Most storage guarantees aren’t lies. They’re conditional truths.

Most storage guarantees aren’t lies. They’re conditional truths.

In Web3, storage protocols are marketed with confident language:

“high availability,”

“permanent storage,”

“strong redundancy,”

“trustless persistence.”

And in calm markets, those guarantees often look real.

But calm markets are the easiest environment a system will ever face.

So the real question isn’t whether a guarantee is true today.

It’s whether it survives the moment the market stops being calm.

That is the right lens for evaluating Walrus (WAL).

Calm markets are when incentives behave like documentation.

In calm conditions:

token prices are stable,

participation is predictable,

operating costs are manageable,

demand doesn’t spike violently,

repair is affordable.

This is when protocols look like their whitepapers.

Guarantees feel solid because the economic engine underneath them is stable. Operators do the work, redundancy stays healthy, retrieval is smooth, and “available” feels binary.

But calm markets are not the baseline in crypto.

They’re a temporary phase.

The moment markets turn, guarantees become negotiations.

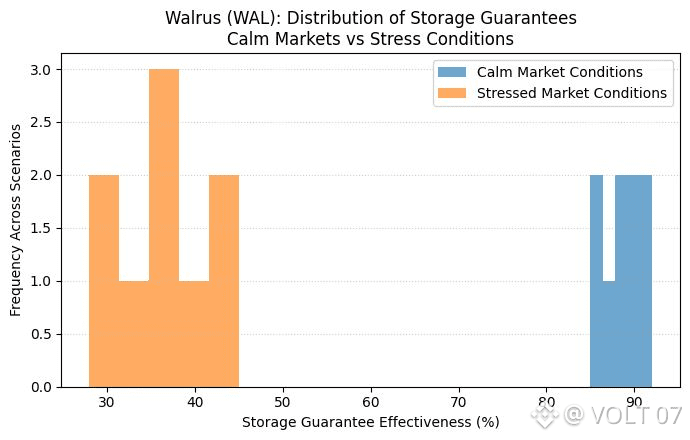

When volatility hits, the guarantee surface changes:

1) Incentives weaken faster than users update expectations

A token drawdown doesn’t just reduce price it reduces participation quality:

fewer nodes,

lower repair urgency,

slower response,

thinner redundancy.

The guarantee doesn’t vanish immediately. It degrades quietly which is worse.

2) Congestion and demand spikes reveal hidden bottlenecks

Stress concentrates traffic into the “paths that work,” which creates:

retrieval congestion,

inconsistent performance,

reliance on a small set of gateways.

A system can be decentralized in topology but centralized in practice under pressure.

3) Long-tail data becomes the first casualty

During stress, networks prioritize what’s actively requested. Rarely accessed data becomes neglected until it becomes urgently needed during the worst moment.

That’s the cruel irony: the data you need most during crises is often the data least maintained during calm periods.

4) Repair becomes optional when it becomes unprofitable

Calm markets make repair feel automatic.

Stress markets reveal the truth: repair only happens if someone is economically forced to do it.

If the system doesn’t enforce repair, guarantees become “best effort.”

The most misleading guarantee is “it’s still there somewhere.”

In calm markets, “still there somewhere” feels fine because retrieval is easy.

In stress markets, it becomes a liability statement:

the data exists, but you can’t retrieve it quickly,

the proof verifies, but the context is fragmented,

availability is technically true, but practically false.

And in Web3, practical truth is what settles disputes, restores state, and moves capital.

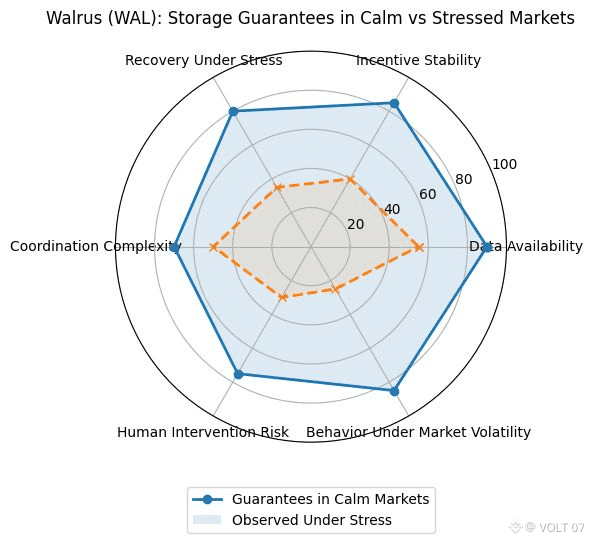

Walrus is designed for the market condition guarantees are weakest in.

Walrus’ relevance comes from designing around the assumption that calm markets are temporary.

So the system must:

surface degradation early (before users are harmed),

penalize neglect upstream (so silence isn’t rational),

keep repair economically rational even in low-demand periods,

preserve recoverability when volatility increases.

Walrus doesn’t treat “calm market performance” as proof of reliability. It treats it as the easiest test case.

Why this matters now: storage is becoming consequence infrastructure.

Storage now underwrites:

settlement proofs,

governance legitimacy,

compliance records,

recovery snapshots,

AI dataset provenance.

In these contexts, calm-market guarantees are not enough because stress events are when data becomes most valuable:

audits tighten after volatility,

disputes rise when money moves fast,

recovery is needed when systems break,

proof becomes urgent when trust collapses.

If a guarantee fails when the market is stressed, it fails when it matters most.

Walrus aligns with this reality by designing storage as a long-horizon obligation, not a calm-weather service.

I stopped trusting guarantees that aren’t stress-defined.

Because a guarantee that doesn’t specify its stress behavior is just a vibe.

I started asking:

What happens when token incentives weaken?

What happens when demand spikes violently?

What happens when operators churn?

What happens when long-tail data becomes urgent?

Who is forced to act before users pay?

Those questions reveal whether the guarantee is real or calm-market-only.

Walrus earns relevance by being built for the market conditions where guarantees are most likely to collapse.

A guarantee that only exists in calm markets is not a guarantee it’s a fair-weather promise.

The protocols that survive aren’t the ones that perform perfectly on good days.

They’re the ones that keep recoverability alive when:

incentives drift,

attention fades,

volatility hits,

and users suddenly need proof.

Walrus matters because it is designed for the hard version of storage the version that still works when the market stops being calm.

A system’s guarantees aren’t defined by its best day they’re defined by what still holds when conditions stop being friendly.