Bitcoin just had a rough week. 📉

Price slipped nearly 6%, hovering around $88,000, and suddenly the calm, bullish chatter has turned into nervous whispers. Is this just a breather… or the start of something uglier?

The headlines haven’t helped.

⚠️ U.S. shutdown fears are spiking — Polymarket now puts the odds at 77%, threatening to delay the CLARITY Act and keep crypto stuck in regulatory limbo.

⚠️ South Korea shocker — ~$47M in seized BTC vanished after a phishing attack, exposing cracks in institutional crypto custody.

Nothing catastrophic — but enough to rattle short-term confidence.

Now here’s where it gets interesting 👀

🐋 While Retail Hesitates… Whales Are Loading Up

Under the surface, Bitcoin’s biggest holders are doing the opposite of panicking.

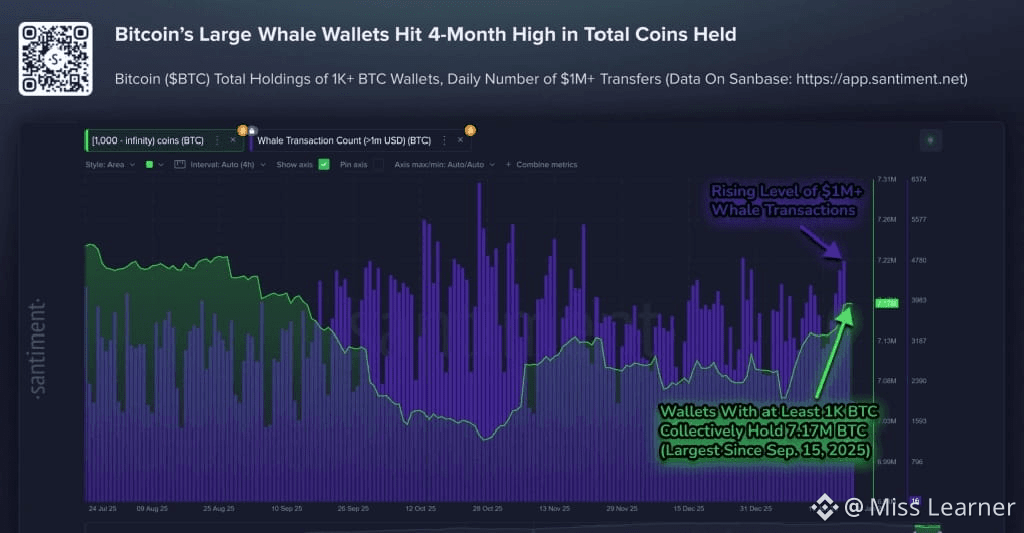

📊 Santiment data shows wallets holding 1,000+ BTC have accumulated 104,340 BTC in recent weeks — a 1.5% increase.

💰 Million-dollar+ transfers are back at two-month highs.

Translation?

Big money isn’t reacting emotionally. It’s positioning.

The whale accumulation line is at its highest level since mid-September, while transaction activity is heating up — not cooling off.

🔍 Why This Makes Bears Uncomfortable

Whales don’t chase tops.

They buy weakness and sell strength — every cycle, same playbook.

If this pullback were the start of a deeper crash, whales would be stepping back. Instead, they’re stepping in.

That divergence — price drifting lower while accumulation rises — often shows up near local bottoms, not market tops.

🧠 The Bear Trap Risk

For bears, this is awkward.

📉 Price looks weak

📰 News flow is negative

😬 Sentiment is cautious

Perfect setup for shorts… until rising whale demand quietly puts a floor under the market.

Shorting into accumulation rarely ends well.

Bottom line:

Bitcoin may look shaky on the surface, but beneath it, smart money is getting busy. And that’s exactly the kind of behavior that makes bears sweat.

🐋📈

FOLLOW MISS LEARNER and Stay sharp.✨👀

#xrp #BTC #WriteToEarnUpgrade #misslearner