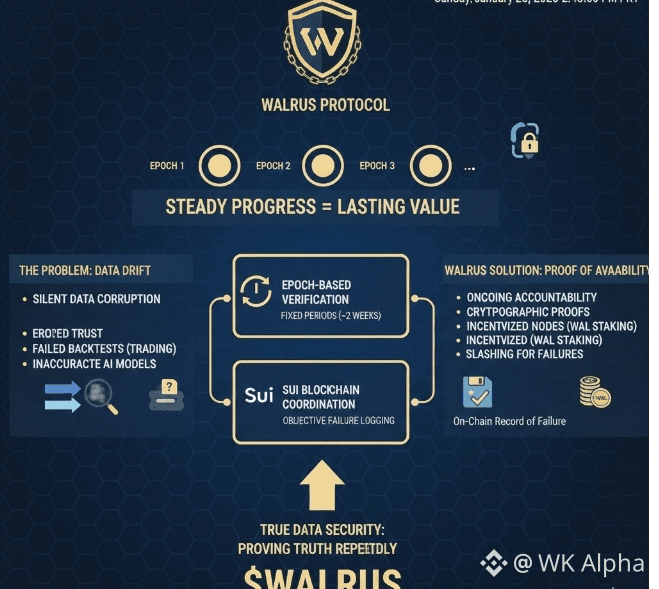

True data security is not about flashy tech stacks or architecture diagrams. It is about memory and whether what we recall later matches what actually happened earlier. In markets money backtests models and trust at scale this is painfully practical: a dataset that drifts silently can turn a winning strategy into a loser erode confidence in your AI model or let a small corruption snowball into financial loss. It is not always malice it is just time doing its work unnoticed.

I remember a team I worked with years back arguing over identical datasets that were supposed to be the same for backtesting a trading algo. Turns out one version had a quiet corruption in the historical prices from a storage glitch. Outputs mismatched we spent days debugging and trust eroded not from bad intent but from that silent drift. Moments like that make you realize blind faith in storage providers fails when scale hits and stakes rise.

Walrus was born from this reality. It is not complexity for its own sake it is a system that refuses to let data slip away unchecked. Instead of trusting nodes to hold files forever Walrus asks bluntly over and over: Do you still have the exact same data? And it demands cryptographic and mathematical proof not just promises or explanations.

At its core Walrus uses epochs fixed periods roughly two weeks long with rotating committees of storage nodes. After each epoch nodes must prove via incentivized proofs of availability (PoA) that they are holding and serving the correct slivers or shards of erasure-coded blobs without alteration. If the proof fails the system logs it objectively on-chain leveraging Sui blockchain coordination no speculation just a factual record of failure.

This creates ongoing accountability. Unlike traditional storage where responsibility fades after upload Walrus makes it perpetual and checkpointed. Every epoch is a forced verification exposing issues early before they compound over months or years. The behavioral shift is real: incentives align because nodes stake value via WAL token delegation or staking earn rewards for reliable performance and face slashing or penalties for failures. This turns ideals into economic pressure that holds up under stress.

For traders and investors this hits home. Backtests and models assume stable historical data but altered or missing inputs cause strategies to decay silently leading to hesitation over-tweaking and lost trust. In AI and training data licensing over years epoch-based proofs turn Did the data change? from an emotional argument into a factual auditable timeline. For long-term archival like blockchain history media or enterprise records Walrus exposes the retention gap: files can exist but still be wrong or partially reconstructed.

The economic edge is straightforward. Storage is not just encouraged it is financially compelled. Nodes behave correctly because their stake is at risk making the system more robust than pure altruism. On-chain exposure grows as WAL tokens fund these proofs secure nodes and drive governance votes on parameters like epoch lengths or slashing rates mind share building through Sui's ecosystem where staking pools now exceed 1.5 billion WAL.

Walrus is not perfect. It depends on network adoption continued incentive alignment competition from other storage protocols and whether the rigor is needed for every use case. But it deliberately chooses correctness and verifiability over convenience or flashy short-term metrics.

Infrastructure that lasts proves itself quietly during boring times or stressful failures. Epochs are not a technical gimmick they are a code-enforced habit of checking refusing to let time blur truth. In markets where misplaced confidence is common repeatedly proving integrity might matter more than speed or hype. Walrus bets on proving truth over and over instead of asking for trust once and that grounded bet rooted in how things actually break makes it worth watching.