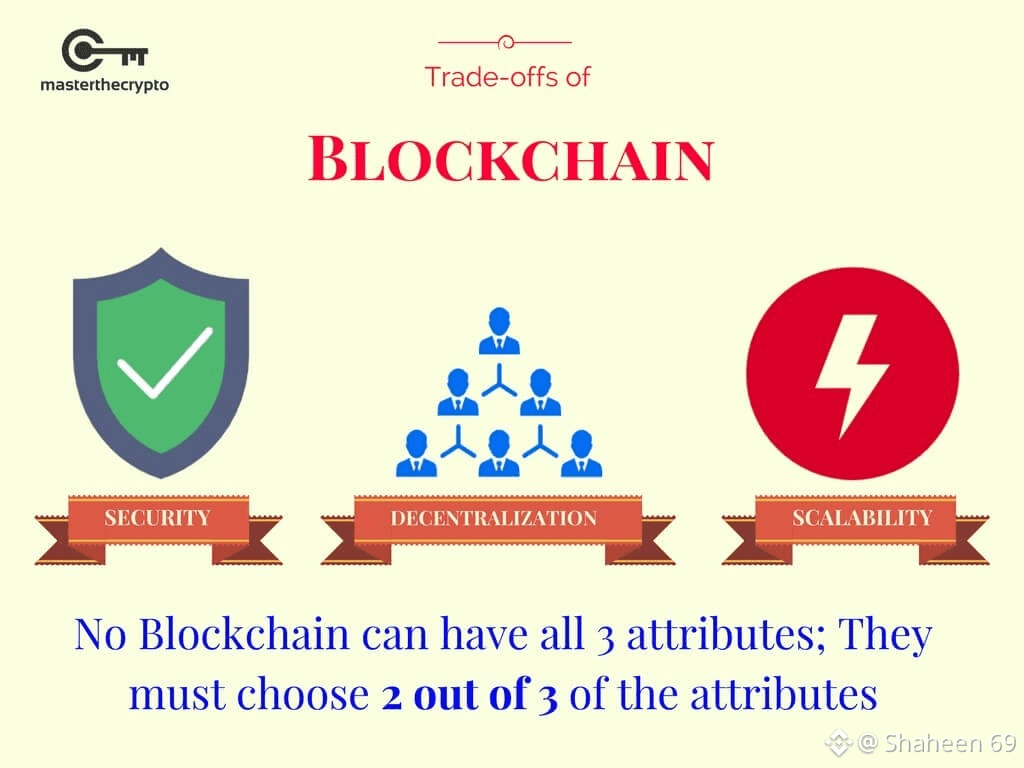

As blockchain adoption increases, scalability has become one of the most persistent challenges in the ecosystem. Early networks were designed for decentralization and security, but rising usage exposed limitations in throughput, latency, and transaction costs.

This is where Plasma-based solutions enter the conversation.

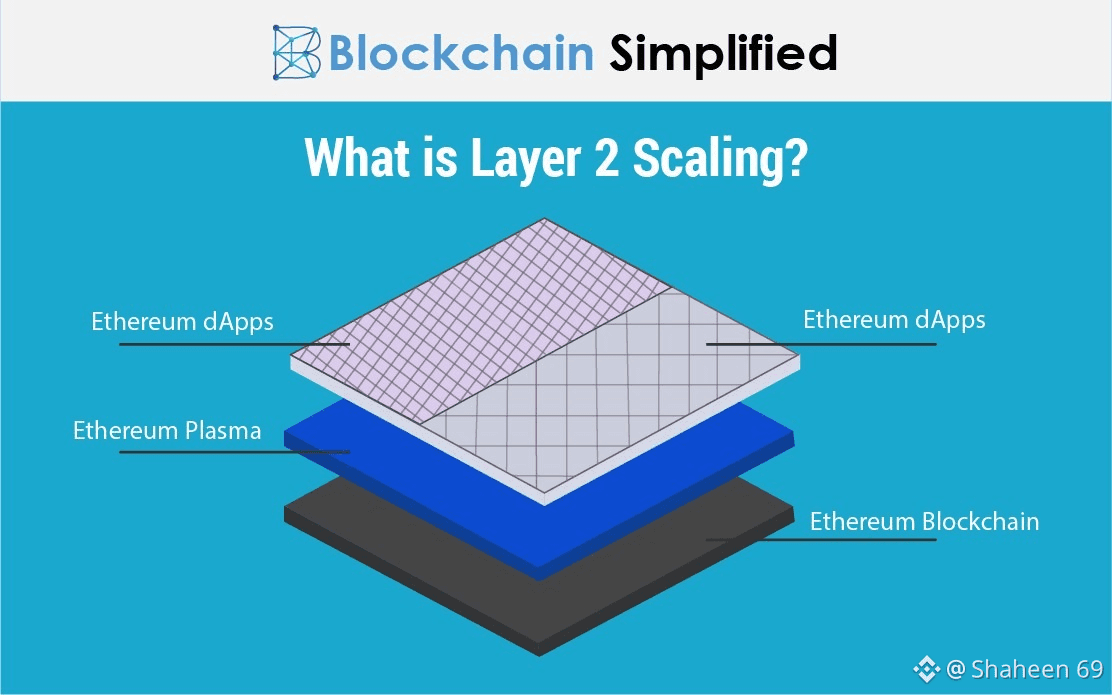

Plasma Coin is connected to a broader scaling philosophy that focuses on moving computation off the main chain while maintaining security guarantees. Rather than processing every transaction on a congested base layer, Plasma architectures allow secondary environments to handle activity more efficiently.

The importance of this approach grows as decentralized applications expand. Gaming, DeFi, NFTs, and payment systems all generate high transaction volumes. Without scalable execution layers, user experience deteriorates quickly.

Plasma Coin reflects this structural need. Its relevance is less about short-term market momentum and more about infrastructure alignment with future demand. As transaction volume grows, cost efficiency becomes a decisive factor for both users and developers.

Another strength of Plasma-based models is their contribution to network sustainability. Lower congestion means reduced resource strain, making systems more viable over extended periods of growth.

Historically, scalability solutions gain recognition only after congestion becomes visible. By that stage, networks that already support efficient execution tend to attract attention rapidly.

Plasma Coin fits into this pattern as an enabling layer rather than a consumer-facing narrative.

Key takeaway: Plasma Coin aligns with the long-term need for scalable blockchain execution rather than speculative experimentation.

#Plasma #PlasmaCoin #BlockchainScalability @Plasma #CryptoAnalysisUpdate #BinanceSquare $XPL