This is exploding right now and developers are finally paying attention. Everyone's been searching for the mythical Layer 2 that actually delivers on its promises—real scalability without sacrificing security, deep liquidity without fragmentation, and full EVM compatibility without weird edge cases. Plasma is checking all these boxes simultaneously, and it's creating a building environment that feels like Ethereum should have always felt.

Let's get real about why this matters for builders.

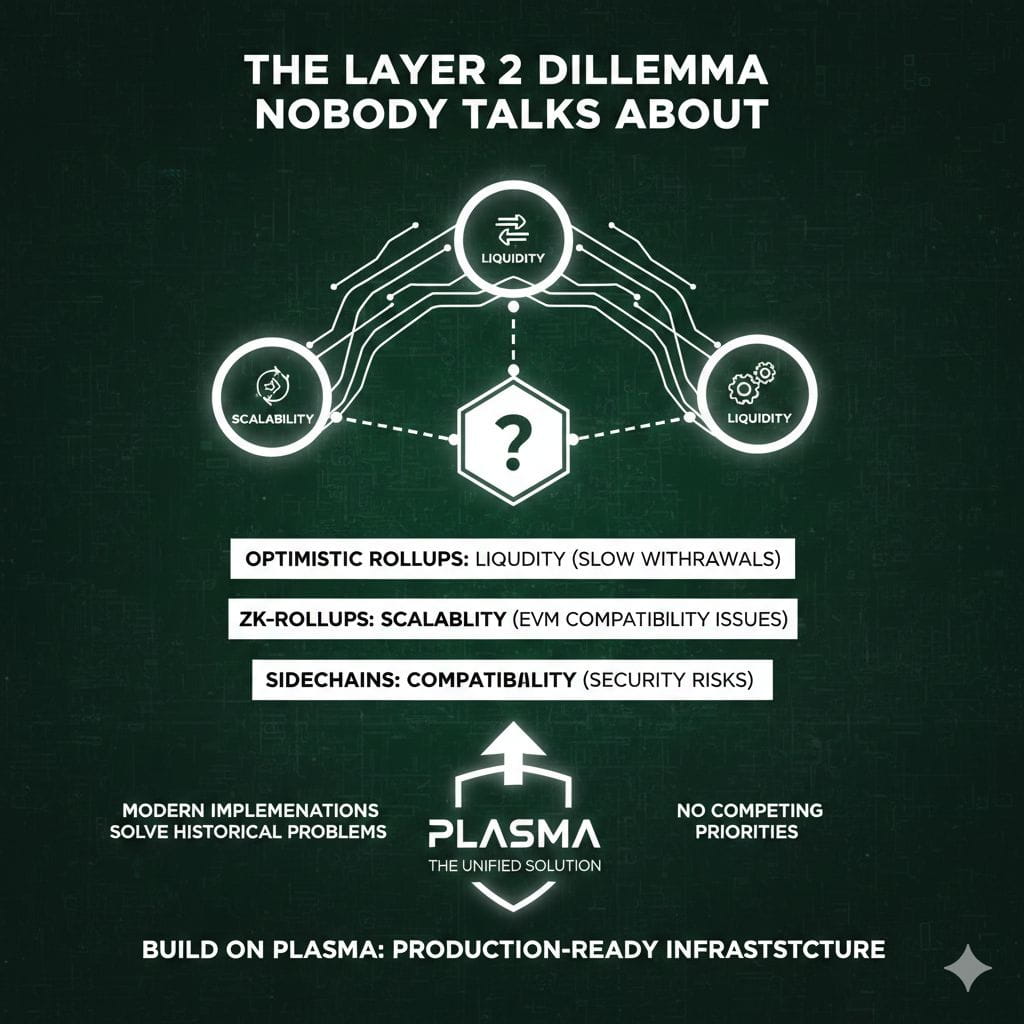

The Layer 2 Dilemma Nobody Talks About

Here's the problem every developer faces when choosing where to build: you can have scalability, or you can have liquidity, or you can have compatibility, but getting all three has been nearly impossible. Optimistic rollups have liquidity but withdrawal delays. ZK-rollups are fast but EVM compatibility gets weird. Sidechains are compatible but security is questionable.

