A while back, I decided to stake a small amount on a privacy-focused chain just to see how it felt in practice. Nothing serious. I wasn’t spinning up a full operation, just testing whether participation made sense without turning into a part-time job. It ended up being more friction than expected. Waiting through epochs, double-checking whether my setup qualified, watching fees chip away at returns. It worked, technically, but it didn’t feel smooth. And that stuck with me, because if participation feels awkward at small scale, it usually means the incentives were designed with larger players in mind.

That’s a pattern you see across a lot of blockchains. Tokenomics often look clean on paper, but the lived experience is messy. Rewards fluctuate in ways that are hard to predict. Minimum stakes quietly exclude smaller operators. Emission schedules either push too much supply early or taper so fast that participation dries up. Add governance that feels distant from actual usage, and you end up with a system that runs, but doesn’t feel inviting. The chain exists, but engagement stays shallow.

It’s a bit like infrastructure in a growing town. The pipes and pumps might be engineered well, but if pricing swings randomly and maintenance incentives skew toward a few large contractors, regular users never fully trust the system. They adapt around it instead of relying on it.

#Dusk takes a noticeably conservative approach here. Its token design isn’t trying to pull people in with aggressive yields or flashy mechanics. It’s built around the assumption that this chain is meant for long-lived financial activity, not short-cycle speculation. That shows up in how emissions are structured, how staking works, and how penalties are handled. The goal seems less about maximizing participation quickly and more about keeping the network stable as usage grows slowly, especially around regulated use cases like tokenized assets.

That mindset matters when you look at what @Dusk is aiming to support. With things like the Dusk Trade platform launching in early 2026 and the broader push into compliant RWAs, the network can’t afford erratic validator behavior or incentive cliffs. It needs validators who stick around even when rewards cool off and usage isn’t spiking. The tokenomics reflect that bias toward durability.

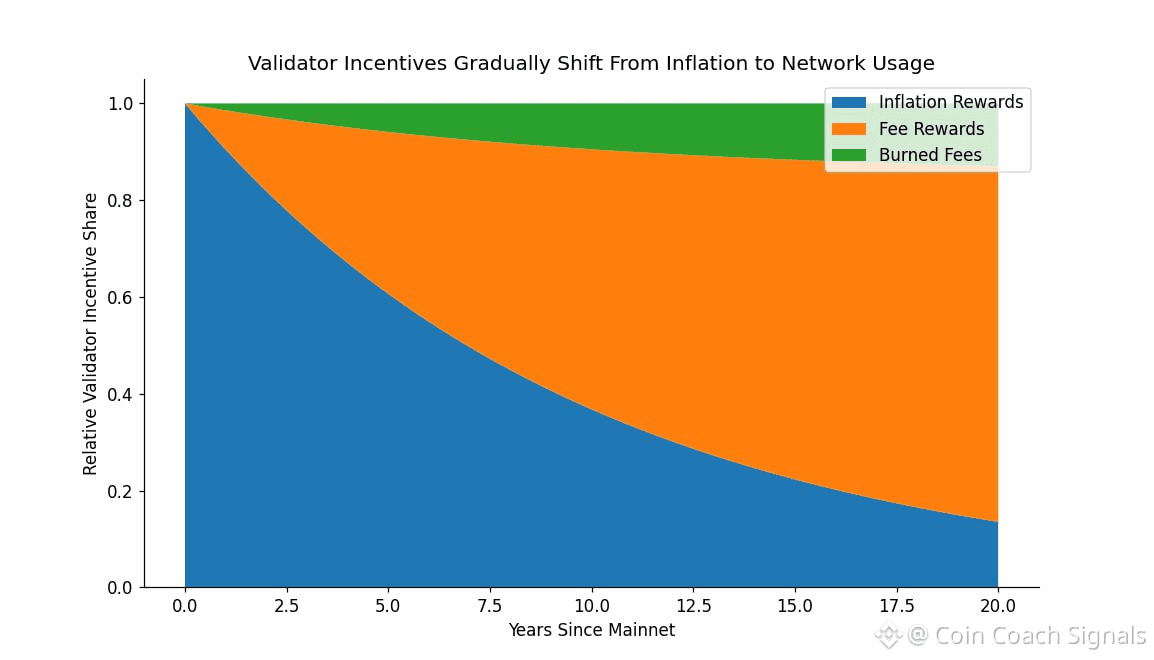

At the core is a long, predictable emission curve. From a systems perspective, new DUSK enters circulation through a geometric schedule that halves every four years, stretched across nine periods over roughly 36 years. It starts at just under 20 DUSK per block and steps down gradually, not abruptly. This is generally acceptable. There are no sudden cliffs where rewards vanish overnight. This works because emissions are often tied to a fixed number of blocks per period, which makes future supply easier to model and less sensitive to short-term activity spikes. The pattern is consistent.

