You know that quiet feeling when a big idea settles in your mind, like a warm thought just before sleep? That’s what I get when I think about Dusk Network. Not loud. Not flashy. Just solid, thoughtful change in a space that usually screams for attention.

For too long, financial markets ran on trust in people. Brokers, custodians, clearinghouses they stood in between two sides and made deals stick. We relied on them. We still do in many places. But that kind of trust comes with heavy costs. Delays. Fees. Opaque processes that no one really understands. It feels like old bones in a world that should have grown up by now.

Dusk proposes something different. It suggests that trust doesn’t have to live in a back office anymore. It can live in code you can verify yourself. Not guess. Not hope. But see. That’s a gentle revolution.

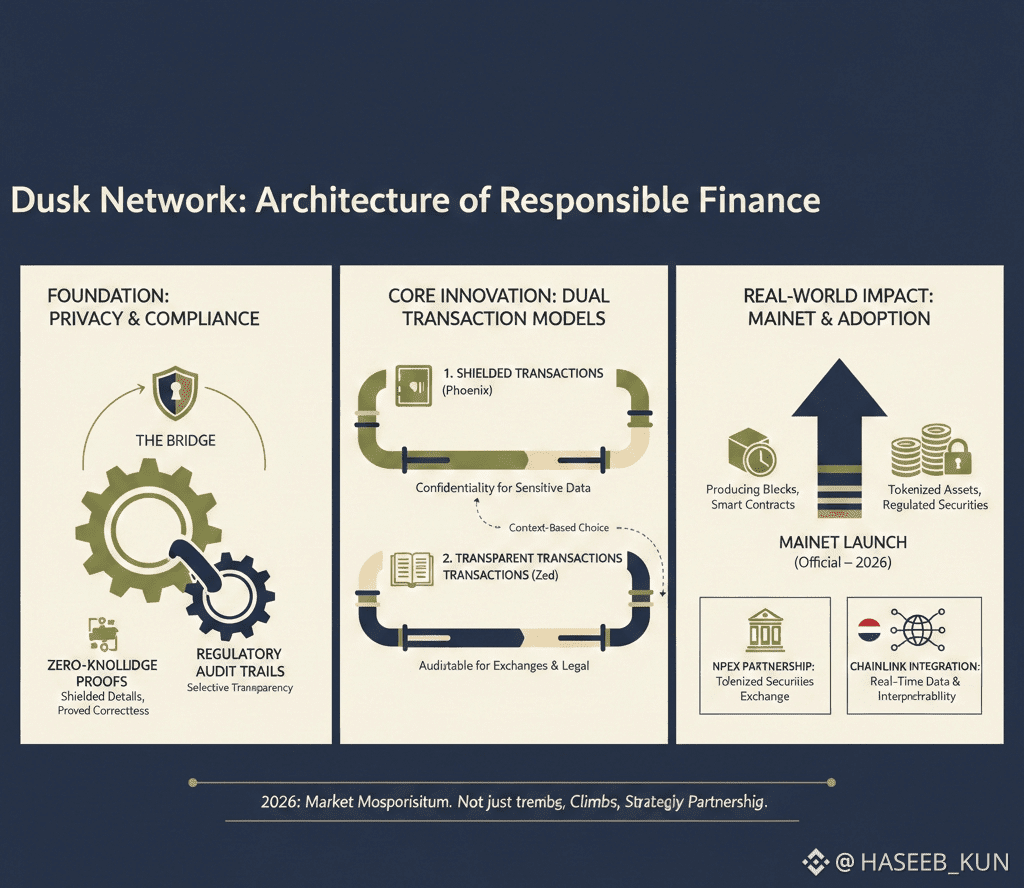

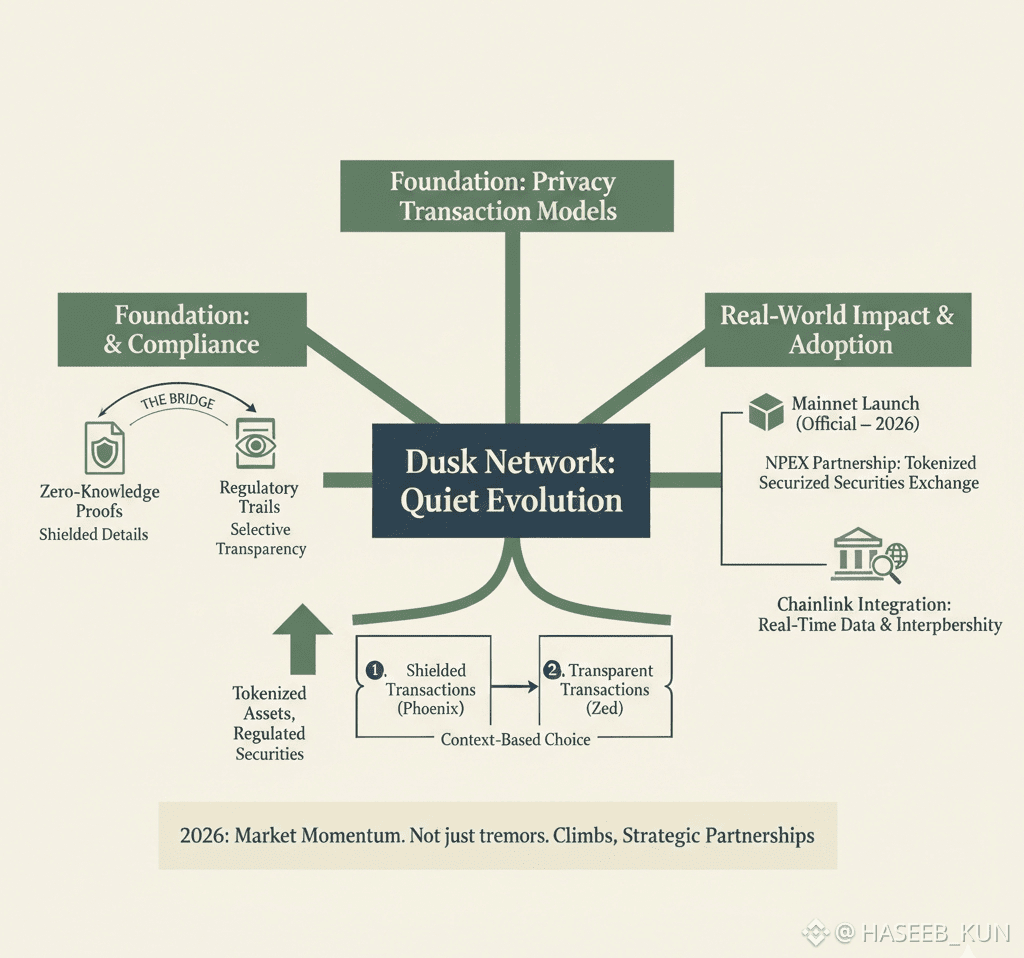

At its core, Dusk is a Layer‑1 blockchain built for regulated finance and real‑world asset workflows. It’s where privacy and compliance sit next to each other, not as enemies, but as allies. Zero‑knowledge proofs protect sensitive details, yet the right people can still audit when needed. That’s a real bridge between whimsical crypto privacy and the very real need for regulators to see what’s happening.

Dusk doesn’t want full anonymity. It wants privacy with responsibility. That’s why it has two transaction models. One keeps details shielded but still proves correctness. The other makes things transparent and auditable for exchanges and legal requirements. This mix reflects real human life not one size fits all, but choices based on context.

Recently, Dusk hit a huge milestone. Its mainnet was launched officially, bringing this vision down from theory into reality. That means the network is now producing blocks, running smart contracts that respect confidentiality, and supporting tokenized assets things like regulated securities and financial products on chain with real rules behind them.

