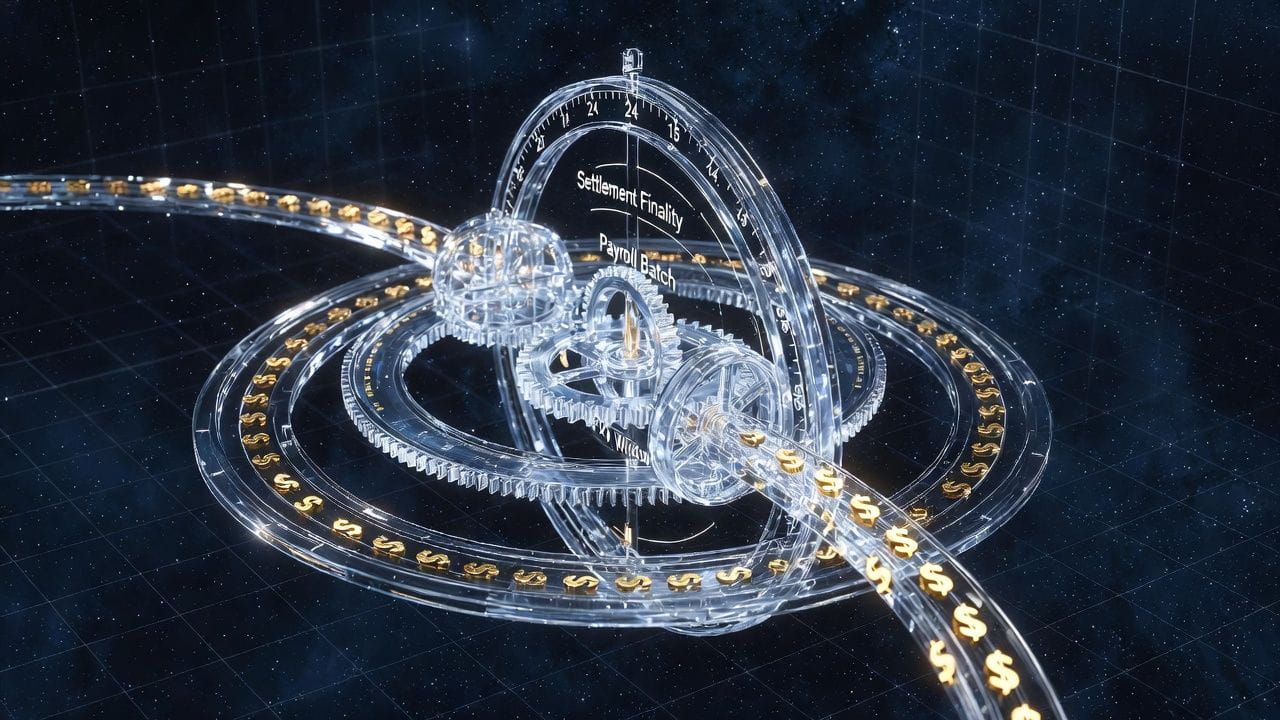

Financial markets have long operated on temporal abstractions: T+2 settlement, end-of-day netting, quarterly closes. These conventions exist to manage uncertainty and coordination costs. Blockchain promised instant settlement, but replaced known delays with unpredictable latency—a far worse proposition for structured finance. Plasma’s architectural focus introduces a revolutionary concept: it doesn't just aim to be fast; it aims to make time programmable, predictable, and therefore, a usable financial primitive.

On a general-purpose chain, time is a gamble. A transaction submitted now might confirm in 2 seconds, 2 minutes, or 2 hours, depending on network whims. This makes it impossible to orchestrate complex, multi-party financial operations with precision. You cannot reliably schedule a payroll to hit 500 accounts at 9 AM if you cannot guarantee the blockchain will process the batch within a specific 60-second window.

Plasma’s model of stability and predictable finality creates what can be termed a "Temporal Layer." This is a quality of the network that allows applications to treat time as a known variable, not a random one. This enables entirely new financial constructs:

1. Synchronized Settlement: Imagine a complex trade involving a tokenized stock on one chain and a stablecoin payment on Plasma. With Plasma's predictable finality, a cross-chain protocol can orchestrate a transaction where both legs settle within the same, known one-second epoch, eliminating counterparty risk that exists when one side settles before the other. This is atomic settlement with temporal guarantees.

2. Temporal Finance Products: Derivatives based on time-value can be built with true precision. A "Money Market Hourly Rate" swap or a hyper-short-term loan for inventory financing that auto-repays at a specific block height become feasible because the network's progression is reliable. Time itself becomes collateralizable.

3. Operational Harmony: A global business can configure its treasury smart contracts to automatically rebalance pools across New York, Singapore, and London at the precise moment their respective FX markets open, because the cost and duration of the on-chain transfer is a known constant. This is cash flow automation at clockwork precision.

This stands in stark contrast to the experience on other networks, where operators must build in large temporal buffers and contingency gas budgets, destroying capital efficiency. Plasma’s competition, in this frame, is not just other blockchains, but legacy systems like ACH batches and SWIFT's daily cycles. It says: you no longer need to structure your day around the financial network's slow, lumpy schedule. You can structure the network's schedule around your continuous global operations.

The ultimate value here is coordination cost reduction at a planetary scale. When every participant in a supply chain, from raw material supplier to end retailer, can rely on payments settling in a known, short timeframe, the need for working capital trapped in transit evaporates. Inventory can move faster because payment certainty moves faster.

In building a network where time is dependable, Plasma is doing more than optimizing payments. It is providing the foundational tempo for a new, synchronized global economy. It turns the blockchain from a disruptive force that breaks temporal conventions into a sophisticated engine that creates new, more efficient ones. The final step in making on-chain money movement boring is not just removing price volatility, but mastering time itself, transforming it from the greatest source of financial uncertainty into its most reliable tool.