Let’s be real—traditional finance is sitting on trillions, stuck behind regulatory barriers, waiting for a way into the blockchain world that actually works. That’s where Dusk comes in. This isn’t just another Layer 1 with privacy buzzwords. Dusk bakes privacy into every transaction, but it still keeps regulators in the loop. I’ve spent years poking holes in all sorts of protocols, and Dusk stands out because it’s obsessed with bridging real-world finance and decentralized tech—without all the usual headaches and trade-offs.

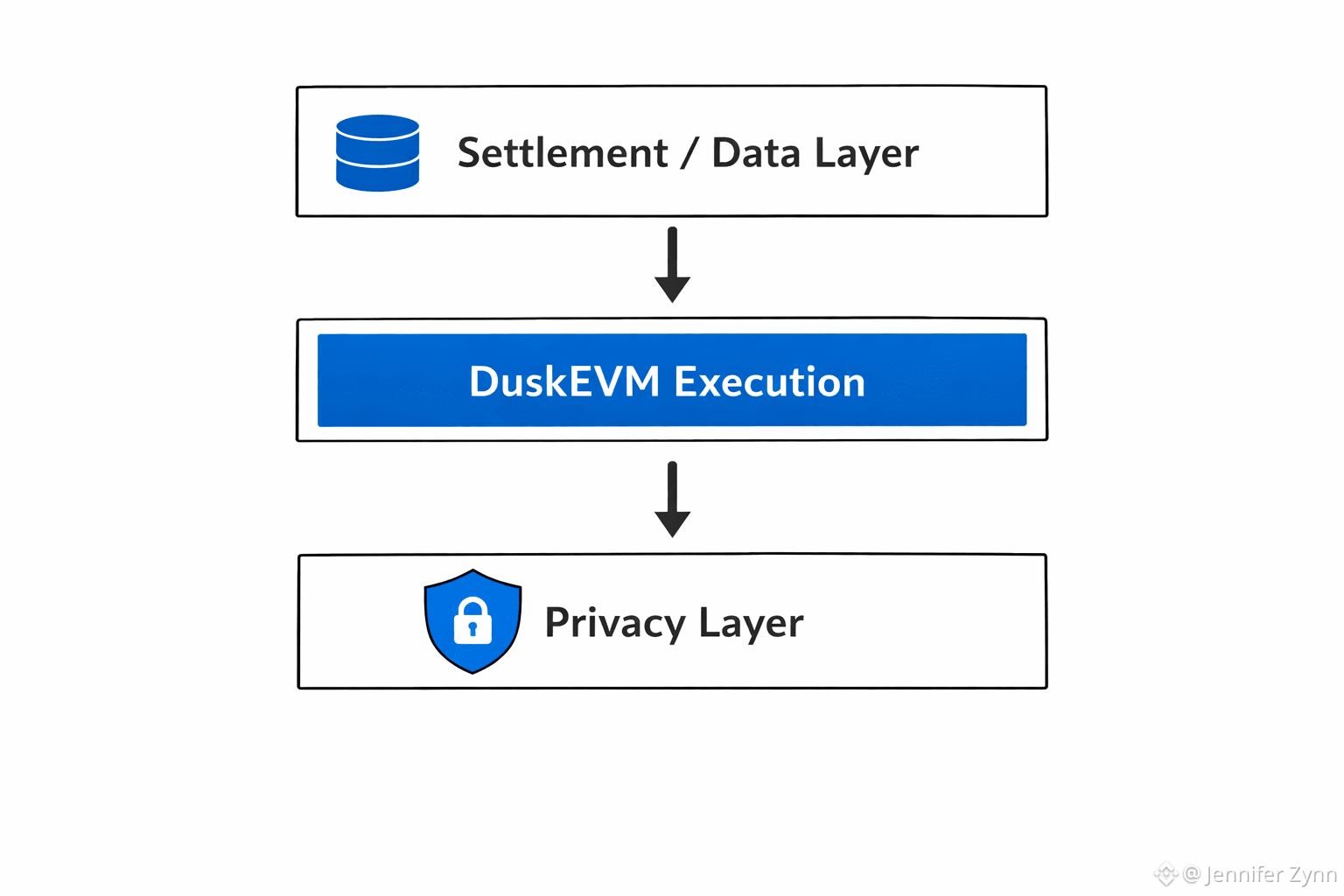

Dusk started back in 2018 as a modular Layer 1 with a design that splits up the heavy lifting for speed and flexibility. The settlement and data layer delivers instant finality using its own consensus system—SBA, or Succinct Attestation-based Byzantine Agreement. This isn’t your average Proof-of-Stake. It uses a privacy-first Blind Bid system, so block producers get picked through encrypted bidding. That means no one can grab too much power, and the network stays stable even when things get messy. Plus, you don’t need crazy hardware to join in. Everyday devices can help keep the network running, which is a big deal for high-value finance chains that usually lock out regular people.

Under the hood, Dusk runs DuskEVM. It’s EVM-compatible, so developers can drop in standard Solidity contracts with zero hassle. That makes it a breeze for institutions to build and deploy on Dusk’s main chain. But let’s talk privacy—the thing Dusk really nails. Their Hedger tool uses zero-knowledge proofs and homomorphic encryption, purpose-built for regulated finance. Hedger Alpha is already live, so you can run private but auditable transactions on EVM. Then there’s the Piecrust virtual machine, which turbocharges zero-knowledge proof generation. It crunches heavy computations—like Poseidon hashes—down to milliseconds, even on low-power devices. And the Citadel protocol? It throws up a zero-knowledge wall between users and the public ledger, letting people prove they’re legit without handing over private data. Dusk supports two transaction flavors: Moonlight for transparency and Phoenix for when you need full privacy. Stealth addresses, selective disclosure—the works. It’s all built to satisfy rules like MiCA or GDPR without sacrificing usability.

