The Agent Revolution Ready For

Something fundamental is shifting in how software operates. AI agents autonomous systems that observe, decide, and act are moving from research prototypes to operational tools. They're managing portfolios, coordinating supply chains, automating customer service, and increasingly operating across multiple platforms simultaneously.

The implications for blockchain infrastructure are profound, and largely unexamined.

Most existing blockchains were designed for human-triggered transactions. A user clicks a button, signs with their wallet, waits for confirmation. The chain processes discrete events initiated by conscious human decisions.

AI agents behave differently. They operate continuously, often without direct human input. They maintain state remembering what they've done before and why. They coordinate actions across different systems, APIs, and platforms. They generate high volumes of small, frequent transactions rather than occasional large ones.

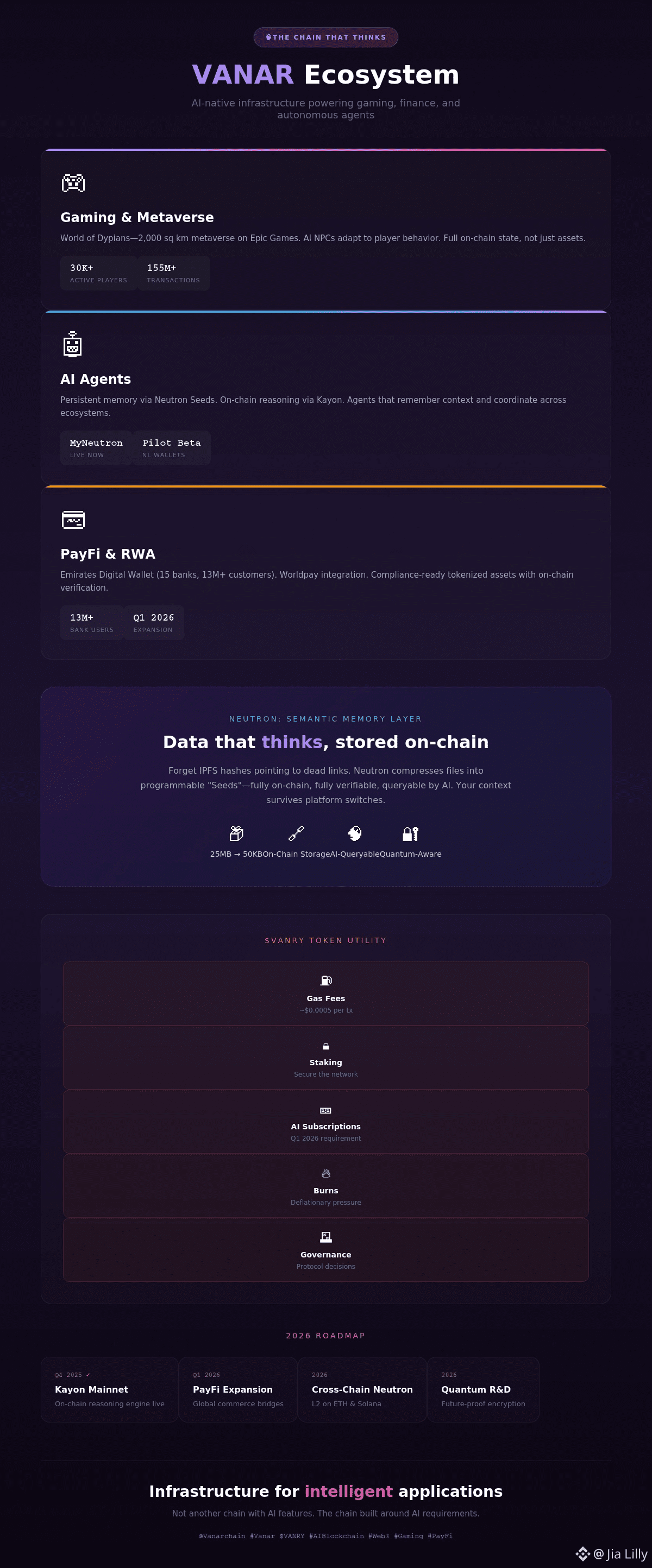

The infrastructure requirements are fundamentally different. And that's why projects like Vanar, designed from the ground up for AI workloads, matter.