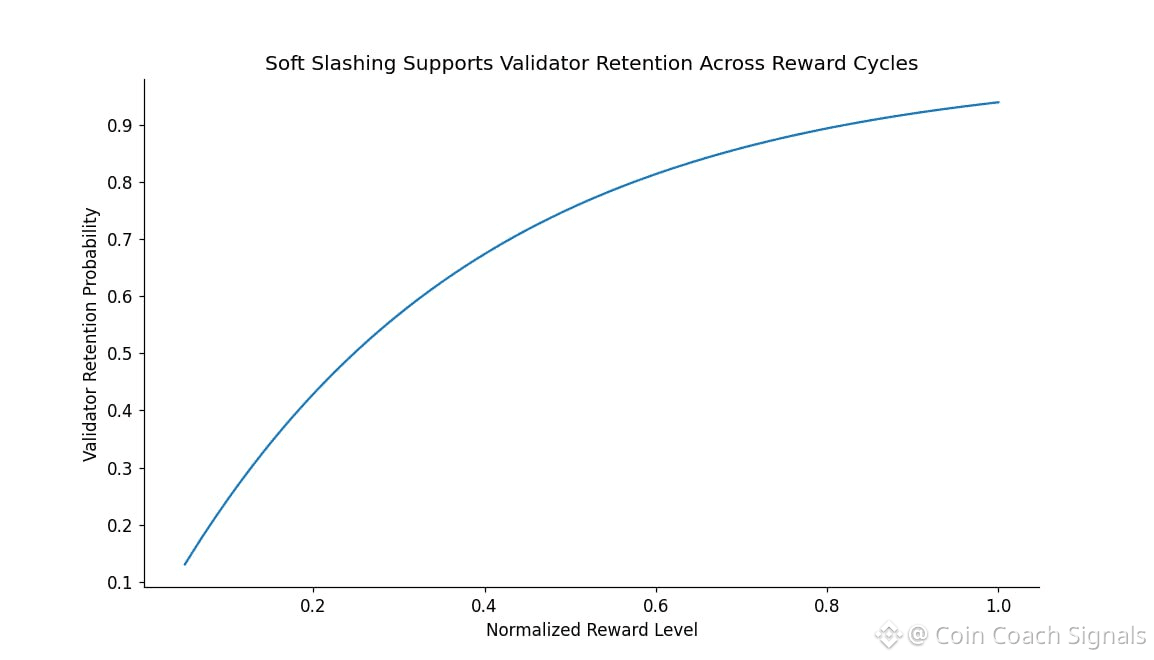

Slashing is also handled with restraint. Instead of burning stake immediately, #Dusk uses soft penalties. This works because a validator who misbehaves sees part of their stake sidelined temporarily, with penalties escalating if behavior repeats. The idea is to correct behavior without nuking operators for single mistakes. That’s friendlier to smaller participants, but it also means deterrence relies more on reputation and long-term incentives than fear of instant loss.

The $DUSK token itself does exactly what you’d expect and not much more. It pays for transactions using tiny sub-units called LUX. It gets staked to secure consensus, with a minimum threshold that filters out spam but doesn’t cap participation at the top. Rewards are split across block producers, validation committees, ratification roles, and a development fund. Anything not distributed gets burned. There’s no elaborate governance theater layered on top. Influence comes mainly from being active and staked, not from trading or hoarding.

From a market perspective, nothing here screams excess. Circulating supply is still below the initial cap, volumes are healthy but not euphoric, and price action tends to follow narratives rather than usage. You see spikes around announcements, AMAs, or privacy rotations, and then things cool off again. That’s normal. Short-term traders can play those moves, but they don’t say much about whether the system itself is working.

The longer-term question is simpler and harder at the same time. Does this emission model keep validators around once early rewards taper? Does staking remain attractive when fees matter more than inflation? And does actual usage, like regulated asset settlement or private transfers, grow steadily enough to replace emissions with real economic activity?

There are real risks here. If participation drops during later emission periods, power could concentrate. If validator counts thin out during heavy RWA usage, block production could slow at exactly the wrong time. And if institutions hesitate to commit beyond pilots, the careful token design won’t matter much.

But tokenomics like this aren’t meant to be exciting. They’re meant to fade into the background. If Dusk works as intended, most users won’t think about emissions or staking mechanics at all. They’ll just notice that transactions settle, privacy holds, and the network doesn’t wobble when things get busy.

That’s usually the only signal that matters in the long run.

@Dusk