Late last year, around the holidays, I was moving some USDC between chains for a small arbitrage. Nothing fancy. Just shifting capital, catching a yield gap, moving on. What should’ve been routine turned annoying fast. Fees crept in where I didn’t expect them, and a short burst of network activity stretched confirmation time past a minute.

It wasn’t a disaster. But it stuck with me.

Stablecoins are supposed to be boring. That’s the whole point. You shouldn’t have to think about them. Yet somehow, even now, moving “stable” value still comes with hesitation. Will fees spike? Will the bridge lag? Will this settle when I expect it to?

That friction isn’t accidental. Most blockchains were never built for stablecoins as the main event. They’re general-purpose systems. Everything shares the same space. When trading heats up somewhere else, payments slow down. Fees move even if nothing about your transfer changed. For everyday usage, that’s a dealbreaker. Businesses don’t want surprises. Neither do users sending payroll, remittances, or settling invoices.

@Plasma exists because of that mismatch.

Instead of trying to be everything, it narrows the scope aggressively. The chain is built around stablecoins first. Transfers are the core workload, not a side effect. That’s where the zero-fee USDT idea comes in. Basic transfers can be sponsored through paymasters, meaning users don’t need native tokens or gas management just to move dollars. It sounds simple, but removing that friction changes how things feel. Payments become invisible instead of technical.

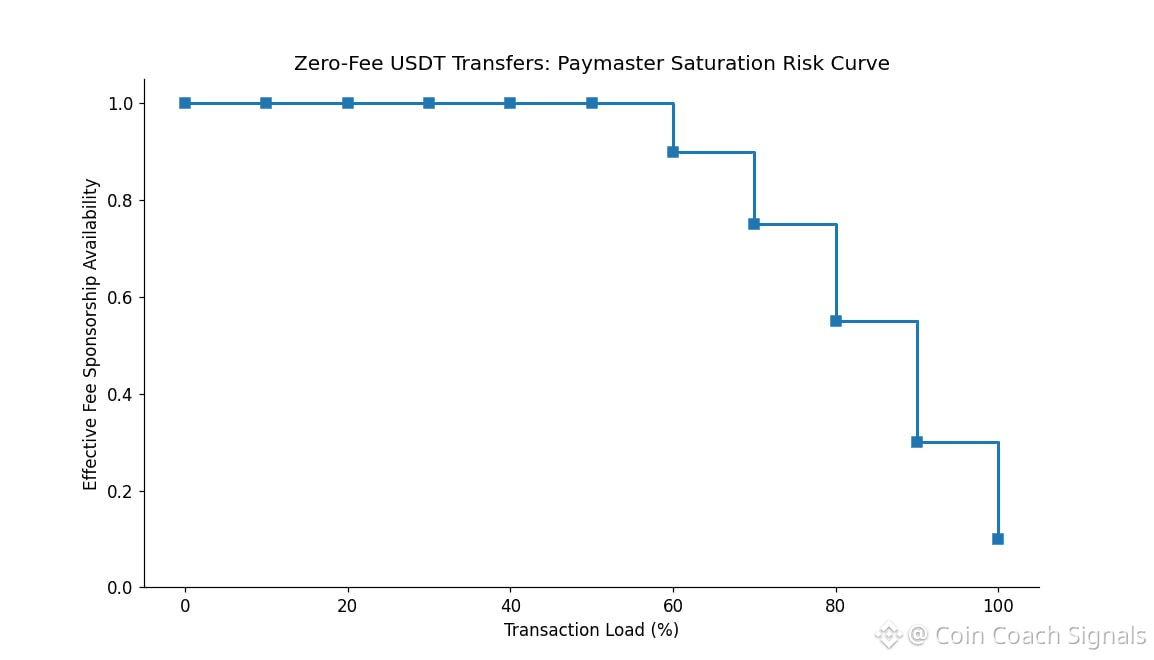

Under the hood, the design choices reflect that focus. PlasmaBFT overlaps consensus steps to keep finality tight, usually under a second when things are calm. The paymaster system has limits baked in so “free” doesn’t turn into spam. None of this is flashy. It’s deliberately constrained. The goal isn’t peak throughput screenshots. It’s predictable behavior.

