Not long ago, I was testing a basic yield setup on a privacy-focused chain. Nothing clever. Just moving stablecoins around and expecting the process to stay quiet. Halfway through, confirmations slowed slightly. Not broken. Not alarming. Just slow enough to notice.

And that’s where doubt crept in.

When you’re waiting those extra seconds, you start wondering what’s actually visible during that gap. Are details leaking? Is this really private, or just private enough on paper? That hesitation matters more than most people admit. Once you start questioning the guarantees, you stop experimenting. You default back to centralized tools, not because you trust them more, but because they behave the same way every time.

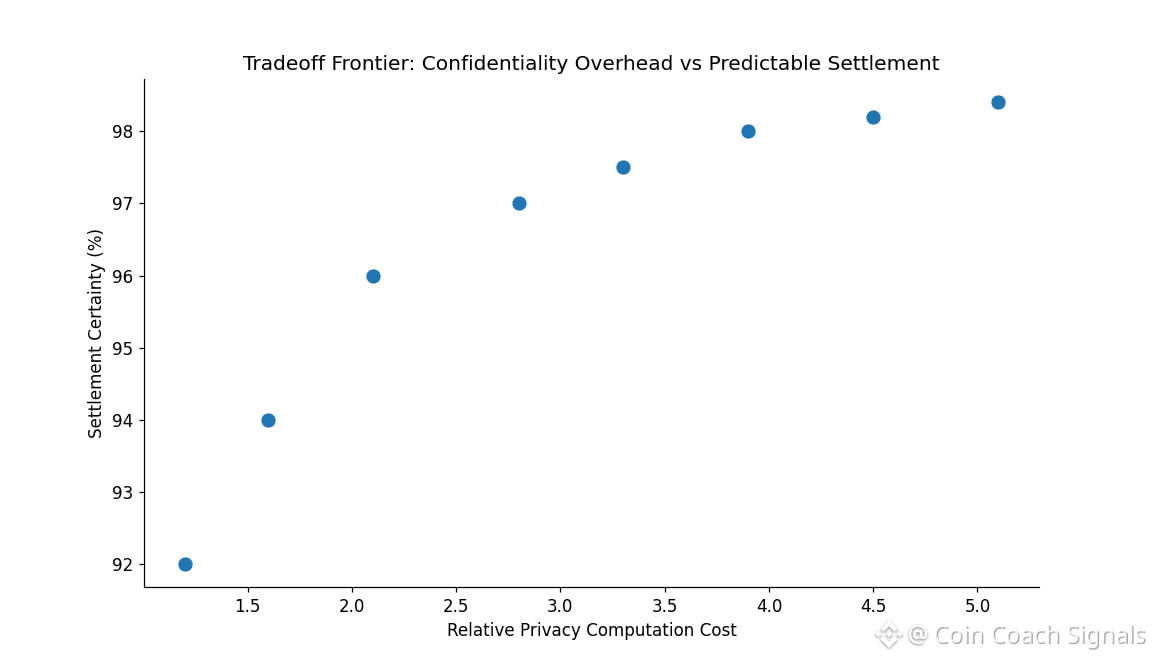

That’s the core problem most “privacy” chains still haven’t solved. Privacy is usually layered on top of public infrastructure. Mixers. Bridges. Extra steps. Each layer adds friction and another place where things can go wrong. For real finance, especially regulated flows, that complexity becomes a deal breaker fast. Institutions don’t care about clever cryptography if settlement feels fragile or unpredictable.

#Dusk is clearly trying to approach this differently. Instead of adding privacy later, it treats confidentiality as a starting constraint. The chain is designed around the idea that financial transactions should be private by default, with selective disclosure only when required. That’s why it doesn’t chase volume-heavy retail use cases. No meme tokens. No gaming throughput wars. Just a narrow focus on confidential finance.