The Continuity Problem

Here's a scenario that illustrates the challenge:

An AI agent manages treasury operations for a DeFi protocol. It monitors multiple blockchains for arbitrage opportunities, rebalances liquidity positions based on market conditions, and executes transactions when optimal conditions arise.

On a traditional blockchain, each action is stateless. The agent must reconstruct context from scratch every time it operates. If network congestion delays a transaction, the agent may execute duplicate actions or miss time-sensitive opportunities. If the agent's memory is stored off-chain, that external dependency becomes a point of failure.

What the agent needs is persistent state a reliable way to remember what it's done, understand current conditions, and coordinate future actions without reconstructing everything from external sources.

Vanar's architecture addresses this directly.

Neutron allows agents to store semantic memories on-chain not just data references, but compressed representations that capture meaning and context. An agent can store its decision history, market observations, and pending actions in Neutron Seeds that persist across sessions.

Kayon enables agents to query this stored context and reason about it in real-time. Instead of parsing raw blockchain state, agents can ask questions in natural language and receive structured responses.

The combination creates an environment where agents can maintain continuity, remember their past, and operate as persistent processes rather than stateless functions.

The Cost Problem is solve my vanar

AI agents can generate enormous transaction volumes. A trading agent might evaluate thousands of potential actions per minute, executing dozens. A coordination agent orchestrating supply chain logistics might process millions of data points daily.

On networks with high or volatile fees, this becomes economically prohibitive. Ethereum mainnet during peak congestion can charge $50+ for a simple transaction. Even "cheap" networks can see fee spikes during high activity periods.

The result: agents either stop functioning when fees exceed economic utility, or they batch actions in ways that reduce responsiveness and miss time-sensitive opportunities.

Vanar's fixed fee structure approximately $0.0005 per transaction makes continuous agent operation economically viable. Not cheap enough to ignore, but predictable enough to model and plan around.

This isn't about attracting retail users with low fees. It's about enabling a class of operations that simply can't exist on networks where costs are volatile and unpredictable.

The Trust Problem

When an AI agent acts on behalf of a user or organization, accountability matters. What did the agent do? Why did it make that decision? Can we prove its actions to regulators, auditors, or counterparties?

Blockchain-based execution provides an immutable audit trail. Every action the agent takes is recorded, timestamped, and verifiable. This transparency is useful not just for security but for debugging—when an agent behaves unexpectedly, developers need to trace its actions across systems.

Vanar's architecture enhances this with on-chain reasoning. Because Kayon's decision-making happens on-chain, the logic behind agent actions is also recorded and auditable. Not just what the agent did, but why according to the data it queried and the rules it applied.

For institutional use cases where accountability isn't optional, this matters significantly.

Cross-Ecosystem Coordination

The most interesting AI agent applications don't operate on a single platform. They coordinate across ecosystems reading data from one source, executing transactions on another, storing results in a third.

Traditional blockchain architectures handle this poorly. Each chain is an island with its own state, and bridging between chains introduces latency, cost, and trust assumptions.

Vanar's approach addresses this through its five-layer architecture:

Layer 1 (Vanar Chain): The scalable base layer handling consensus and execution.

Layer 2 (Neutron): Semantic memory storing compressed, queryable data.

Layer 3 (Kayon): On-chain reasoning enabling intelligent queries and decisions.

Layer 4 (Axon): Intelligent automation for workflows spanning multiple systems.

Layer 5 (Flows): Industry-specific applications built on the lower layers.

This vertical integration means agents don't need to bridge between separate systems for storage, computation, and execution. Everything operates within a unified architecture designed for interoperability.

Real-World Adoption Signals

The theory is compelling, but what matters is whether real builders are using this infrastructure.

World of Dypians demonstrates AI agent capabilities in a consumer-facing application. The game's AI-powered NPCs adapt to player behavior in real-time, requiring exactly the kind of continuous, stateful operation that Vanar's architecture supports. Over 155 million on-chain transactions and 30,000+ active players suggest the infrastructure handles real loads.

