A while back, I was rotating out of a few privacy-focused positions after a market pullback. Nothing dramatic. Just rebalancing, moving stakes around, checking where capital actually felt safe sitting. One project looked clean on the surface, but when I dug into the supply schedule, it got murky fast. Big chunks still locked. Emissions stretching years into the future. Rewards that looked fine today, but hard to trust tomorrow.

That kind of thing sticks with you. Not because it blows anything up immediately, but because it introduces doubt. You start wondering whether the fees you’re paying now are quietly being offset by dilution later. Or whether staking rewards only work as long as everyone keeps playing along.

That’s the quiet tension behind most token models. The gap between what’s live today and what’s still waiting to come online later.

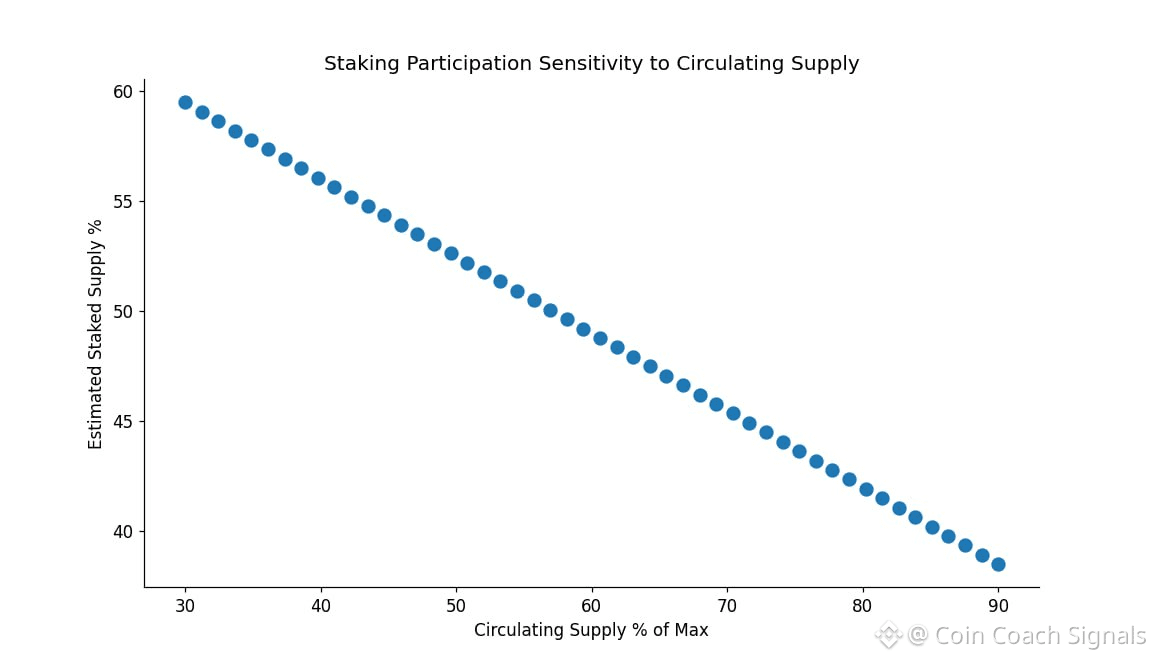

It’s not exciting, but it matters. Circulating supply affects behavior. Validators decide whether it’s worth staying active. Users decide whether fees feel fair. Developers decide whether the chain feels stable enough to build on. If future supply changes incentives too sharply, participation thins out without warning, and security suffers in subtle ways.

It’s a bit like running a town off a reservoir. The water level you see today looks fine, but if there’s a slow, steady inflow you don’t fully control, planning gets harder. Too much water later can devalue what’s there now. Too little participation, and everything dries up when demand rises.

