Layer-1 showdown heating up in 2026! 🚀

Solana ($SOL) is flexing hard: Price consolidating ~$126–$130 after touching $146 early Jan, TVL smashing $10B+, DEX volumes dominating, Ondo tokenized stocks/ETFs live on-chain, spot SOL ETFs pulling inflows, and upgrades (Firedancer/Alpenglow) promising even faster blocks. It's the go-to for retail/DeFi/memes/RWAs—feels like the high-beta beast ready to rip if it breaks $140+.

Avalanche ($AVAX )? Stuck in the mud at $12–$13 (down big from 2025 highs), but subnets are quietly building: custom chains for enterprise/gaming/RWAs, strong institutional ties (JPMorgan vibes), no outage drama, and analysts eyeing $45–$100+ long-term if adoption kicks in. It's the modular play—build your own blockchain without congestion.

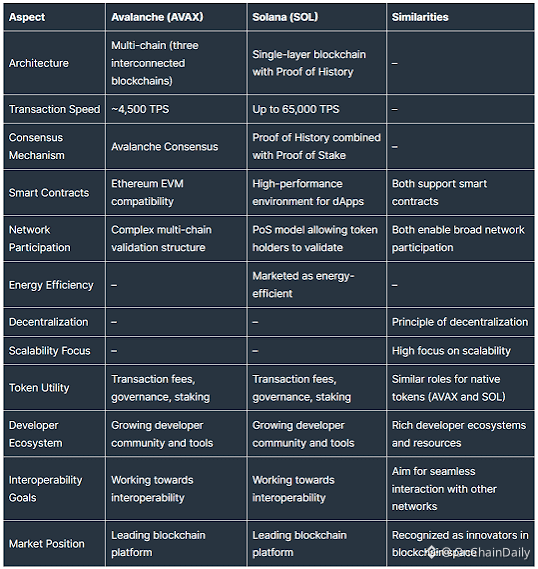

Quick head-to-head (Jan 2026 stats):

Market Cap: SOL ~$72–$79B vs AVAX ~$5–$6B (SOL crushes in size/liquidity)

TPS/Fees: Solana ~1k–5k TPS + near-zero fees; AVAX subnets flexible but C-Chain slower/higher fees

Ecosystem: Solana wins retail/DeFi velocity; AVAX edges enterprise/custom chains

Momentum: SOL accumulation signals strong (50% below 2025 highs but whales loading); AVAX consolidating, waiting for breakout

Solana's single-chain speed + ETF FOMO vs Avalanche's subnet innovation + institutional upside. Who's the 2026 winner? SOL for moonshot volume or AVAX for asymmetric enterprise flip?

Square fam, pick your side!

Team SOL – speed & adoption king? 📈

Team AVAX – subnets & enterprise sleeper hit? 🏔️

Holding both for L1 diversification?

Drop your charts (SOL support hold vs AVAX range looks primed!), predictions (SOL $200+? AVAX $50+?), or trades below! Who's positioning for the L1 rotation?

#Solana #Avalanche #SOLvsAVAX #Layer1 #Crypto2026 #RWA #DeFi #Solana #Avalanche #SOLvsAVAX #Layer1 #Crypto2026 #RWA #DeFi #AltcoinBattle