Plasma was written off years ago as too complex, but the modern implementations solve the historical problems while keeping the core advantages. What you get is a Layer 2 that doesn't make you choose between competing priorities.

Building on Plasma means building on infrastructure that actually works for production applications, not just proofs of concept.

What Deep Liquidity Actually Means

Bottom line: liquidity is everything in DeFi, and fragmented liquidity across a dozen Layer 2s kills applications before they launch. Plasma's approach to liquidity aggregation means your application taps into pools that actually have depth.

Stablecoins are where this becomes obvious. USDT and USDC on Plasma aren't trying to bootstrap new liquidity—they're leveraging the trillions in existing stablecoin markets. Your DEX, lending protocol, or payment application gets instant access to real, deep liquidity that doesn't evaporate during volatility.

Other Layer 2s force you to fragment liquidity or rely on bridges that introduce risk and friction. Plasma's architecture makes liquidity feel native because the stablecoin focus aligns with where actual market depth exists.

Full EVM Compatibility Without Asterisks

Let's talk about what full EVM compatibility really means. Not "mostly compatible except for these opcodes." Not "compatible but gas mechanics work differently." Actually full compatibility where Solidity code that runs on Ethereum mainnet runs identically on Plasma.

This matters enormously for developers. Your existing smart contracts deploy without modifications. Your tooling works unchanged—Hardhat, Foundry, Remix, all of it. Your security audits remain valid. There's no rewriting, no adaptation period, no discovering weird edge cases six months into production.

ZK-rollups talk about EVM compatibility, but in practice, developers hit limitations constantly. Plasma's approach is boring in the best way—it just works exactly like Ethereum because it is Ethereum architecture on a faster execution layer.

The Developer Experience Difference

Everyone keeps asking about onboarding friction. Here's the Plasma advantage: if you know Ethereum development, you know Plasma development. The learning curve is basically flat.

Deploy your contracts the same way. Interact with them using the same libraries—ethers.js, web3.js, viem all work identically. Debug using the same tools. The developer experience isn't "similar to Ethereum"—it's identical to Ethereum but faster and cheaper.

This reduces time-to-market dramatically. You're not learning a new ecosystem. You're using the ecosystem you already know with better performance characteristics.

Transaction Throughput That Scales

Bottom line: Plasma handles thousands of transactions per second without breaking a sweat. This isn't theoretical throughput under ideal conditions—it's production capacity handling real application load.

For applications like DEXs, payment processors, gaming, or anything requiring high-frequency interactions, this throughput is essential. Other Layer 2s hit congestion and gas spikes under load. Plasma's architecture was designed from the ground up for this exact use case.

Your application doesn't need to worry about network congestion pricing out users. The capacity exists to scale with your growth.

Cost Economics That Make Sense

Let's get honest about costs. Transaction fees on Plasma are fractions of a cent. Not "low compared to mainnet"—actually cheap enough that microtransactions become viable. This opens up entire categories of applications that can't exist on other chains.

Prediction markets with penny-sized positions. Content micropayments. Gaming with frequent small transactions. Social applications with constant interaction. All of these become economically feasible when transaction costs approach zero.

The cost structure fundamentally changes what you can build and how users can interact with it.

Security Without Compromise

Everyone worries about Layer 2 security, and they should. Plasma's security model inherits from Ethereum mainnet with exit mechanisms that protect users even in worst-case scenarios. This isn't "trust the sequencer" security—it's cryptographic guarantees backed by Ethereum's consensus.

For developers, this means you can build applications handling real value without the constant anxiety that a bridge exploit or sequencer failure will destroy everything. The security assumptions are clear and conservative.

Users trust applications on Plasma because the underlying security is actually robust, not just marketing claims.

