I have been trading long enough to know that a token without a business model is just a memecoin with a better website. We often get caught up in the technology—the ZK proofs, the fancy consensus algorithms—but as investors, we need to ask the hard question: How does value actually accrue to the token? In the Dusk ecosystem, the answer lies in its economic engine, which was clarified significantly in the late 2024 updates. It isn't just about governance; it is about paying for the heavy lifting of privacy.

Think of DUSK not just as a currency, but as the fuel for a very specific type of engine. Generating a Zero-Knowledge Proof (ZKP) is computationally expensive. It requires more math and more processing power than a simple "send A to B" transaction on Bitcoin. Therefore, every time an institution issues a security or a trader executes a private swap, they burn gas in DUSK. This creates a direct correlation between network activity and token demand. Hmmm, yes, it’s a classic utility model, but with a twist: the more complex the compliance, the more gas it consumes.

What makes this trending for 2026 is the staking yield structure. Dusk uses a fixed inflation model—around 3% annually—where a massive 70% of those new tokens go directly to the Provisioners (stakers). This is a deliberate move to incentivize long-term security over short-term speculation. If you are locking up your capital to secure the network, you aren't just paid in "hopes and dreams"; you are paid in a steady, predictable yield derived from the protocol's own inflation schedule.

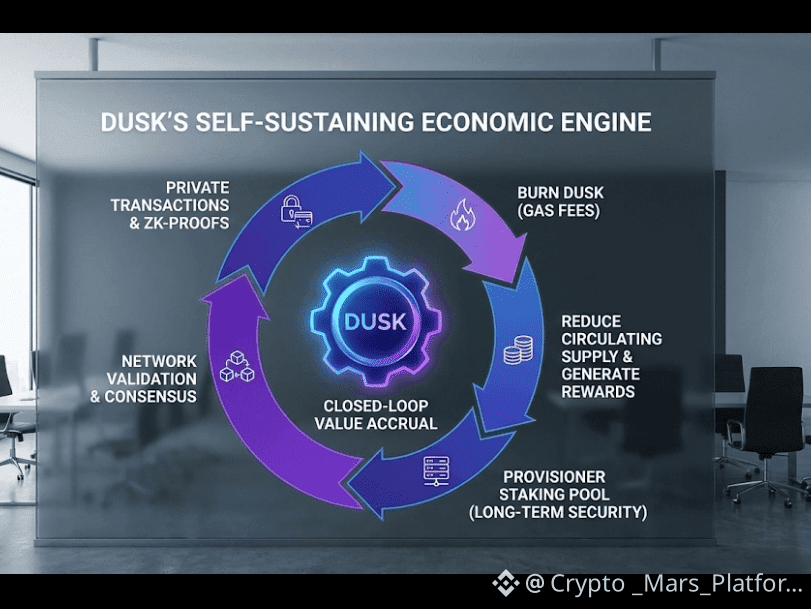

From a personal perspective, I look for "closed loops" in crypto economics. In Dusk, the loop is tight: Institutions buy DUSK to pay for RWA transactions - Provisioners stake DUSK to process those transactions - Rewards are distributed to Provisioners. It’s a self-sustaining cycle.

Philosophically, this model asserts that privacy is a premium service. It is not free to be private in a public world. It costs energy and computation. By pricing this correctly, Dusk ensures that its network remains solvent and secure, rather than relying on venture capital subsidies. In the end, the most trustworthy economic model is one that pays its own bills.

Would you like me to break down the specific differences between the "Block Generator" and "Provisioner" reward splits?