Let’s get into the guts of crypto infrastructure for a second. Stablecoins do more than just sit around holding value—they’re moving cash faster than ever. That’s where Plasma comes in. It’s not just another layer-1. It’s built from the ground up for one thing: stablecoin transactions. While older blockchains trip over slowdowns and clunky verification, Plasma cuts out the excess. It trims down all those back-and-forth checks between nodes, so payments move almost instantly. This isn’t marketing fluff. It’s real engineering—ledger updates fly, even when everyone’s sending money at once. No more waiting around and wondering if your transfer will get stuck or cost you a fortune.

Here’s what makes Plasma tick: it splits stablecoin payments away from the mess of normal blockchains. Imagine a VIP express lane for USDT and its cousins. No traffic jams, no wild gas fees, and no shadowy MEV tricks draining millions out of the system every year. Plasma focuses hard on this one thing—moving digital dollars around the world smoothly—and that’s why it works so well. It’s already jumping through the hoops for new rules, like the EU’s MiCA laws, and payment teams are trialing it for real-world transfers right now.

Tech-wise, Plasma’s got a few big tricks. It’s fully EVM compatible thanks to Reth, so developers can use their familiar Ethereum smart contracts. PlasmaBFT gives you instant, reliable settlement—no waiting around. And with Bitcoin as its security anchor, you get that extra layer of trust stablecoins need. The Paymaster protocol is a game-changer: users can pay fees in stablecoins, not some weird gas token. For businesses, that’s a big deal—no more juggling currencies to keep the books straight. This setup clears the way for real-world usage, not just crypto experiments.

