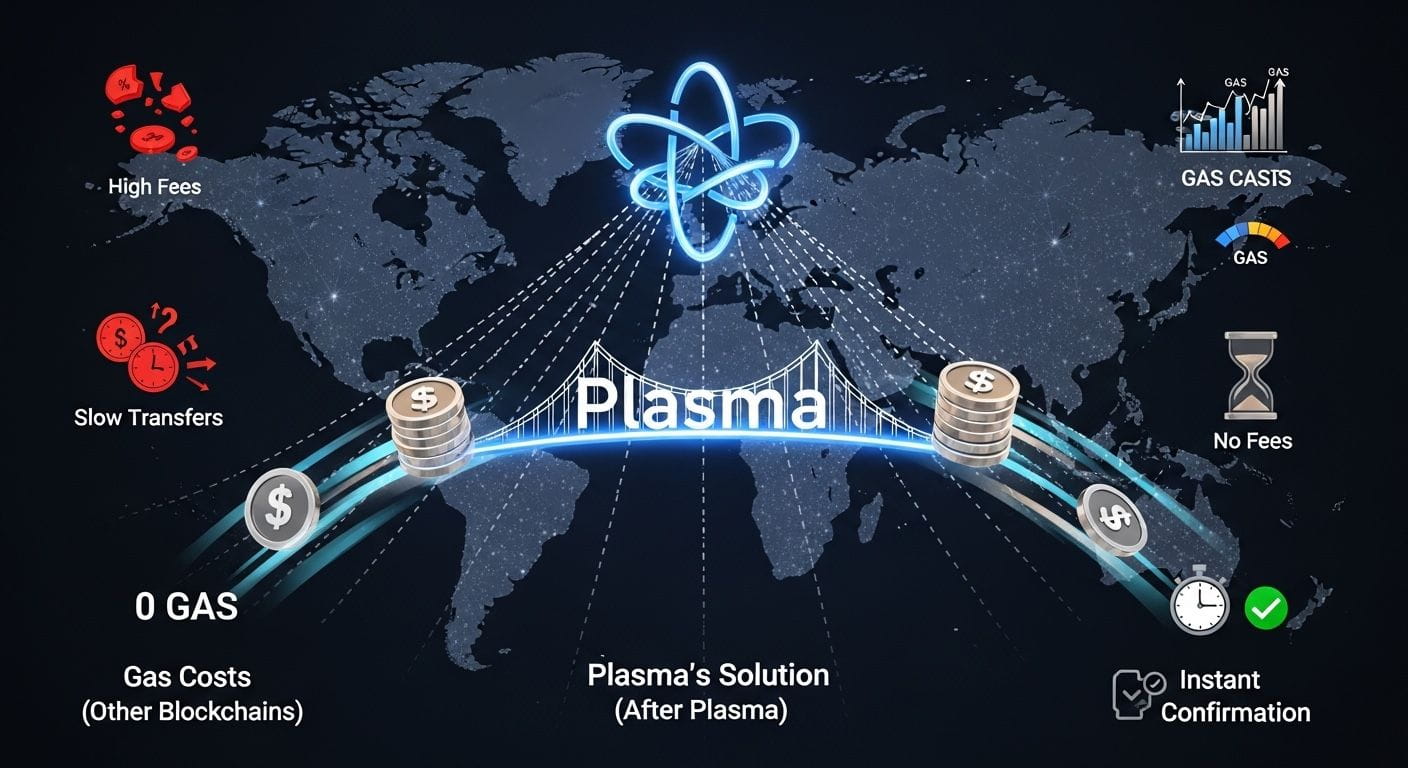

Most of us have felt that sting: wiring cash to family overseas eats 5-10% in fees, takes days to clear, and leaves you checking your bank app every hour. Stablecoins promised to fix that nightmare, but even on big chains, gas costs add up fast when you're moving real money regularly. That's where @Plasma quietly changes the game.

This isn't some do-everything blockchain chasing every trend. Plasma built itself from the ground up as a dedicated home for stablecoin traffic—especially USDT. Send dollars digitally and the user sees literally zero gas deducted for those transfers. The chain handles it natively through smart design: pre-funded paymasters cover the tiny underlying costs so everyday people never notice. Confirmation hits in under a second most times, which matters when suppliers are waiting or remittances need to land same-day.

Security isn't an afterthought either. By anchoring parts of its trust model to Bitcoin's rock-solid history while still running full EVM code, developers get the best of both worlds—Ethereum tools they already know plus Bitcoin-grade finality without the usual trade-offs. Validators stake XPL, earn rewards that taper down over time, and the whole setup burns some fees Ethereum-style to keep things balanced long-term.

Right now in early 2026, numbers tell a story. TVL sits comfortably in the billions after mainnet beta kicked off last year, daily trading holds steady even during quieter market weeks, and bridges keep pulling in fresh capital. The recent unlock waves (like that ecosystem batch) stirred things briefly, but activity didn't drop off—DEX volumes and fee generation show people are actually using the rails, not just parking tokens.

What gets me excited personally? Imagine small businesses in places like Pakistan or Southeast Asia accepting payments instantly without losing chunks to intermediaries. Or freelancers getting paid in stable value without waiting for slow banks. Plasma isn't promising moonshots or viral memes; it's grinding on boring-but-critical plumbing that could quietly power trillions in real flows.

If you've ever grumbled about high remittance costs or clunky cross-chain swaps, swing by plasma and poke around. XPL sits at the heart—governing votes, rewarding the folks securing it, and unlocking grants for builders who want to plug in. This feels less like hype and more like infrastructure finally catching up to how people actually want to move money today.

Who's building something cool on it next? Drop ideas below—I'm watching this one closely.

$XPL #Plasma

Статья

Why Plasma Feels Like the Missing Link for Anyone Sending Money Across Borders

Отказ от ответственности: на платформе опубликованы материалы и мнения третьих лиц. Не является финансовой рекомендацией. Может содержать спонсируемый контент. См. Правила и условия.

45

7

Последние новости криптовалют

⚡️ Участвуйте в последних обсуждениях в криптомире

💬 Общайтесь с любимыми авторами

👍 Изучайте темы, которые вам интересны

Эл. почта/номер телефона