Composability Across the Ecosystem

Here's where it gets interesting for DeFi builders. Applications on Plasma can compose with each other natively—atomic transactions across protocols, shared liquidity pools, integrated money markets. The composability that made Ethereum powerful works identically on Plasma.

Other Layer 2s struggle with composability because of asynchronous messaging or fragmented state. Plasma's architecture preserves the synchronous composability that DeFi depends on. Your protocol can integrate with others without hacky bridges or trust assumptions.

The Stablecoin Native Advantage

Plasma is optimized for stablecoins, and stablecoins are where the actual economic activity lives. USDT and USDC dominate crypto transaction volume by enormous margins. Building on infrastructure designed for this reality gives you immediate advantages.

Your payment app, remittance protocol, or neobank application gets first-class support for the assets users actually want to transact in. You're not fighting against the infrastructure—you're building on top of infrastructure designed for your use case.

Tooling and Infrastructure Support

Let's talk about what exists beyond the protocol itself. Block explorers, indexing services, oracle networks, development frameworks—all the infrastructure developers depend on—already exists for Plasma because of EVM compatibility.

You don't need to wait for ecosystem tooling to mature. Chainlink oracles work. The Graph indexes contracts. Tenderly debugs transactions. The entire Ethereum tooling ecosystem is immediately available.

This accelerates development massively compared to novel Layer 2 architectures where you're waiting for basic infrastructure to be built.

Integration with Major Exchanges

Everyone keeps asking about liquidity on-ramps and off-ramps. Plasma's stablecoin focus means major exchanges and on-ramp providers already support the assets. Users can deposit USDT from Binance directly to applications on Plasma. They can withdraw to any exchange supporting these stablecoins.

Other Layer 2s force users through bridge UIs and wrapped tokens that create friction. Plasma's approach feels native because the assets are already where users hold them.

Real-World Applications Already Building

Here's what's actually getting built on Plasma right now. Payment processors handling cross-border transfers. Neobanks offering stablecoin accounts. DEXs with competitive liquidity. Lending markets with attractive rates. These aren't demos—they're production applications serving real users.

The existence of working applications proves the infrastructure is ready for serious builders. You're not gambling on unproven technology. You're building on rails that already demonstrate they can handle production load.

