Picture this: real-world assets move on-chain, fully tokenized, and totally private—yet regulators can still audit everything they need. That’s not some distant dream. Dusk is making it happen right now. I’ve spent years digging through crypto projects, hunting for ones that actually fix the messes of traditional finance. Dusk stands out, plain and simple. It’s not just another Layer 1 trying to ride the hype. Dusk was built from scratch to handle regulated securities with serious cryptography—so compliance isn’t a headache, it’s a superpower.

Dusk Network kicked off in 2018. Since then, it’s grown into a heavyweight in decentralized finance, putting institutional security and data control front and center. What really makes Dusk different? It’s a mouthful, but here goes: Dusk runs on a quasi-Turing complete state transition model, baking zero-knowledge proof verification right into the protocol itself. That means developers can build smart contracts that handle complex stuff—think tokenized bonds or stock—while keeping the nitty-gritty details private and still fully compliant. No more patchwork privacy hacks or slow workarounds. Dusk’s architecture is built for serious, real-world applications, and it works as a scalable sidechain that plugs right into existing blockchains.

Privacy isn’t some bolt-on feature here; it’s in Dusk’s DNA. Take stealth addresses—they generate a fresh, one-time address for every transaction. Everything’s done with cryptography, so nobody can link your transactions together. Throw in zero-knowledge proofs, and your transaction details show up as encrypted commitments on the ledger. Only recipients can spot their funds. The network checks everything for double-spending or fraud, but nobody learns anything extra. This stuff is tailor-made for regulated markets, where you sometimes need to let auditors in—without exposing everyone’s private data. Dusk nails that balance, making it perfect for things like tokenized securities and regulations like the EU’s MiCA. Auditors can see what they need, but sensitive info stays locked.

The privacy runs even deeper with Dusk’s signature schemes. Transactions get authorized with cryptography and ZK proofs, so ownership and validity are proven without ever revealing identities or amounts. It works on a UTXO model for even stronger privacy. And this isn’t vaporware—it’s all live on mainnet, launched January 7, 2026. Their Rusk VM compiles contracts into ZK circuits using PLONK-style proofs, so you get fast, efficient blocks, even with heavy traffic. Early numbers show the network is active: around 1,200 daily transactions, over 25,000 total since launch. Dusk is ready for real financial action.

Now, here’s where Dusk really pulls ahead—regulatory integration. It doesn’t just talk compliance; it lives it. Dusk is in the EU regulatory sandbox, testing privacy tools in live scenarios and tuning everything to match the latest laws. Real-world deals are rolling out, too. Take NPEX, a regulated Dutch exchange—they’ve already tokenized more than €200 million in securities with Dusk, and that pool is growing to €300 million. We’re talking corporate equity and bonds, all on-chain, all with legal backing and built-in compliance. And with the upcoming EURQ, a euro-denominated token fully aligned with MiCAR, Dusk is making settlements faster and slashing fragmentation and custodian headaches.

Bottom line: Dusk isn’t just promising privacy and compliance for tokenized assets. It’s delivering, right now, and changing how real-world assets move on-chain.

Dusk’s Segregated Byzantine Agreement, or SBA, does things a little differently. Instead of chasing raw speed, it splits up the work to make sure transactions are final fast, but keeps throughput capped on purpose—stability wins out over bragging rights. The team’s also upgraded their bridges, so moving assets takes just minutes now. On one day alone, people moved nearly 27 million USDT across the network without a hitch.