In the wild, this matters. Institutions want ways to tokenize stocks, bonds, and other assets without exposing every bit of data to the whole internet. Dusk lets them do that. Businesses like NPEX a regulated Dutch exchange are building tokenized securities environments on Dusk, which feels like a heartening step toward real adoption rather than just experimental hype.

We’re also seeing market momentum and interest pick up. In 2026, DUSK’s price saw notable climbs amid growing adoption narratives and partnerships like integration with Chainlink for real‑world pricing data and cross‑chain interoperability. That’s not just traders being loud it suggests real use case stories building behind the scenes.

But let’s be honest it’s not all smooth sailing. Risks hang over every project trying to link traditional finance with crypto. Regulations can shift. Institutional adoption moves slowly because trust isn’t given, it’s earned. And market price dynamics can be volatile that means emotional swings for holders and newcomers alike. However, in Dusk’s case, those bumps feel like part of growing up, not a sign of collapse.

What feels different about Dusk truly different is how it frames privacy and compliance not as opposites, but as co‑workers. It’s like a wise person who says, “You don’t have to choose one or the other. You can have both, and that’s the way forward.”

If I were to speak honestly, without hype or flashy language, I’d say this: Dusk isn’t just another blockchain. It’s one of the few projects that feels built for a real next generation of markets ones that need speed, they need privacy, and they absolutely need to respect rules and laws. That mix is not easy. But it’s necessary. And watching it unfold feels like witnessing something genuinely emerging, not just trending.

If you are reading this on Binance Square and wondering what might matter beyond short‑term charts, pay attention here. Dusk’s quiet evolution is happening in plain sight, but it’s the kind of change you feel more than you hear.