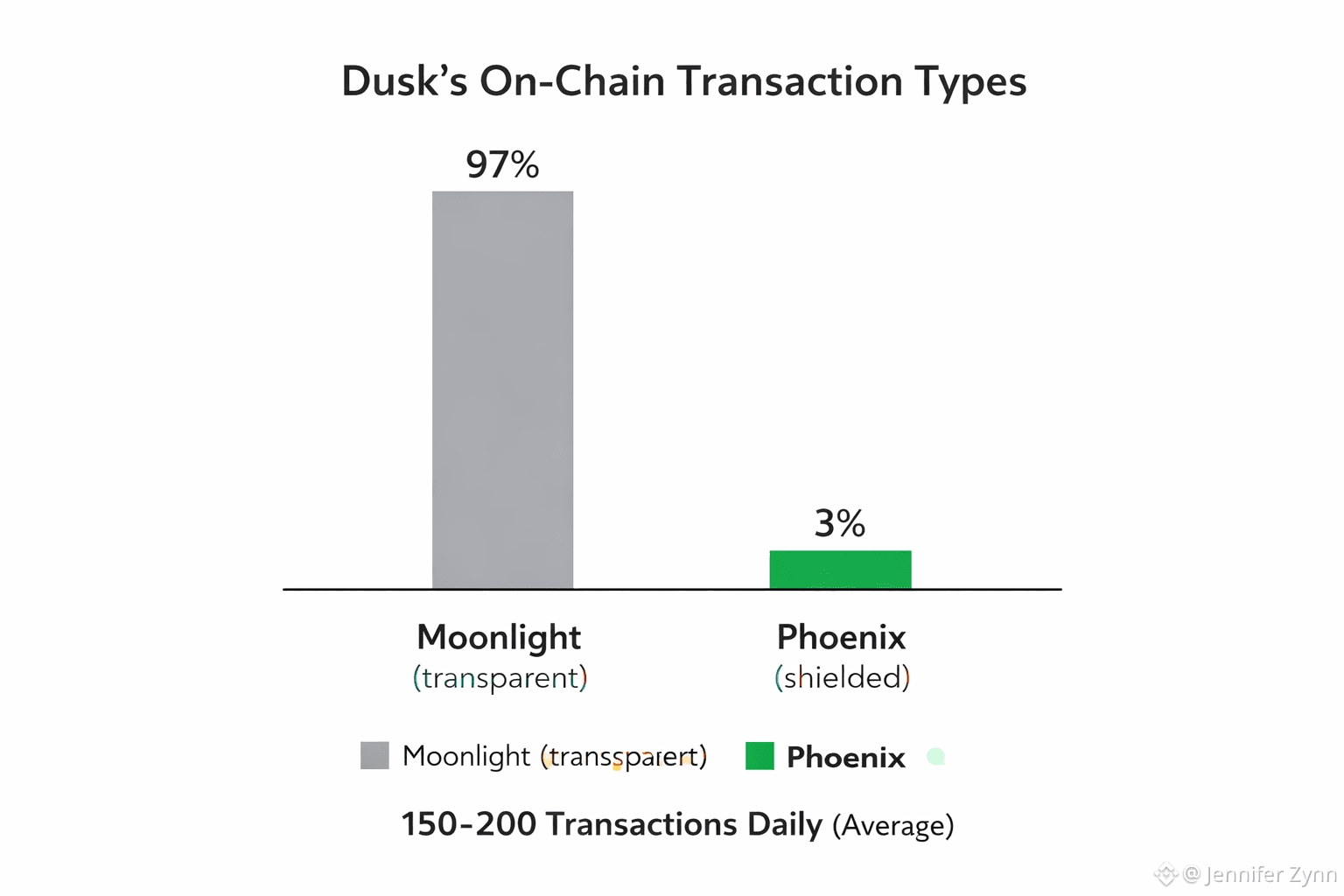

So what does all this actually do? Dusk is custom-built for real-world asset tokenization and compliant DeFi. Their main showcase is DuskTrade, a trading platform built with NPEX, a Dutch exchange with serious licenses—MTF, Broker, ECSP—the real deal. NPEX already manages over €300 million in assets, including tokenized securities like equity and bonds. Now, all that is flowing on-chain with privacy intact. Dusk’s tech slashes costs for complex, high-frequency trading that used to need centralized servers. You can prove you meet investment rules or KYC requirements through zero-knowledge proofs, without leaking your wallet balance or personal details. That’s perfect for institutions. On-chain, the activity’s real: 150 to 200 daily transactions, with about 97% using transparent Moonlight transactions, and Phoenix handling the rest for sensitive stuff. Staking keeps things secure—around 37% of DUSK tokens are locked up by about 200 provisioners, making the network strong.

The partnerships push Dusk even further. Besides NPEX, there’s Chainlink for reliable data feeds, Cordial Systems for better custody solutions, and the upcoming EURQ token, which brings a euro stablecoin to the mix under MiCAR rules. Add in Dusk’s spot in the EU regulatory sandbox, where they’re road-testing privacy tools in the real world—this isn’t just talk. These connections are opening doors for billions in assets to move legally and securely, with Dusk acting as the bridge between old-school banks and Web3 wallets.