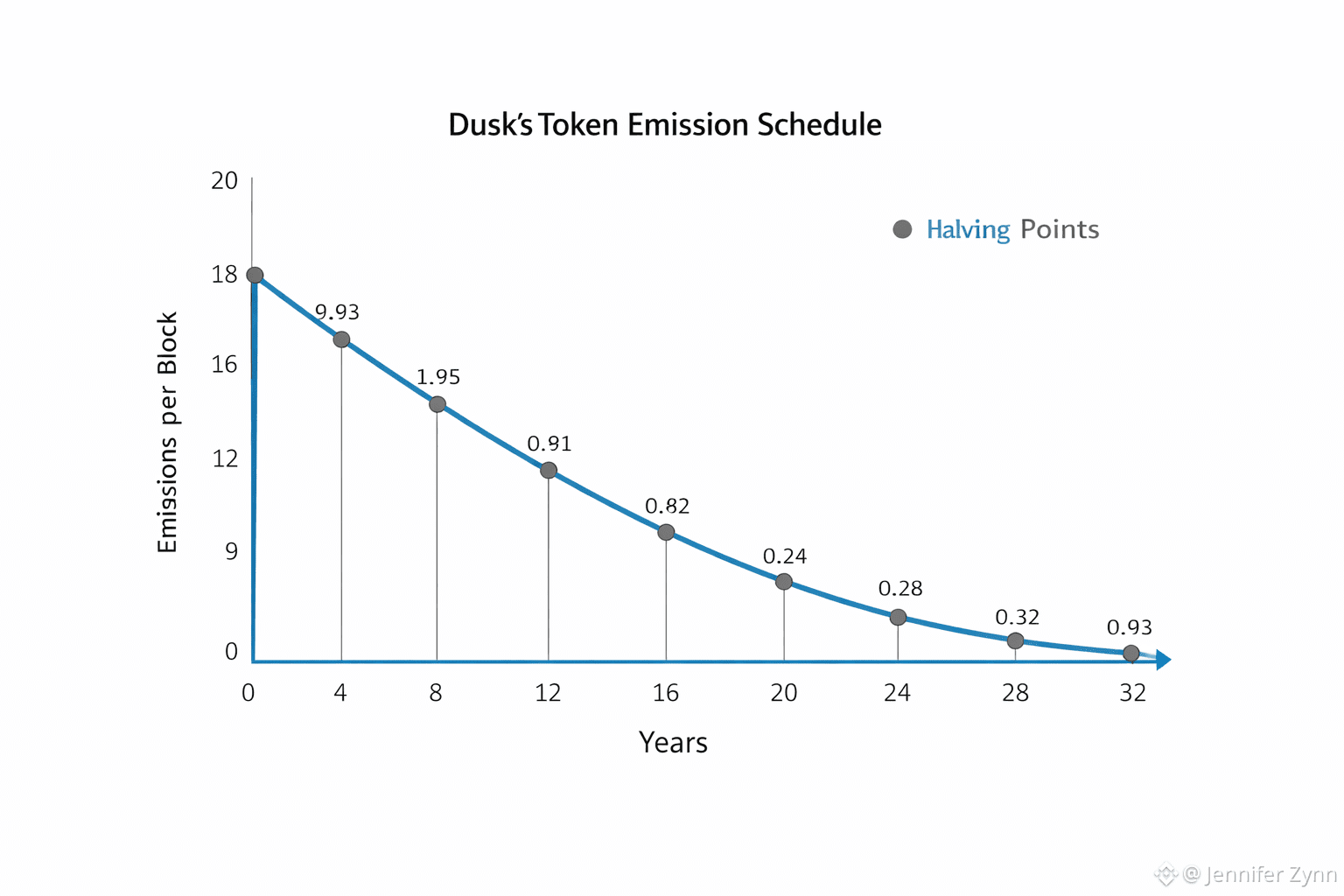

They keep decentralization tight by sticking to 128 validators, each putting up at least 1,000 DUSK. Rewards start at 19.86 DUSK per block, cut in half every four years. Fees? They use a burn mechanism inspired by EIP-1559—some get destroyed every time, helping balance out supply. Right now, there’s less than 500 million DUSK in circulation, out of a billion total. This approach isn’t just about numbers; it keeps the network secure for the long haul, and stakers get a real say in how things adjust if regulations change.

For businesses and institutions, Dusk is pretty much a shortcut—you can hand off expensive tasks like clearing and automation to smart contracts. Regular users get self-custody and can access all kinds of assets directly. It’s changing how payroll, payments, and asset management work, letting people use bulletin boards as a single source of truth, all without the headaches of traditional custodians. The latest DuskEVM upgrade even lets developers use Solidity in a privacy-friendly setup, so you get compliant DeFi apps handling everything from merchant liquidity to exchange settlements—no need to put everything out in the open.

Look, there’s a ton of noise in crypto, but Dusk isn’t trying to dazzle anyone with TPS stats. It’s about real cryptography and playing nice with regulations, setting up the rails for a digital economy that actually respects people’s control over their data. In the end, it’s not about hype—it’s about letting trillions in assets move on-chain, safely and privately, away from the old centralized gatekeepers.

@Dusk $DUSK #Dusk