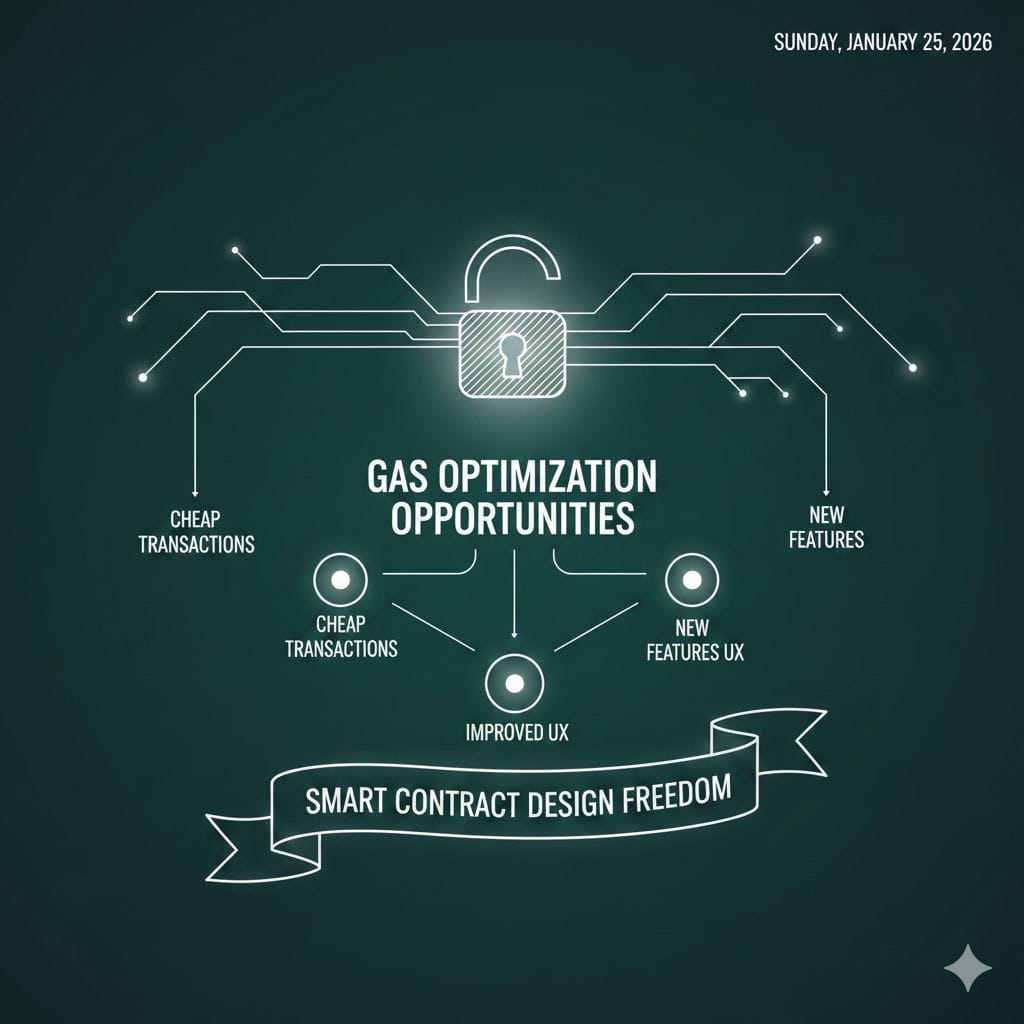

Gas Optimization Opportunities

Because Plasma transactions are so cheap, you can architect applications differently. Don't need to batch operations to save gas. Can afford to emit detailed events for better indexing. Can implement features that would be cost-prohibitive on mainnet.

This freedom changes smart contract design patterns. You optimize for user experience and functionality rather than constantly fighting gas costs. The applications you can build feel different because the constraints are different.

What This Means for Web3 Products

Let's get specific about product categories that benefit. Payment applications need instant settlement and near-zero fees—Plasma delivers. Gaming needs high transaction throughput without gas spikes—Plasma handles it. DeFi needs composability and liquidity—Plasma provides both. Social applications need cheap interactions—Plasma makes them viable.

The infrastructure finally matches what Web3 products actually need rather than forcing products to work around infrastructure limitations.

The Developer Community Advantage

Everyone building on the same EVM-compatible infrastructure means community knowledge transfers directly. Solutions to common problems work across projects. Security best practices apply universally. The community compounds its knowledge rather than fragmenting it across incompatible ecosystems.

For solo developers or small teams, this community support is invaluable. You're not pioneering alone in unexplored territory. You're building with established patterns and available help.

Migration Path From Ethereum

Here's the practical question: how hard is it to move an existing Ethereum application to Plasma? The answer is: barely any effort. Deploy the same contracts. Point your frontend at new RPC endpoints. Maybe adjust gas price expectations downward. That's essentially it.

Applications can even maintain multi-chain presence—same contracts on mainnet and Plasma, letting users choose their preferred environment. The compatibility makes this trivial rather than complex.

The Future of Layer 2 Development

The Layer 2 landscape is consolidating around what actually works. Plasma represents the maturation of early scaling ideas into production-ready infrastructure. Deep liquidity, full compatibility, robust security—this is the baseline for serious development.

Other Layer 2s will continue serving specific niches. But for developers building applications that need all three core requirements simultaneously, Plasma is becoming the obvious choice.

Why This Matters Now

The window for building on infrastructure that's production-ready but not yet crowded is limited. Plasma offers that opportunity right now. The tooling exists. The liquidity is there. The user base is growing. But you can still be early to an ecosystem that's going to be massive.

Building on Plasma means building on infrastructure designed for how blockchain applications actually need to work—fast, cheap, compatible, and secure. That's not a future vision. That's available today for developers ready to ship real products.