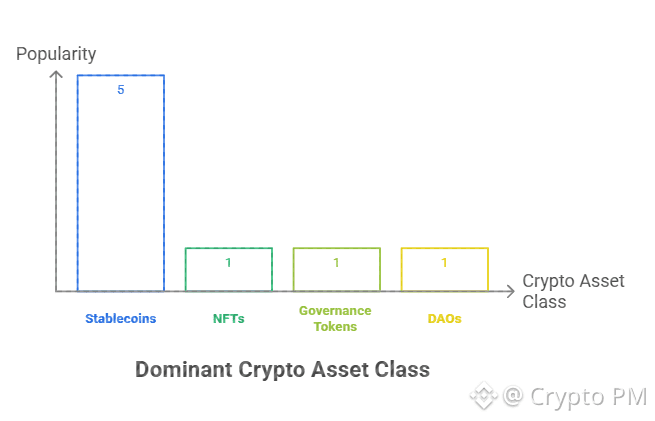

Stablecoins already won crypto. Not NFTs not governance tokens not DAOs. Dollars won. People move USDT USDC faster than they do opinions. Plasma did not fight this reality. It built directly for it.

While other chains still argue about being general purpose Plasma made a very specific choice. Become a stablecoin settlement network that does not break under scale pressure. That decision already filters out 90 percent of noise.

But the real interesting part is not zero fees or UX. It is security. And Plasma made a choice most chains are scared to make.

Why Plasma Did Not Anchor To Ethereum

Most chains anchor narratives to Ethereum because it sounds modern and composable. Plasma anchored to Bitcoin instead. That alone tells you who this is built for.

Bitcoin is slow. Everyone knows that. Ten minute blocks are useless for payments. Plasma does not deny this. It simply does not use Bitcoin for execution. It uses Bitcoin for finality.

That difference matters more than people realize.

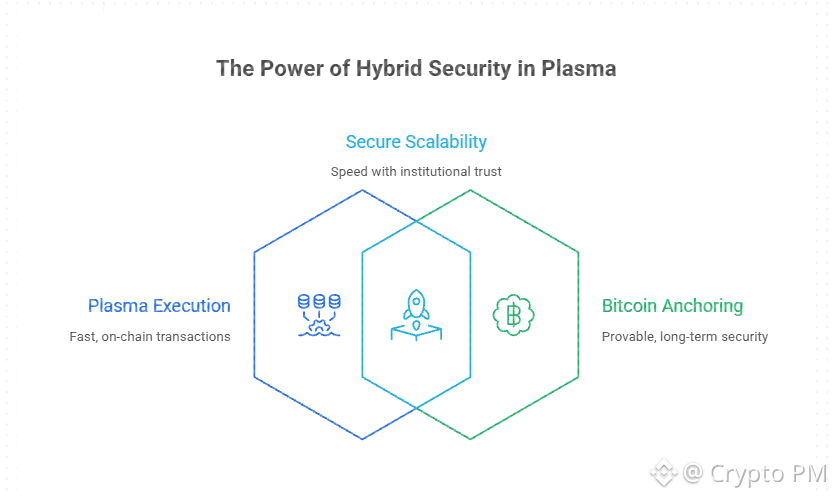

Hybrid Security Model Without The Fantasy

Plasma runs as a Bitcoin sidechain. It executes transactions fast on its own network but periodically anchors its state root to Bitcoin. That means Plasma can move fast without pretending speed equals security.

Execution happens on Plasma. Final truth lives on Bitcoin.

If Plasma fails internally Bitcoin still holds the last agreed state. This is not perfect trustlessness but it is provable security backed by the only chain that has never suffered a 51 percent attack in sixteen years.

Institutions understand this instantly. Retail mostly ignores it.

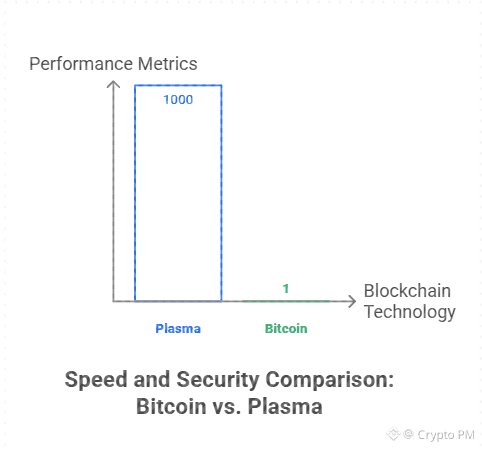

Speed Where It Matters Safety Where It Matters More

Plasma uses PlasmaBFT a HotStuff inspired consensus. Sub second finality over one thousand TPS. Pipelining parallel rounds quorum certificates. All the words people usually skip.

What matters is this. Payments settle fast. And they stay settled.

Bitcoin gives slow but ultimate security. Plasma gives speed without gambling that validators will behave forever. This is how the scalability trilemma is actually handled not tweeted about.

Validator Assumptions Are Not Magical Here

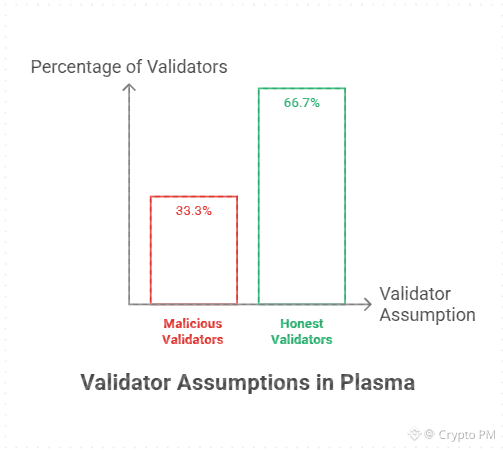

Plasma uses standard BFT assumptions. Less than one third malicious validators and the system holds. Same majority resistance logic that Bitcoin relies on economically.

