A few months back, I was testing a simple AI trading agent that needed to store model checkpoints and small datasets. Nothing fancy. A couple of gigabytes per run. The idea was to treat storage as background infrastructure and forget about it. Instead, it became the bottleneck. One retrieval lagged during a live test, the agent stalled, and I had to fall back to a manual check. Not catastrophic, but enough to break trust. When storage interrupts execution, it stops being infrastructure and starts being a liability.

That experience sums up a broader problem with decentralized storage today. Large, unstructured data is still awkward to manage once real usage shows up. Redundancy drives costs higher than expected. Retrieval can slow under load. And enforcing access rules or proving availability often means bolting on extra tooling. For AI workflows, media delivery, or anything time-sensitive, those rough edges matter. Builders don’t mind complexity when it’s optional. They walk away when it’s unavoidable.

It reminds me of a shared warehouse with loose rules. You rent space, but access depends on who else is loading or unloading at the same time. Most days it’s fine. On busy days, your pallet is buried somewhere in the back, and suddenly “decentralized” means “wait and hope.”

This is where #Walrus takes a very deliberate approach. Built on top of Sui, it doesn’t try to be a general-purpose chain. It sticks to one job: blob storage and data availability. No execution layer. No smart contract sprawl. You upload a blob, receive a Proof of Availability certificate anchored on Sui, and retrieve data through a specialized node network. That narrow scope is intentional. It lowers surface area and keeps performance predictable, at least in theory.

Two design choices matter here. The first is Proof of Availability. Instead of trusting that a hash corresponds to retrievable data, Walrus issues a signed certificate on Sui confirming that the blob is actually distributed and live across nodes. Apps can query that directly, which reduces fake availability or “stored but unreachable” scenarios. The second is Quilt, which batches small files into storage-efficient blobs. For AI workloads that deal with lots of tiny artifacts, that changes economics meaningfully. These aren’t flashy features, but they’re practical. You see it in behavior: integrations like elizaOS v2 using PoA receipts for agent memory, or partners like Pudgy Penguins quietly scaling from about 1TB to over 6TB without redesigning their pipelines.

WAL, the token, stays utilitarian. From a systems perspective, you pay upfront for storage in WAL, priced to remain roughly stable in fiat terms via adjustable parameters. Those fees get streamed to node operators over time. Staking WAL secures availability, with nodes earning rewards based on uptime and facing penalties if they fail checks. Governance is where WAL becomes risky. Staked holders vote on parameters like penalty severity, subsidy levels, and pricing buffers. These choices directly affect reliability and operator incentives. There’s no abstraction layer here. Governance decisions change how storage behaves in production.

