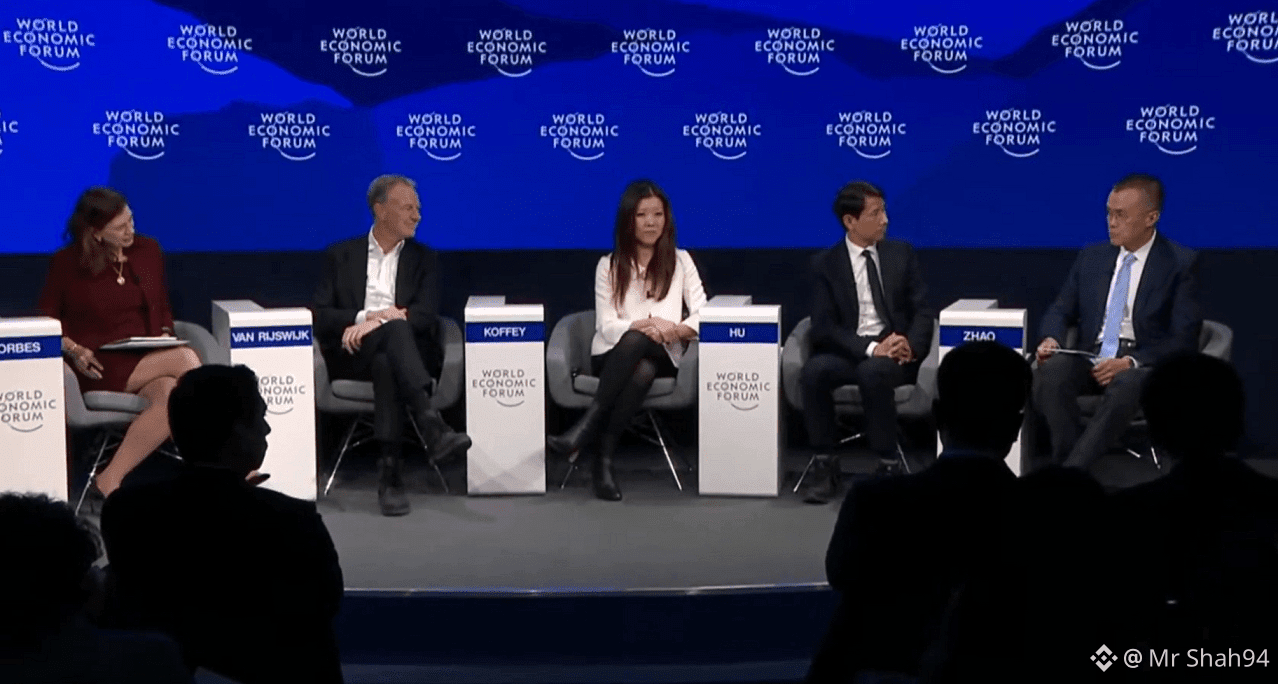

At the 2026 World Economic Forum, Binance co-founder Changpeng Zhao (CZ) offered a sobering assessment of the crypto landscape, prioritizing structural integrity over speculative optimism.

1. The Adoption Gap & Speculative Volatility

Despite a decade of infrastructure building, CZ acknowledged that crypto payments have failed to achieve mainstream saturation. He characterized the sector as an experimental phase where high failure rates are the prerequisite for rare, high-impact breakthroughs.

Regarding meme coins, CZ remains cautious:

• Sustainability: Most lack utility and are bound to fail once speculative sentiment cools.

• Survival Criteria: Only assets tethered to genuine cultural value (e.g., Dogecoin) demonstrate long-term viability, mirroring the "hype vs. fundamentals" cycle seen in NFTs.

2. Liquidity Resilience: Crypto vs. TradFi

CZ dismissed the notion that AI-driven "bank runs" are a new risk, arguing that technology merely accelerates the exposure of existing insolvency.

• The Binance Benchmark: He cited Binance’s ability to process $7 billion in daily withdrawals without friction.

• The Contrast: He argued that traditional banks, hamstrung by fractional reserve systems, remain structurally vulnerable to liquidity shocks that the crypto industry is better equipped to handle through full-reserve transparency.

3. The Future of Global Governance

CZ views a unified global regulator as a near-term impossibility due to divergent national interests in taxation and capital control.

Strategic Outlook: Instead of a central authority, CZ advocates for regulatory passporting. This model allows for jurisdictional reciprocity, where licenses from one credible region are recognized by others, streamlining compliance in an otherwise fragmented legal environment.

#WEFDavos2026 #Dogecoin #BTC #AI