We discuss AI agents as if they are users. They are not. A user opens MetaMask, approves a gas fee, signs a transaction. An AI operates on instruction, not intuition, it cannot navigate a wallet pop up, does not hold a private key, and fails at the first step of Web3's human centric security model. The industry focus has been on making AI smarter on chain, letting it reason or execute. But if an agent cannot autonomously and reliably pay for the services it uses, its intelligence is stranded. This disconnect is not a feature gap, it is a fundamental infrastructure flaw. Vanar Chain approaches this from a different angle. My review of their technical documents and ecosystem announcements suggests they are not adding payments to a blockchain. They are building a blockchain where payment, compliance, and settlement are native primitives, designed for the agent environment, not retrofitted for the user.

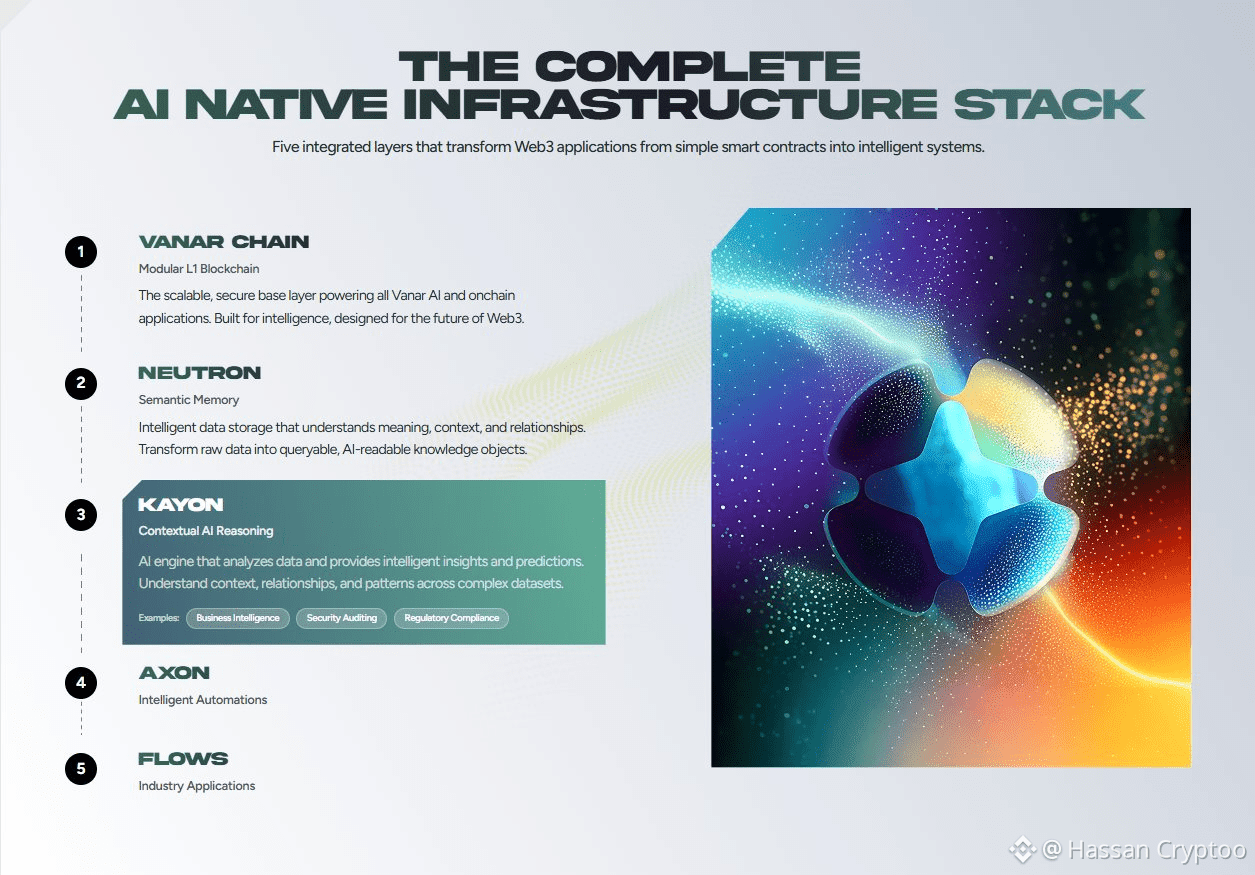

The problem is one of abstraction. Traditional Layer 1 and Layer 2 chains offer superb settlement for human driven transactions. For an AI, this requires a complex, fragile stack of intermediaries, relayers, paymasters, and signature abstraction layers that introduce points of failure and cost. It treats payment as an application layer problem. Vanar thesis, as evident in its architecture and live products like the payment focused "Flows" protocol, embeds this capability at the chain level. Think of it not as building a road and then adding toll booths, but engineering the road material itself to conduct and account for the toll seamlessly as anything moves. This shifts the paradigm from making AI compatible with crypto to making crypto inherently operable by AI.

