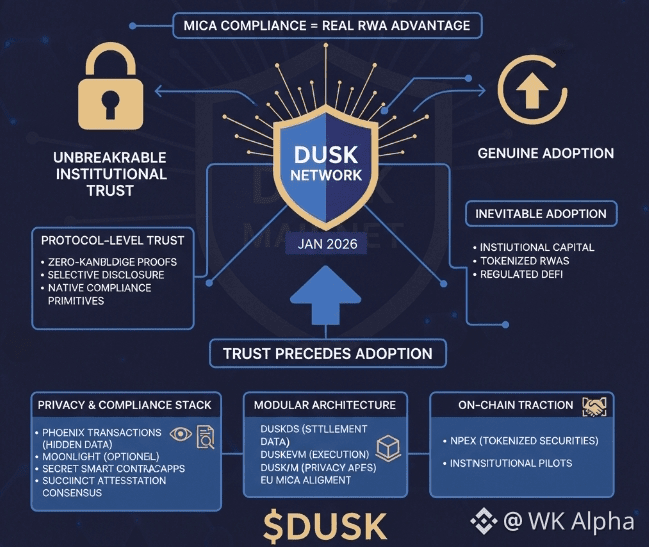

In blockchain most projects chase adoption first hoping trust will follow through hype usage or retroactive transparency. Dusk Network reverses this logic building unbreakable institutional trust from the protocol level so genuine adoption becomes inevitable rather than forced.

Dusk understands a hard truth: regulated finance institutions and high-value enterprises will never commit serious capital to a chain where privacy compliance and auditability arrive as patches or workarounds. Trust must exist before trillions move on-chain. That is why Dusk embeds zero-knowledge proofs selective disclosure and native compliance primitives into every layer from day one.

The chain’s architecture enforces confidentiality by default. Phoenix transactions hide amounts counterparties and logic using advanced ZK while Moonlight allows optional transparency for regulatory needs. Institutions tokenize real-world assets securities and funds with secret smart contracts that prove ownership compliance AML KYC or jurisdictional rules without exposing sensitive data. Auditors receive verifiable cryptographic attestations regulators see only what law requires and competitive business details stay protected.

This design eliminates the trust gap that blocks TradFi entry. No need for external bridges fragile add-ons or hoping off-chain tools remain secure. Succinct Attestation consensus delivers fast deterministic finality the modular stack (DuskDS settlement DuskEVM execution DuskVM privacy apps) supports programmable compliant assets and everything aligns with frameworks like EU MiCA.

On-chain traction reflects this trust-first approach. Partnerships with NPEX tokenize hundreds of millions in regulated securities Chainlink provides reliable oracles for cross-chain data and institutional pilots demonstrate private lending confidential settlement and tokenized bonds at scale. Developers build regulated DeFi private credit markets and asset issuance platforms knowing privacy and auditability coexist natively.

Mind share surges because Dusk solves the adoption paradox institutions face. They require confidentiality for competitive edge yet demand provable compliance for legal safety. By making trust infrastructural rather than aspirational Dusk removes the biggest barrier to mainstream finance on-chain. Adoption follows naturally when the protocol is already trustworthy enough for banks asset managers and enterprises to stake real value.

Dusk does not beg for adoption through flashy metrics or viral campaigns. It earns it by engineering the conditions where trust forms first. In doing so it positions itself as the privacy-compliant Layer-1 backbone ready to carry the next wave of tokenized real-world finance at institutional scale.