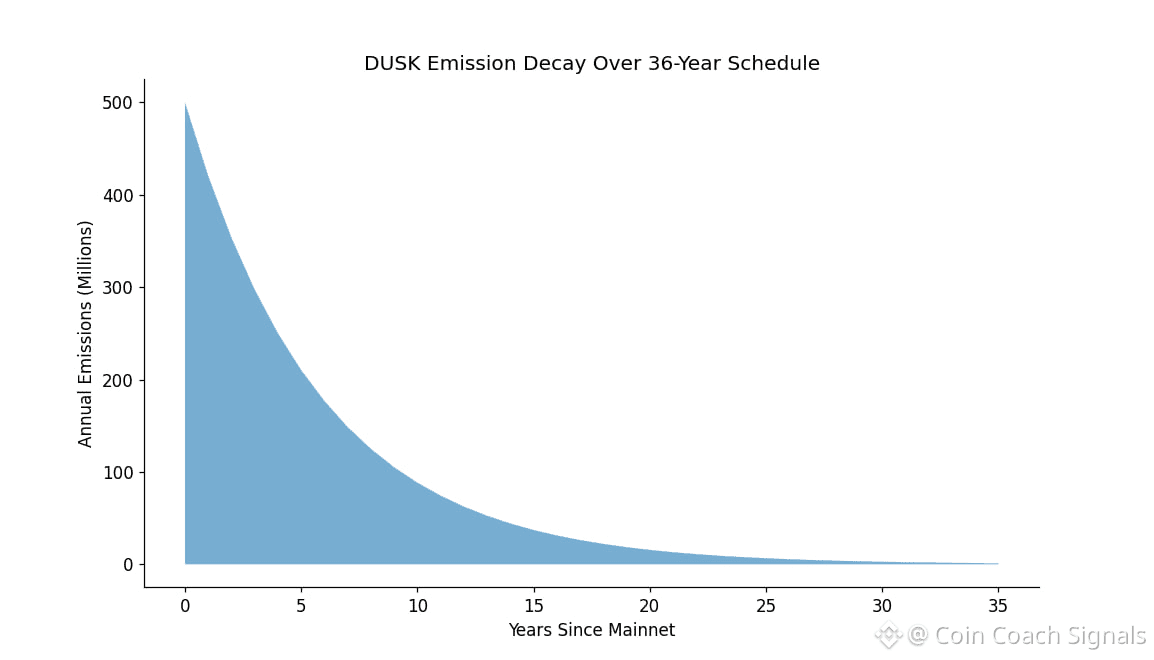

#Dusk takes a relatively conservative stance here. Supply is capped, emissions are defined, and there’s no surprise minting lurking in the background. The network is designed for financial use cases where predictability matters more than growth hacks. Tokenized securities. Regulated assets. Transfers where privacy is required but auditability still exists.

That focus shapes the supply design. Emissions taper over time instead of staying aggressive forever. Validators earn from a mix of block rewards and fees, not just inflation. A portion of fees is burned, so usage at least pushes back slightly against dilution. It’s not trying to be deflationary for marketing reasons. It’s just trying not to undermine itself.

$DUSK itself doesn’t pretend to be anything exotic. You use it to pay for transactions. You stake it to help secure the network. If you’re a validator, your rewards depend on staying online and behaving correctly. Governance exists, but it’s practical, not performative. Changes to parameters happen slowly, and mostly around infrastructure, not short-term incentives.

As of early 2026, roughly half the total supply is circulating, with the rest scheduled to enter over time. That matters. It means there’s still dilution ahead, but it’s visible and paced. Staking participation sitting around forty percent suggests that, for now, enough holders are comfortable committing capital instead of dumping rewards immediately. That’s a healthier signal than price spikes.

Short term, the market does what it always does. Unlocks get talked about. AMAs spark brief volume surges. Then attention drifts. I’ve traded those moments before. Sometimes they work. Often they don’t. They rarely say much about whether the system itself is holding together.

Longer term, the real question is simpler. Does the supply model support boring, repeat behavior? Do validators keep validating even when hype fades? Do fees stay predictable enough that financial apps don’t flinch every time the market turns? If emissions drop faster than usage grows, does the network still feel worth securing?

There are real risks here. If a large unlock hits during a period of low participation, staking could thin out quickly. If emissions outpace real demand for too long, dilution quietly eats confidence. And if institutional adoption doesn’t materialize, the model relies heavily on crypto-native discipline to hold together.

None of that shows up in a chart right away.

Supply mechanics don’t usually break things loudly. They erode them slowly. And that’s why they matter more than most people realize.

In the end, Dusk’s approach feels careful rather than aggressive. That won’t excite everyone. But for something aiming to sit underneath regulated finance, caution might be the point. Whether that restraint turns into durability will only show up over time, in how often people come back to use the chain without rechecking the supply schedule first.

@Dusk