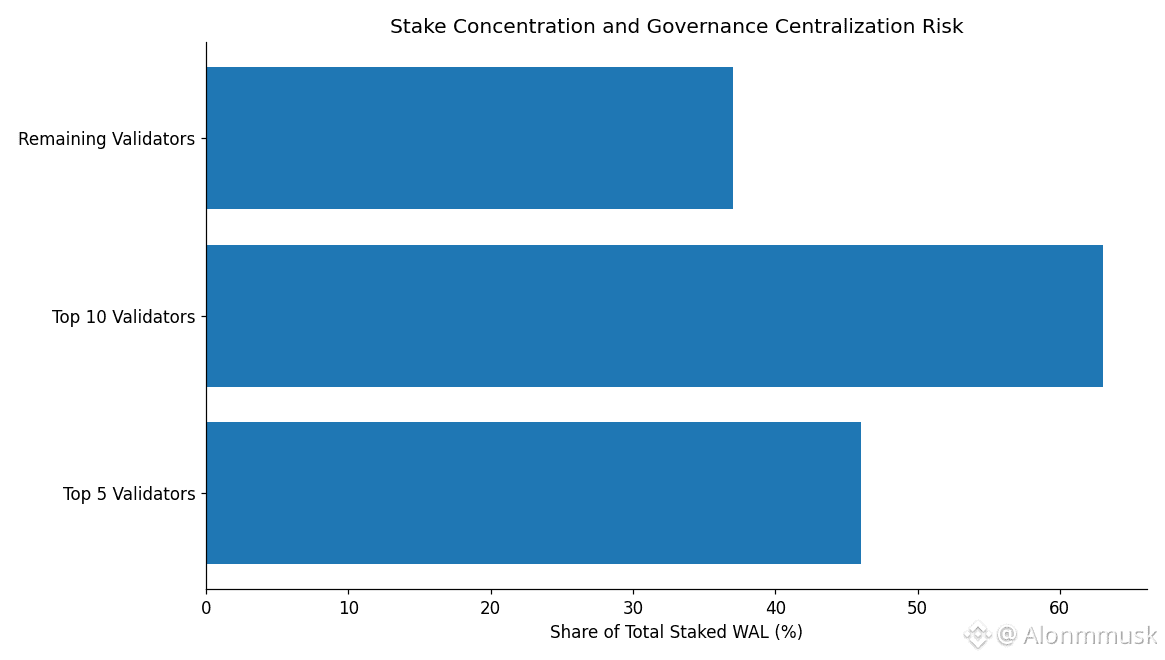

Market-wise, $WAL sits around a $200M cap with daily volume near $10–12M. Not illiquid, but not deep either. Usage is real but early. Roughly 100 active nodes. Around $18K in Q4 2025 revenue. That’s fine for a young storage network, but it also means governance participation is thin relative to impact.

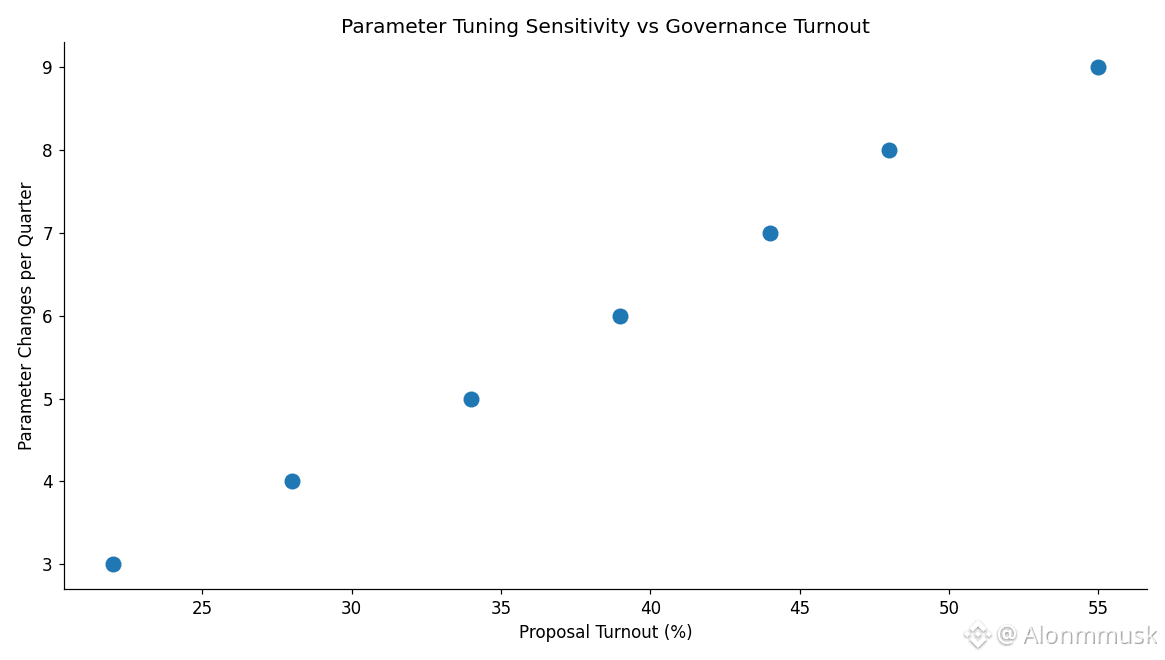

That’s where the risk creeps in. Parameter tuning in low-participation governance systems is dangerous. If too few stakeholders vote, you get skewed outcomes. Penalties can become too harsh, pushing smaller nodes offline. Or too soft, encouraging lazy uptime and silent degradation. Either way, reliability suffers. In storage, users don’t forgive easily.

One failure mode that worries me: during a high-load event, say a surge from media partners like ONE Championship or a spike in AI retrievals, a coordinated or coincidental node underperformance could delay Proof of Availability confirmations. If governance parameters are misaligned, responses could be slow or ineffective. Retrievals stall. Apps fail. Trust breaks. Once that happens, unstaking cascades faster than any marketing can fix.

Competition doesn’t help. Filecoin and Arweave already have deeper liquidity and larger operator bases. Walrus’s Sui alignment gives it speed and composability, but it also concentrates ecosystem exposure. Cross-chain ambitions exist, but real usage is still Sui-heavy. That amplifies the importance of correct parameter tuning early.

In the end, this isn’t about hype or roadmaps. Storage networks live or die on boring reliability. Governance matters because it quietly decides whether that reliability compounds or degrades. You only notice when it fails. The real signal won’t be price moves or announcements. It’ll be whether the second, third, and tenth retrieval happens without anyone thinking about it. That’s when infrastructure becomes invisible. And that’s what Walrus still has to prove.

@Walrus 🦭/acc #Walrus $WAL