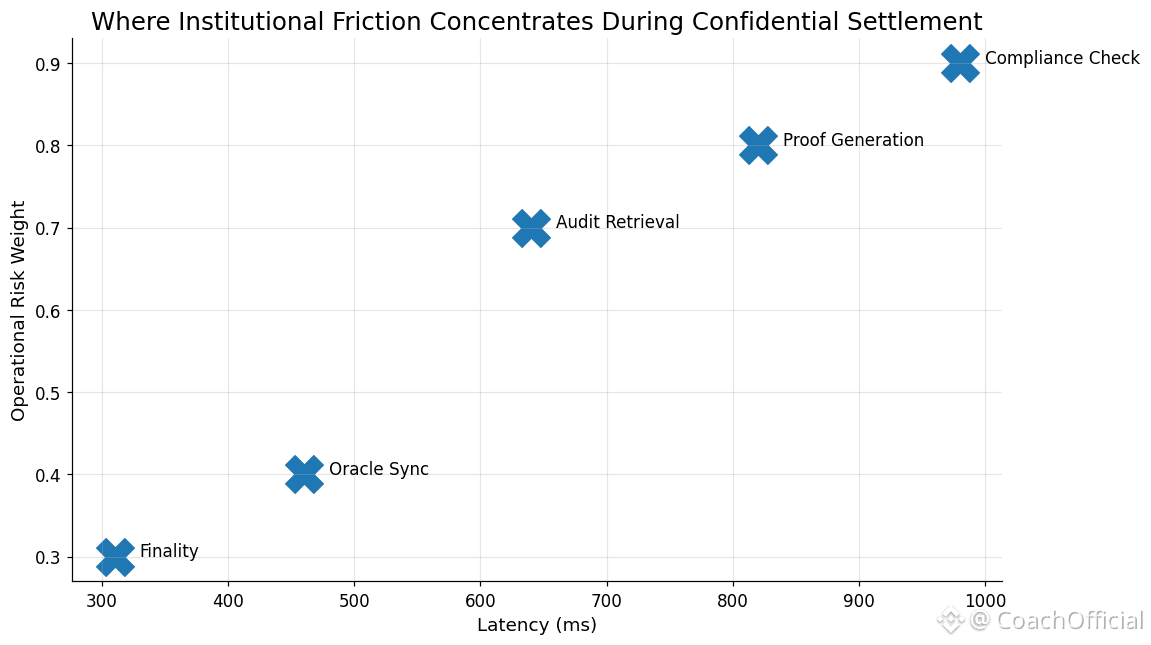

What I noticed wasn’t a hard failure. It was hesitation. Proofs took longer than I expected. Oracle data lined up most of the time, but not always. That meant stopping, checking, waiting. It wasn’t broken. It just wasn’t something I could forget about yet.

And that matters when you’re dealing with financial data you don’t want exposed.

That experience isn’t unique to Dusk. It’s a problem across crypto. Privacy usually comes as an add-on. Compliance comes later, if at all. Chains tend to force a choice. Either everything is public and fast, or private and heavy.

If you’re tokenizing securities or settling regulated assets, neither extreme really works.

Developers feel that friction first. Tools don’t line up cleanly. Interfaces ask you to trust the system instead of reassuring you through behavior. When real-world data is involved, every small mismatch turns into a pause.

It reminds me of working in a secure office where the vault exists, but the filing system is a mess. The protection is there. The workflow isn’t.

#Dusk is clearly trying to avoid that trap by narrowing its scope. It isn’t trying to be everything. It’s aiming straight at private financial activity. Confidential smart contracts. Selective disclosure. No attempt to chase retail hype or high-volume games.

The mainnet launch in January made that clear. This wasn’t about showing off throughput. It was about shipping something institutions can actually test without rewriting their compliance logic from scratch.

That’s why the NPEX partnership matters. Bringing regulated assets on-chain is not a marketing demo. It’s a slow, uncomfortable process where things either hold up under scrutiny or they don’t. Dusk is positioning itself for that kind of pressure, not for viral usage.

