Randomness is one of those things blockchains rely on constantly but rarely examine deeply. It decides who proposes blocks, who validates them, who earns rewards, and who gets excluded. In many systems, randomness is treated as a technical afterthought—something generated, mixed, and consumed without much philosophical weight. Dusk Network takes a very different stance. In Dusk, randomness is treated as an economic and security-critical resource, not a passive utility.

This framing changes everything.

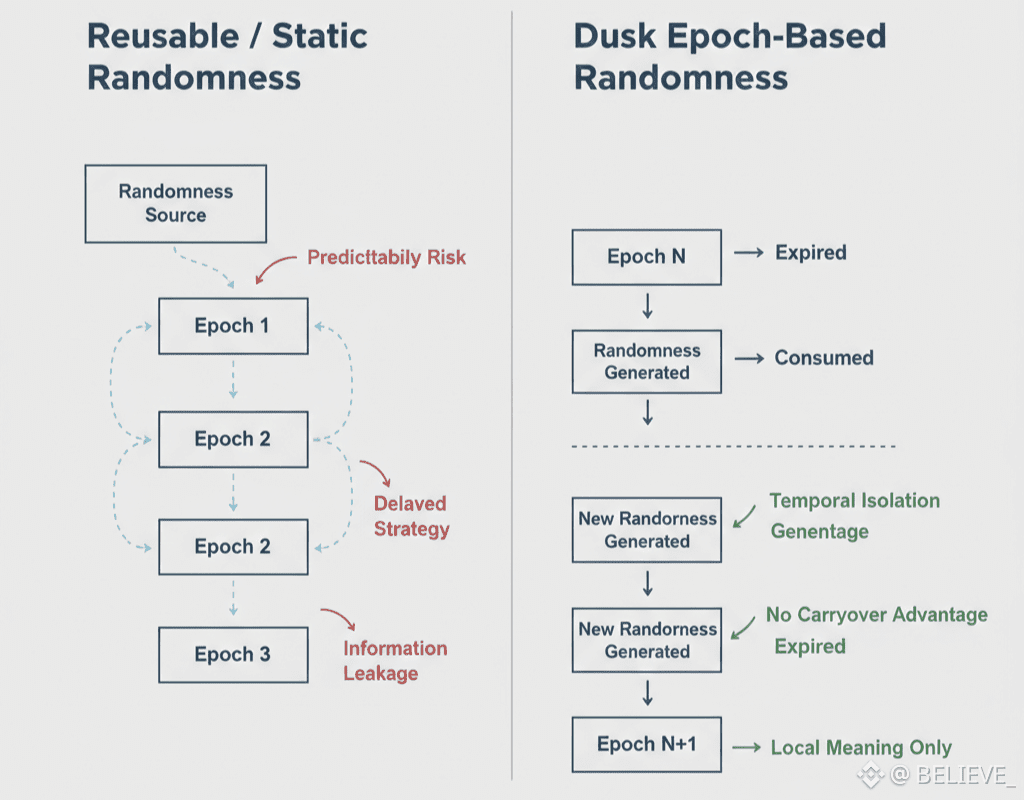

In decentralized systems, poor randomness does not just weaken security. It distorts incentives. If participants can predict outcomes, influence selection, or bias probabilities, they gain leverage over the system without openly breaking rules. The network may appear healthy while quietly becoming gameable.

Dusk’s architecture is built to prevent that drift.

Instead of relying on a single, static randomness source, Dusk ties randomness to epochs, with clearly defined lifecycle boundaries. Randomness is generated, consumed, and retired in a structured way. Once an epoch ends, its randomness is no longer reusable. That temporal isolation matters because it prevents participants from carrying informational advantages forward.

This design removes a subtle but powerful exploit vector: delayed strategy. In some networks, knowing future randomness lets actors prepare bids, stake movements, or infrastructure changes in advance. Dusk cuts that off by ensuring randomness is locally meaningful and globally ephemeral.

More importantly, randomness in Dusk is not just unpredictable—it is un-ownable. No participant, committee, or privileged role controls it. It emerges from protocol-defined processes that cannot be meaningfully influenced without breaking cryptographic guarantees. That keeps randomness neutral rather than competitive.

From an economic perspective, this neutrality is critical. If randomness can be influenced, it becomes a tradable asset. Actors invest resources not into honest participation, but into influencing selection. Over time, value leaks away from productive behavior into extraction strategies.

Dusk refuses to create that market.

Another key aspect is how randomness interacts with privacy. In systems where identities or stakes are visible, randomness can still leak information indirectly. Observers correlate outcomes with known participants and infer patterns. Dusk’s privacy-preserving design prevents this kind of inference. Random selection happens without turning participants into visible targets.

That has real-world implications. Validators are less exposed. Leaders are less predictable. Attacks become harder to time. Security improves not by adding complexity, but by removing informational asymmetry.

There is also a governance benefit. Because randomness is protocol-bound rather than socially negotiated, disputes are minimized. Participants do not argue about fairness because outcomes are not subject to interpretation. The randomness either satisfies the rules or it does not.

Professionally, this mirrors how serious systems treat entropy. In cryptography, randomness is guarded, audited, and isolated because its compromise undermines everything else. Dusk applies that same discipline at the protocol level.

The DUSK token plays a quiet but important role here. Economic participation—staking, bidding, validation—is exposed to randomness without being able to control it. This ensures that rewards are earned probabilistically under known rules, not through influence or coordination. The token’s value is protected because distribution remains structurally fair over time.

Another overlooked dimension is resilience under stress. During network congestion, adversarial conditions, or partial outages, randomness often becomes fragile. Systems fall back to predictable behavior. Dusk’s epoch-based randomness avoids that collapse. Even under pressure, selection remains unbiased and bounded.

This has long-term consequences. Networks fail not only when attacked, but when incentives slowly warp. Predictable randomness encourages cartel formation. Opaque randomness invites mistrust. Dusk avoids both by making randomness transparent in rules but opaque in outcomes.

That balance is difficult to achieve. Too much transparency, and outcomes become predictable. Too much opacity, and trust erodes. Dusk’s design threads that needle carefully.

There is also an important cultural effect. Participants learn to operate without expecting control. They focus on readiness rather than timing, correctness rather than positioning. Over time, that shapes a healthier ecosystem—one less obsessed with gaming selection and more focused on maintaining protocol integrity.

In conclusion, Dusk’s handling of randomness is not flashy. It does not advertise exotic techniques or promise perfect unpredictability. Instead, it treats randomness with the seriousness it deserves—as a shared resource that shapes incentives, security, and fairness.

Randomness decides who acts.

Economics decides how they behave.

By aligning the two carefully, Dusk ensures that chance does not become power—and that participation remains honest, even when outcomes are uncertain.