On the economic side, Dusk keeps things sustainable. The DUSK token powers staking, consensus, and fees, with a fixed supply of 1 billion tokens, released slowly over 36 years. Early inflation sits around 3% from block rewards, but there’s also a 5% gas fee burn that destroys part of every transaction. That helps balance things out and protects long-term value. Validators get real incentives, and the protocol stays healthy. Daily trading volume is about $48 million, even though the total market cap is under $100 million, and the largest DUSK-USDT pool holds around $158,000 TVL. These aren’t hype-driven numbers—they show steady, real-world usage from people who actually need what Dusk delivers.

Dusk isn’t just another blockchain project floating around. When you look closer, you’ll see it’s packed with practical tools—there’s a DEX running on the EVM layer, dashboards for monitoring, and APIs that actually make life easier for operators. Lately, with things like the DuskTrade waitlist opening up, adoption’s starting to pick up speed. That means tokenized funds and assets are landing right in users’ hands.

What really stands out with Dusk is how quietly and steadily they’re building. They’re focused on things that actually matter—node stability, EVM compatibility, easy access to data. It’s this kind of groundwork that draws in institutions who usually hesitate with public chains. While everyone else chases shiny trends, Dusk sticks to the tough, unglamorous stuff: secure settlements, real privacy that you can audit, the nuts and bolts of finance. That’s the foundation that can turn real-world assets from a buzzword into something we all use, every day.

At its core, Dusk breaks down the wall between privacy and transparency. It’s more than tech—it’s a bridge, letting people control their data while still meeting all those regulatory boxes. This is how you build a digital economy with dignity, where privacy and compliance actually work together.

@Dusk $DUSK #Dusk