Under the hood, the choices are conservative. Finality is reasonably fast, but capped. Zero-knowledge proofs are baked in, but constrained. Certain interactions are deliberately limited to reduce leakage risk. It trades flexibility for predictability.

You can feel that in the network activity. Nothing explosive. Just steady. Early. A bit quiet.

The token reflects that same philosophy. $DUSK pays for execution. It secures the network through staking. Fees are partially burned, so activity actually matters. Validator rewards taper, which discourages short-term farming. Governance exists, but it hasn’t turned into a circus. Most discussions so far have been about infrastructure and integrations, not cosmetic tweaks.

From a market point of view, price action has already shown how emotional things can get. Announcements bring spikes. Attention fades. Pullbacks follow. That cycle says more about traders than it does about whether the network is working.

Short-term moves will keep happening. Privacy narratives. RWA headlines. Rotation trades. None of that answers the real question.

The real question is boring.

Do institutions keep using it after the first test.

Do second transactions feel routine instead of stressful.

Does the system fade into the background once people trust it.

That’s also where the risk sits.

Bigger ecosystems might adapt faster. ZK tooling elsewhere could catch up. And any serious flaw in the privacy layer, especially during a regulated settlement, would be catastrophic. You don’t get a second chance with confidential finance.

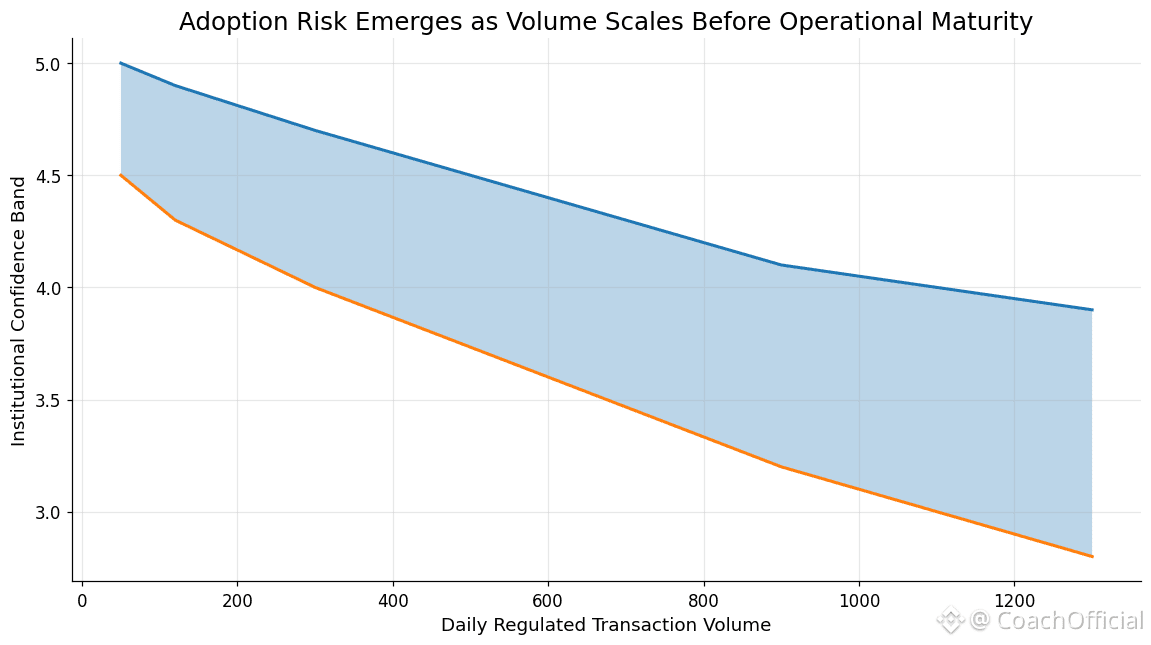

There’s also adoption risk. Institutions move slowly. Even with clearer regulation, priorities change. Pilots don’t always turn into production.

Mainnet activation isn’t proof. It’s exposure.

Dusk won’t win by being exciting. It only wins if nothing surprising happens. If transactions don’t leak. If settlement doesn’t stall. If users stop thinking about the chain at all.

That’s the kind of success most crypto never reaches.

@Dusk #Dusk $DUSK