The blockchain ecosystem is often divided between developer familiarity and regulatory requirements. DuskEVM, Dusk’s EVM-compatible application layer, resolves this tension by allowing developers and institutions to deploy standard Solidity smart contracts while settling directly on the Dusk Layer 1 blockchain. This unique combination of familiar tooling, privacy, and compliance positions Dusk as an institution-ready blockchain network.

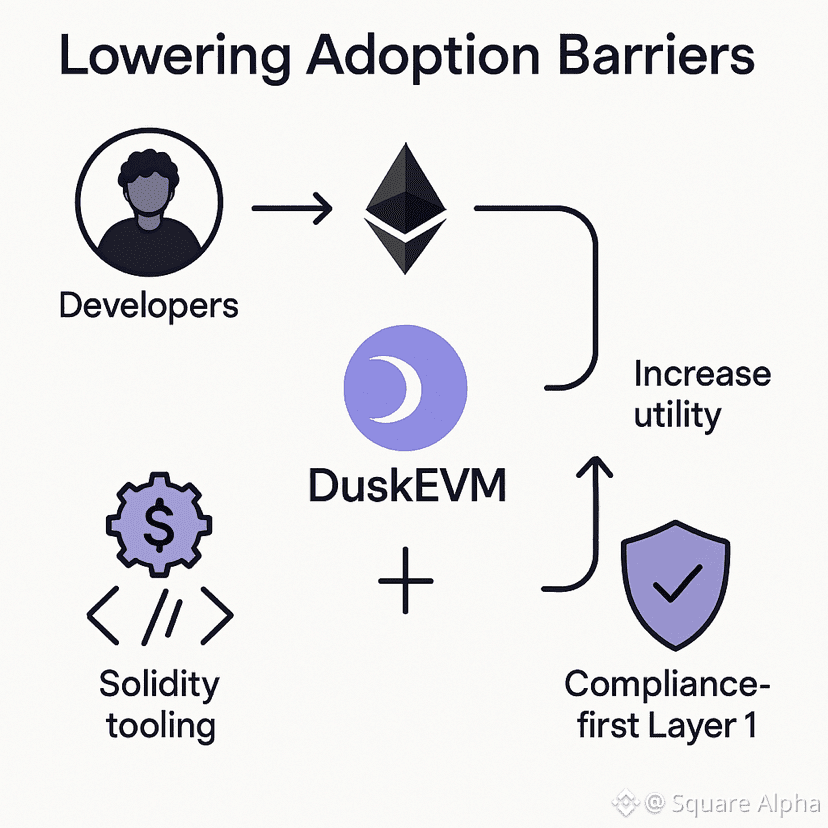

Lowering Adoption Barriers

Developer adoption is frequently slowed by proprietary programming languages or custom execution models. DuskEVM removes these barriers by enabling existing Ethereum developers to seamlessly integrate their applications on Dusk. This reduces friction, accelerates real-world usage, and increases $DUSK utility through transactional and staking activity.

By aligning familiar Solidity tooling with a compliance-first Layer 1, DuskEVM ensures that developers don’t compromise on privacy, auditability, or regulatory standards. This is particularly valuable for DeFi protocols and tokenized real-world assets (RWA), which require predictable and auditable behavior to attract institutional participation.

Compliant DeFi and Tokenized Assets

Unlike standard EVM networks, which prioritize speed or decentralization over compliance, DuskEVM integrates regulated financial logic into its core. Settlements occur directly on Dusk Layer 1, ensuring transactions are auditable without compromising confidentiality.

Privacy is reinforced through Hedger, Dusk’s privacy module leveraging zero-knowledge proofs and homomorphic encryption. This allows confidential transactions while maintaining the ability to demonstrate regulatory compliance. The result is a network capable of supporting institutional DeFi, compliant tokenized securities, and scalable real-world asset applications.

