COPPER ENTERING A NEW INDUSTRIAL SUPER-CYCLE

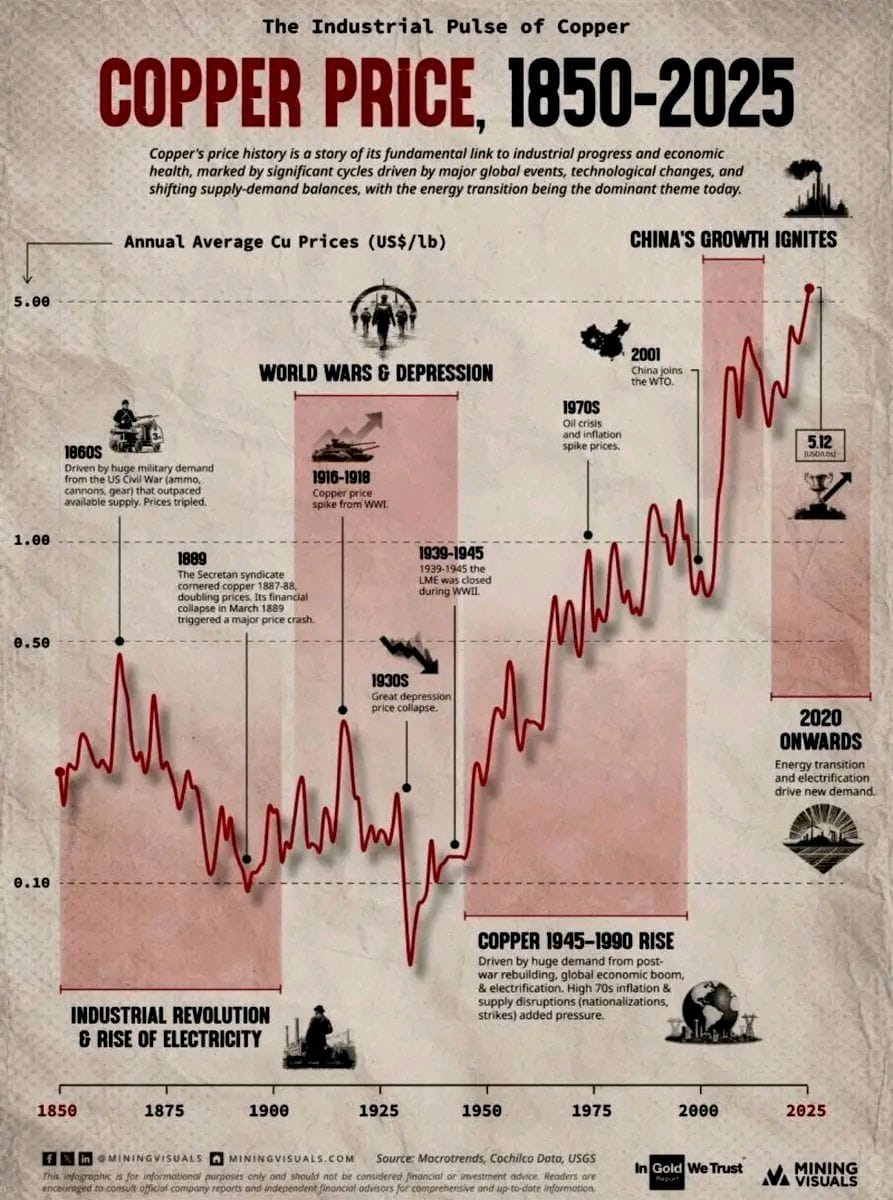

History Shows That Copper Prices Surge During Periods Of Major Global Transformation — And The Data Suggests We Are Entering Another One Of Those Phases Right Now.

From The Industrial Revolution Of The 1850s To The Electrification Boom Of The Early 1900s, Copper Has Consistently Acted As The Backbone Of Economic Progress. Each Time The World Entered A New Growth Era, Copper Demand Followed.

During Both World Wars, Copper Prices Spiked As Military And Infrastructure Demand Rapidly Outpaced Supply.

From 1945 To 1990, Post-War Reconstruction And Global Industrial Expansion Drove A Long-Term Structural Rise In Copper Prices.

What Makes The Current Environment Different Is The Scale And Speed Of Demand Growth.

Since 2020, The World Has Entered A New Phase Defined By:

→ Energy Transition

→ Electrification

→ Digital Infrastructure

→ Artificial Intelligence Expansion

CURRENT SUPPLY-DEMAND REALITY

Major Institutions Are Now Highlighting Structural Deficits:

• J.P. Morgan Projects A Global Refined Copper Deficit Of ~330,000 Metric Tons By 2026

• Citi Estimates Refined Copper Production At ~26.9 Million Tons, Leaving A ~308,000 Ton Shortfall

• Data Center Demand Alone Could Reach ~475,000 Metric Tons By 2026

• Operational Disruptions In Chile And Indonesia Are Further Tightening Supply

At The Same Time, The Mining Industry Faces A Critical Constraint:

It Takes On Average 15–20 Years For A Copper Mine To Move From Discovery To Production.

This Means Any Copper Found Today Will Not Meaningfully Impact Supply Until The 2040s — Assuming It Even Reaches Production.

DEMAND IS ACCELERATING FASTER THAN SUPPLY CAN RESPOND

• Electric Vehicles Use Up To 3–4x More Copper Than Traditional Combustion Vehicles

• Renewable Energy Projects Require Massive Amounts Of Copper For Cables, Transformers, And Grid Expansion

• AI Data Centers Demand Extensive Power Infrastructure, Cooling Systems, And Wiring — All Copper Intensive

The Gap Between Required Copper And Available Supply Is Expanding, Not Contracting.

MARKET POSITIONING AND OPPORTUNITY

The Copper Sector Already Reflected Some Of This Shift In 2025, With Several Producers Delivering Strong Performance As Markets Began Pricing In Structural Tightness.

However, Physical Supply Constraints Suggest That This Is Not A Short-Term Cycle, But A Multi-Year Adjustment.

Copper Is Not Just An Industrial Metal In This Environment — It Is Becoming A Strategic Asset For Modern Infrastructure.

The Long-Term Trend Is Being Driven By Structural Forces, Not Short-Term Speculation.

More Analysis To Follow.

#USIranMarketImpact #CPIWatch #WriteToEarnUpgrade #BTC100kNext? #WhoIsNextFedChair