What does this infrastructure level design actually entail. It means predictable, ultra low transaction costs baked into the protocol economic model, so an agent can calculate execution cost ahead of time. It means native account abstraction where the agent operational identity is a smart contract wallet by default, capable of complex, conditional spending logic without manual signing. Crucially, it incorporates what Vanar terms "compliance ready rails". In a March 2025 update, the team highlighted work on integrating regulated payment pathways. For an enterprise deploying thousands of AI agents to handle micro transactions, for data, compute, or digital goods, this is not optional. It is the bridge from crypto native experimentation to global, real world utility. The agent does not need to know KYC, the infrastructure layer handles it, providing a sanctioned on ramp and off ramp for value.

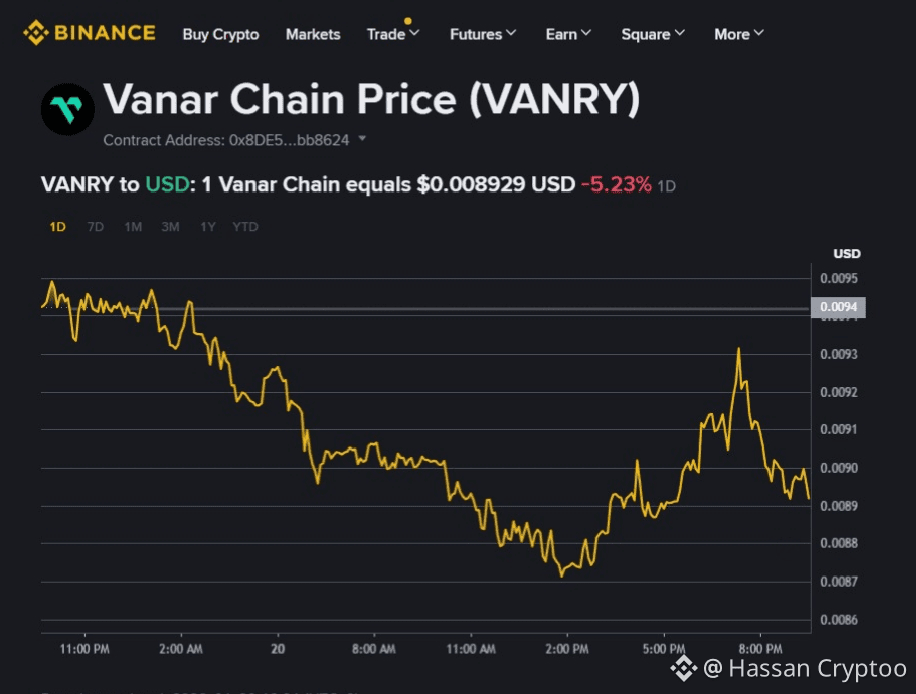

This is where the $VANRY token transitions from a speculative asset to a utility conduit in an operational system. If payment is infrastructure, then the token is the consumable resource that powers that infrastructure. In Vanar model, $VANRY is the medium for paying network fees, staking by validators who secure these agent first transactions, and likely the settlement layer for its native payment products. Practically, its value accumulation is directly linked to the volume and frequency of these automated settlements, not merely to market mood. value accrues in direct correlation with the scale and cadence of these automated agent settlements, independent of market sentiment alone. Chart analysis of VANRY/USDT on Binance Spot depicts a market that remains in a consolidation phase. The price has established a defined range over recent weeks. Importantly, surges in volume reliably correlate with significant ecosystem announcements, demonstrating that attention is fueled by substantive developments. Maintaining consistent 24-hour trading volume frequently reaching tens of millions provides the robust liquidity essential for a token destined to act as a dependable settlement mechanism.

Data from CoinMarketcap as of today shows a market capitalization that positions it within the mid tier of Layer 1 projects. Its classification and connections reveal more than its rank alone It is listed under "AI & Big Data" and "Metaverse," tags that reflect its stated verticals but perhaps undersell its infrastructural thesis. The fully diluted valuation metrics and circulating supply are factors any analyst would model, but the key differentiator is the project attempt to bake utility into its core operation. The recent partnership announcements, like the one with a major gaming network, are not just marketing, they are stress tests for this very settlement infrastructure, promising real transaction flow.

The implication is broader than one chain. The evolution of AI in crypto is moving from "AI that does something on a chain" to "chains built for AI to do everything". This requires a rethinking of first principles, memory, reasoning, automated execution, and, fundamentally, settlement. Vanar approach with Flows for automation and its compliance work attempts to check these boxes not as independent products but as interconnected features of its base layer. The competition is not other AI themed chains offering higher TPS, it is the inertia of legacy systems that force AI into a human shaped hole. If the next wave of adoption is truly automated, then the chains that succeed will be those whose infrastructure is invisible, reliable, and native to the agent. They will not just host AI, they will be for AI. In that framework, a token like $VANRY is not a bet on an AI narrative. It is exposure to the plumbing required to turn that narrative into daily, utility driven transactions

by Hassan Cryptoo

@Vanarchain | #vanar I $VANRY