Emirates Digital Wallet represents institutional adoption in a regulated market. Fifteen Middle Eastern banks with 13+ million customers don't adopt experimental technology casually. Their choice of Vanar signals confidence in the platform's operational readiness.

The Pilot Agent Beta allows natural-language interactions with Vanar wallets users can instruct agents to perform operations through conversational commands rather than traditional interfaces. This is AI-native UX enabled by AI-native infrastructure.

The Gaming Bridge

Gaming might seem tangential to AI agent infrastructure, but it's actually a proving ground.

Games generate high transaction volumes with low individual values exactly the pattern AI agents produce. Games require responsive, low-latency execution exactly what agents need. Games involve complex state management across multiple participants exactly the coordination challenges agents face.

Vanar's gaming infrastructure Unity and Unreal SDKs, metaverse modules, NFT minting tools serves a specific purpose: demonstrating that the architecture handles real-world loads under consumer-scale usage.

The 155+ million on-chain transactions from World of Dypians alone represent stress testing that no amount of theoretical analysis can match.

The PayFi Connection

Vanar's expansion into "PayFi" blockchain-native payments integrated with global commerce creates another pathway for AI agent adoption.

Consider autonomous payment agents that:

Monitor invoices and initiate payments when conditions are met

Optimize payment routing across currencies and jurisdictions

Manage treasury operations across multiple accounts and chains

Handle compliance checking in real-time before executing transfers

These operations require exactly what Vanar provides: low-cost transactions, persistent state, on-chain reasoning, and auditable execution.

The Worldpay integration and Emirates Digital Wallet adoption suggest Vanar is positioning for institutional payment infrastructure, not just retail crypto transactions.

What Could Go Wrong

No technology thesis is guaranteed. Several factors could prevent Vanar's vision from materializing:

Agent Adoption Timelines: If autonomous AI agents remain niche for longer than expected, Vanar's specialized infrastructure provides marginal benefits over general-purpose chains.

Competition: Other projects are building AI-focused blockchain infrastructure. Vanar's first-mover advantage only matters if they execute better than alternatives.

Technical Risks: Novel architectures carry unknown failure modes. Neutron's compression, Kayon's reasoning, and the five-layer stack are new enough that edge cases haven't been fully discovered.

Market Recognition: Technical excellence doesn't guarantee market success. Projects can be right about technology and still fail commercially.

The Investment Thesis

Vanar presents a specific bet: purpose-built AI infrastructure will command premium value as autonomous agents become significant economic actors.

The supporting evidence:

Operational products (MyNeutron, Kayon, gaming infrastructure)

Enterprise partnerships (NVIDIA, Google Cloud, Worldpay, Emirates Digital Wallet)

Real usage metrics (155M+ gaming transactions, 30K+ active players)

Token utility tied to product usage (Q1 2026 subscription requirements)

The counterarguments:

Small market cap and low trading volume suggest limited current interest

AI agent adoption timelines remain uncertain

General-purpose chains may adequately serve agent needs

Competition from other AI-focused projects

The market trades VANRY around $0.008 with ~$20M market cap. For believers in the AI agent thesis, current valuations represent opportunity. For skeptics, they reflect appropriate pricing for unproven technology.

The Practical Question

Ultimately, Vanar's success depends on a simple question: Will AI agents become significant blockchain users?

If the answer is yes

if autonomous systems operating across digital ecosystems become common within the next few years then infrastructure designed for their specific requirements will be valuable. The chains that anticipated agent needs will have advantages over those that retrofit capabilities later.

If the answer is no or not yet if agents remain experimental or human-triggered transactions dominate blockchain usage for the foreseeable future then Vanar's specialized architecture provides complexity without proportionate benefits.

The technology is real. The adoption signals are encouraging. The question is timing whether the AI agent future arrives soon enough for early infrastructure positioning to matter.

Vanar is betting it does. The market will eventually reveal whether they're right.