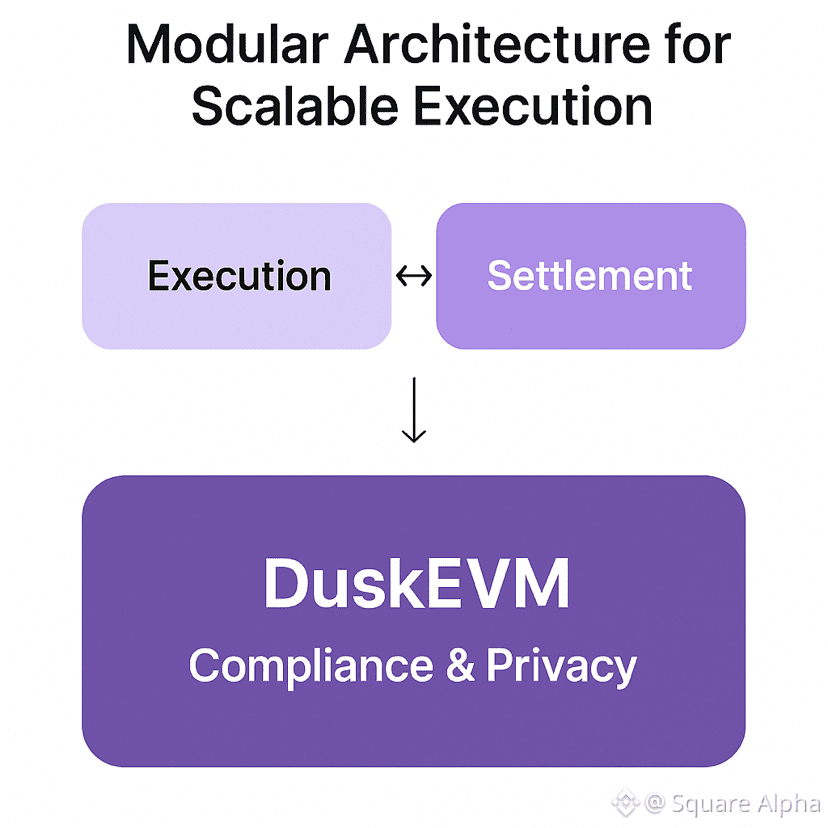

Modular Architecture for Scalable Execution

DuskEVM’s modular design separates execution from settlement, allowing private and public transactions to be processed efficiently. This ensures predictable transaction finality, even under high network load, and provides a stable environment for developers and institutions.

By embedding compliance and privacy at the protocol level, DuskEVM avoids reliance on off-chain tools or centralized services. This makes applications predictable, secure, and easier to audit, building confidence for institutional adoption.

DUSK Utility and Network Economics

Every operation on DuskEVM—from DeFi interactions to RWA issuance—uses $DUSK, creating structural token demand. As DuskEVM adoption grows, the token transitions from a speculative asset to a functional component of the network, reinforcing Dusk’s position as a long-term execution-driven Layer 1 for regulated finance.

Strategic Relevance of DuskEVM

DuskEVM exemplifies Dusk’s focused design philosophy. Unlike multi-purpose networks chasing hype, DuskEVM prioritizes usable, compliant infrastructure. Privacy, regulatory alignment, and auditable execution are core features, not afterthoughts.

The upcoming DuskEVM mainnet launch in January is a significant milestone. Early adopters can deploy compliant contracts, test integration with DuskTrade, and leverage Hedger for confidential transactions. This positions Dusk as a ready-for-institution execution platform, supporting tokenized securities, compliant DeFi, and auditable blockchain operations.

Conclusion

DuskEVM bridges the gap between developer familiarity and regulated financial infrastructure. By combining Solidity compatibility, Layer 1 settlement, and integrated privacy, Dusk positions itself as a leading platform for institutional adoption, tokenized assets, and compliant DeFi applications. The network is execution-ready, not theoretical, and provides the tools necessary for long-term, regulation-aligned blockchain growth.

@Dusk #dusk #DUSKEVM #DUSKFoundation #Privacy $DUSK