No new math no wishful thinking. Familiar security logic applied honestly.

That honesty is rare.

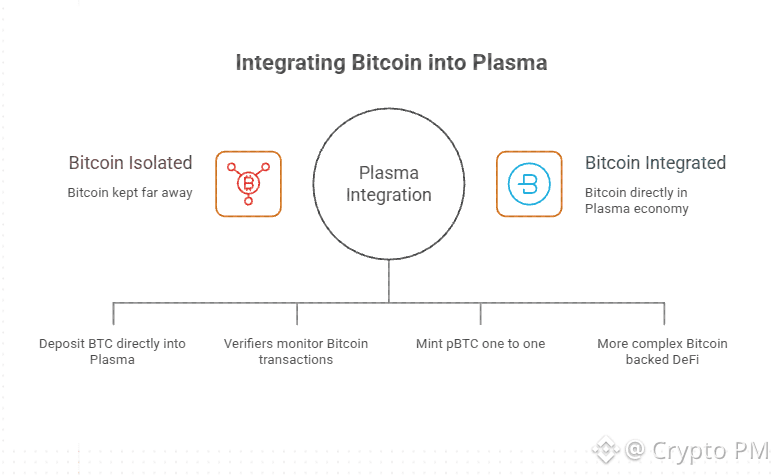

Bitcoin Inside Plasma Not Just Watching It

Most chains say Bitcoin is important but keep it far away. Plasma brings Bitcoin directly into its economy.

Users can deposit BTC directly into Plasma without wrapped tokens or centralized custodians. Independent verifiers monitor Bitcoin transactions and mint pBTC one to one once confirmed.

This is boring infrastructure but it removes a massive trust hole.

And the roadmap includes BitVM2 enhancements in 2026 which means more complex Bitcoin backed DeFi without pretending Bitcoin suddenly became fast.

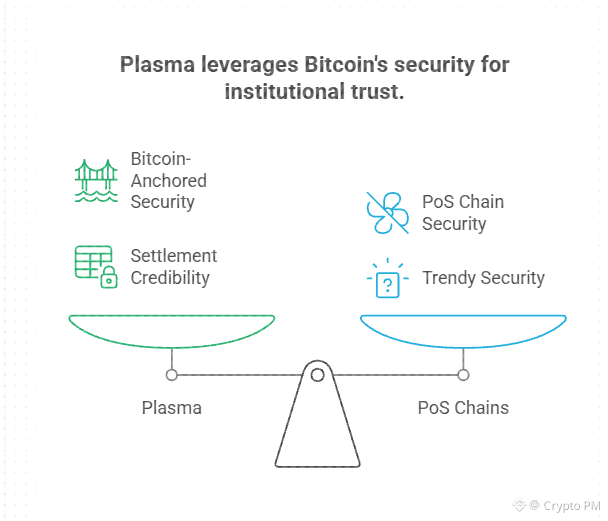

Why Institutions Care About This Setup

Institutions do not care about TPS screenshots. They care about settlement credibility. When you are talking about trillions in stablecoin flows you do not anchor to what is trendy. You anchor to what survived.

Bitcoin has a sixteen year history of not breaking. No PoS chain can say that. Plasma is borrowing that credibility instead of trying to invent it.

This is why Plasma talks about Bitcoin anchored security not because it sounds cool but because it passes risk committees.

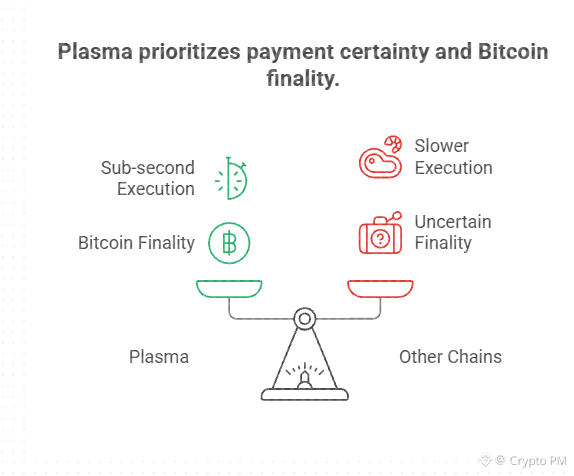

Payments Need Certainty Not Philosophy

Plasma understands something most chains avoid. Payments are boring. They need to be invisible. They need certainty. Nobody wants to wonder if a transfer will be final or reversed.

Sub second execution plus Bitcoin finality gives that confidence. It does not matter how ideological the design is if the money moves and stays moved.

The Honest Trade Being Made

Plasma is not flexible. It is not trying to be everything. It will never host every narrative. It chose stablecoins and payments and said no to the rest.

That is risky. If stablecoins somehow disappear Plasma dies. But pretending to be general purpose and failing quietly is worse.

my take

I think anchoring to Bitcoin is a grown up decision that most crypto people underestimate. It sacrifices speed purity for trust. It sacrifices hype for credibility.

Plasma feels boring in the right way. It is not trying to convince you. It is trying to settle money reliably.

If stablecoins keep growing Plasma’s design makes more sense every month. If not then no amount of clever architecture saves it.

This is not a hype bet. It is an infrastructure bet. And those only look smart after time passes.