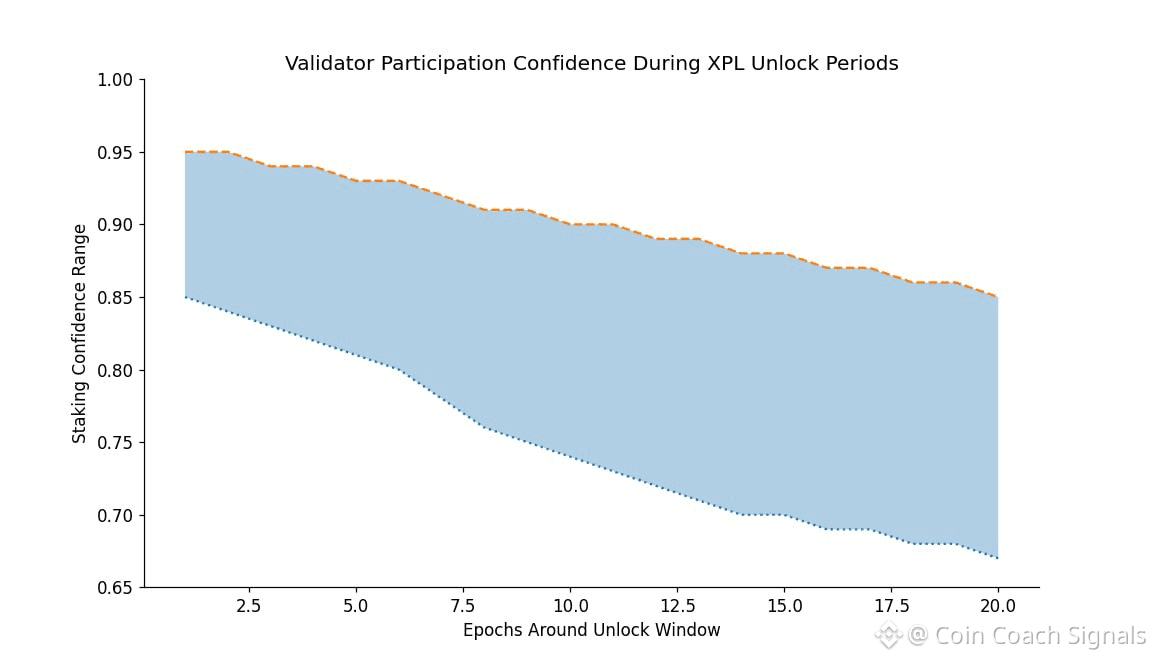

$XPL sits quietly behind all of this. It’s there when sponsorship isn’t. Validators stake it to secure the network. Inflation starts modest and tapers. Fees get partially burned. Governance tweaks things like paymaster limits or reward curves. Nothing exotic. Just enough to keep incentives aligned without turning the token into a casino chip.

Where things get tricky is adoption.

Early deposits were strong. Stablecoin TVL ramped quickly after launch. But actual transaction throughput today is low compared to what the chain can handle. That gap matters. Capacity doesn’t mean much if habits don’t form. A payments chain only proves itself when people come back the second time without thinking.

Short-term, price action reacts to headlines. Listings. Unlocks. Roadmap updates. That’s normal. But it doesn’t tell you whether #Plasma is becoming infrastructure or just another venue. Unlocks like the one happening now can fund growth, or they can shake confidence if staking participation drops too far. That balance is fragile.

There are real risks here. Bigger ecosystems already dominate stablecoin flows. Tron owns volume. Solana owns speed. Convincing users and protocols to switch requires more than architecture. It requires trust built through repetition. If validators exit during volatility, or if sponsored transfers hit limits at the wrong moment, confidence could evaporate quickly.

The upside is straightforward. If zero-fee stablecoin transfers actually become routine, #Plasma turns into plumbing. Quiet, boring, indispensable. The downside is just as clear. Without sustained usage, it stays a niche experiment with good ideas and thin traffic.

Chains like this don’t win on launch day. They win when no one thinks about them anymore.

That’s the real test ahead.

@Plasma