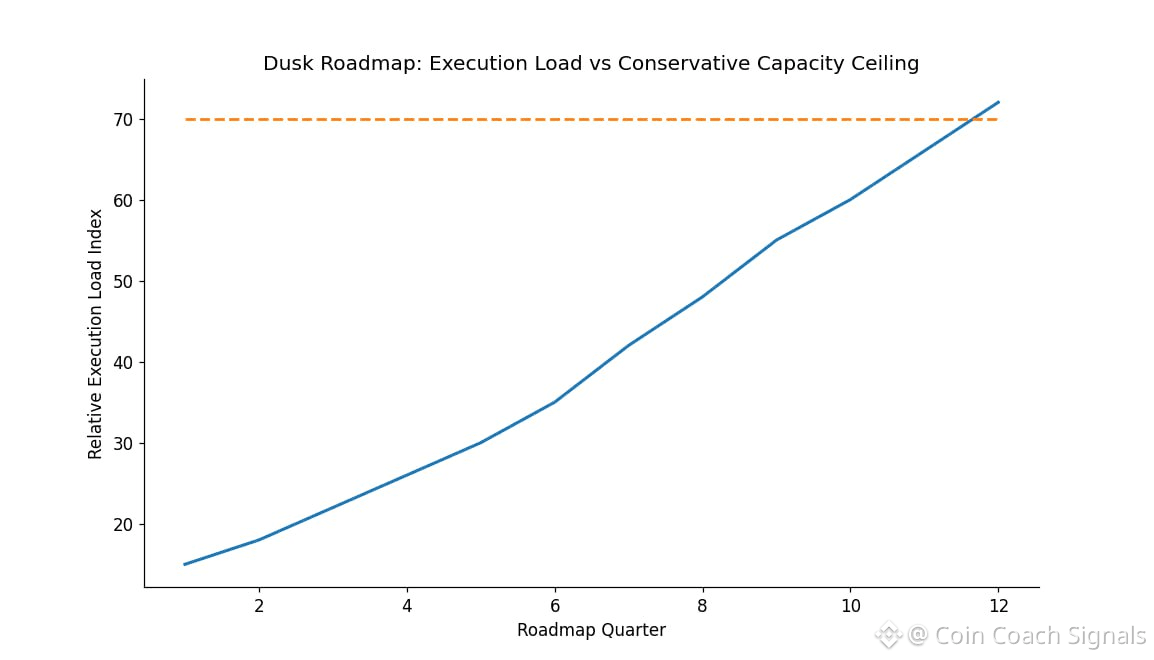

That restraint is intentional. Tokenized assets don’t need extreme speed. They need certainty. A trade settling a few seconds later is fine if it settles cleanly and correctly every time. The January 2026 mainnet launch leaned into that mindset. Stable execution. Conservative limits. No rush to inflate usage metrics. The NPEX partnership is the real test here, not because of the headline number, but because it forces the stack to behave under real compliance expectations.

Under the hood, the choices reflect that caution. Consensus is segmented to reduce exposure. Zero-knowledge proofs validate state without revealing details, but throughput is capped to avoid overloading nodes. Identity handling is built around proving attributes, not exposing users. None of this is flashy. It’s practical.

The $DUSK token itself doesn’t try to do much. It pays for execution. It secures the network through staking. It rewards correct behavior. Fees scale with complexity, which makes sense. Privacy costs something, but it’s predictable. Governance exists, but it’s not designed to be noisy. The token feels like infrastructure, not a marketing tool.

From a market perspective, nothing here screams excess. Liquidity is there. Volume comes and goes with narratives. Price reacts to headlines, then cools off. That’s normal. It also means price action isn’t telling you much about whether the product is actually working.

The real risk is execution over time.

If proof generation slows during real RWA volume, confidence drops quickly. If finality stretches during busy windows, users hesitate. If regulatory requirements shift faster than the stack adapts, the edge narrows. And if competitors ship simpler solutions that institutions trust more, focus alone won’t be enough.

#Dusk doesn’t need hype to win. But it does need consistency. The kind where users stop thinking about privacy mechanics entirely. Where the second and third transaction feel boring. That’s when infrastructure becomes real.

Until then, this remains a careful build with real upside and real fragility. The vision is clear. The design choices make sense. But the roadmap only matters if it turns into something people rely on without thinking.

That’s the risk. And also the opportunity.

@Dusk