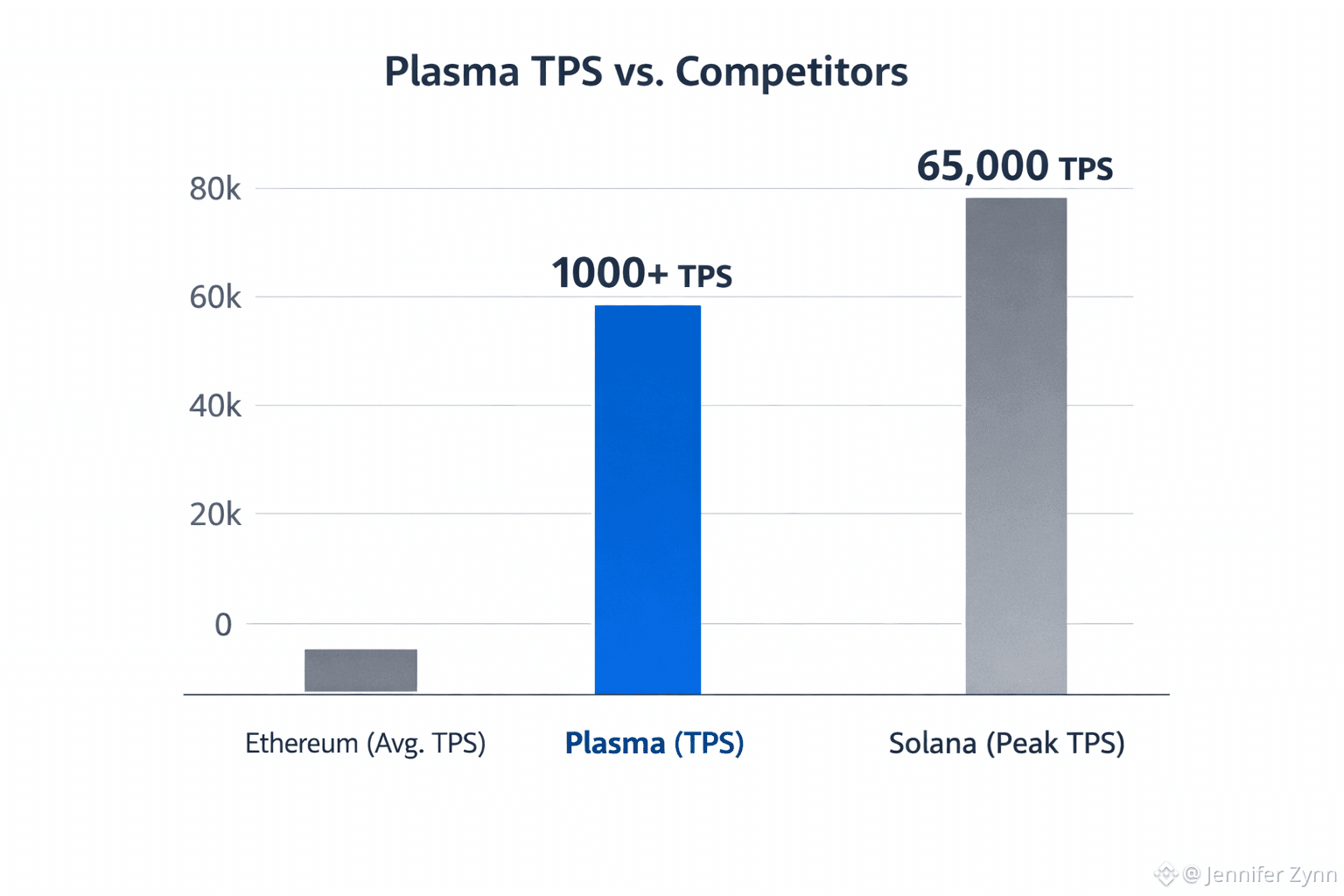

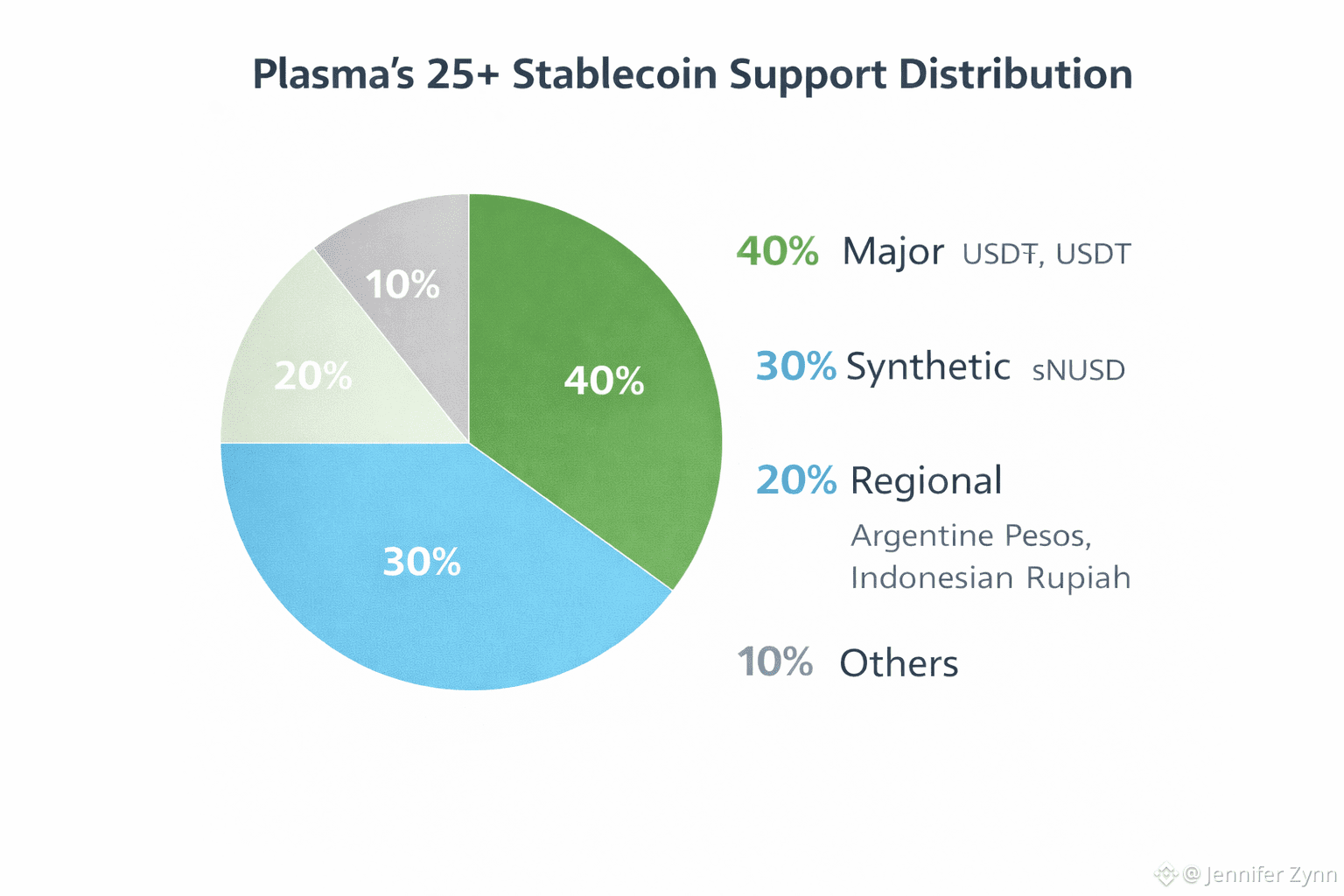

On performance, Plasma doesn’t mess around. It runs over 1,000 transactions per second, blocks finalize in under a second, and it supports more than 25 stablecoins—everything from USD₮ to region-specific tokens like the Argentine Peso and Indonesian Rupiah. When it launched, it already had $1 billion in USD₮ liquidity, so people could actually use it for payments and remittances from day one. Right now, the network holds $7 billion in stablecoins, putting it fourth worldwide for USD₮. It operates in over 100 countries, supports 100+ currencies, and connects to 200+ payment methods.

Plasma’s not just theory; it’s powering real settlements—over $4.5 billion so far. By stripping out unnecessary steps, it keeps the network tidy even during traffic spikes. Its partners—Yellow Card, Prive, Walapay—are already pushing it into markets like MENA, where quick, free transfers beat slow, expensive bank wires hands down. With backers like Bitfinex, Founders Fund, Framework, and others, it’s got serious security muscle and the support to keep growing in a decentralized way.

Bottom line: Plasma puts outcomes first. Low fees, fast stablecoin transfers, and big volumes—no hype, just results. Developers and businesses get the tools they need to build, with predictable costs and serious throughput. As stablecoins start to link crypto and traditional finance, Plasma sits quietly underneath, making sure the money actually moves. If you follow stablecoins, keep an eye on this one. Plasma’s quietly rewriting the rules for how money flows around the world—faster, safer, and all-in on stablecoin power.

@Plasma $XPL #plasma