Picture this: trillions of dollars in real-world assets, just sitting there, locked away in old-school systems that don’t play nice with blockchain. Then Dusk shows up with something different—a privacy-focused Layer 1 that rewrites how big institutions approach trading, automation, and financing. I’ve watched crypto shift from wild speculation to real, working systems, and honestly, Dusk stands out. They’re not chasing the latest trend. They’re building the backbone for serious, on-chain finance that actually puts people first.

Dusk’s real value comes from making institutional-grade assets accessible. Companies can ditch the clunky, manual clearance and settlement headaches, handing those jobs to smart contracts that keep things private but still provable. Since launching in 2018, Dusk has taken a modular approach. They separate settlement from execution, and their Rusk VM compiles contracts into zero-knowledge circuits, PLONK-style. End result? Even the most complicated stuff—payroll, merchant liquidity—runs behind the scenes with privacy intact. You get proof things are happening, but no sensitive data spills out. That’s a big deal for enterprises trying to cut costs and limit risk. Plus, they can automate compliance checks (think MiFID II), so trades settle instantly, no more waiting on middlemen. It all lives on a single, shared ledger everyone can trust.

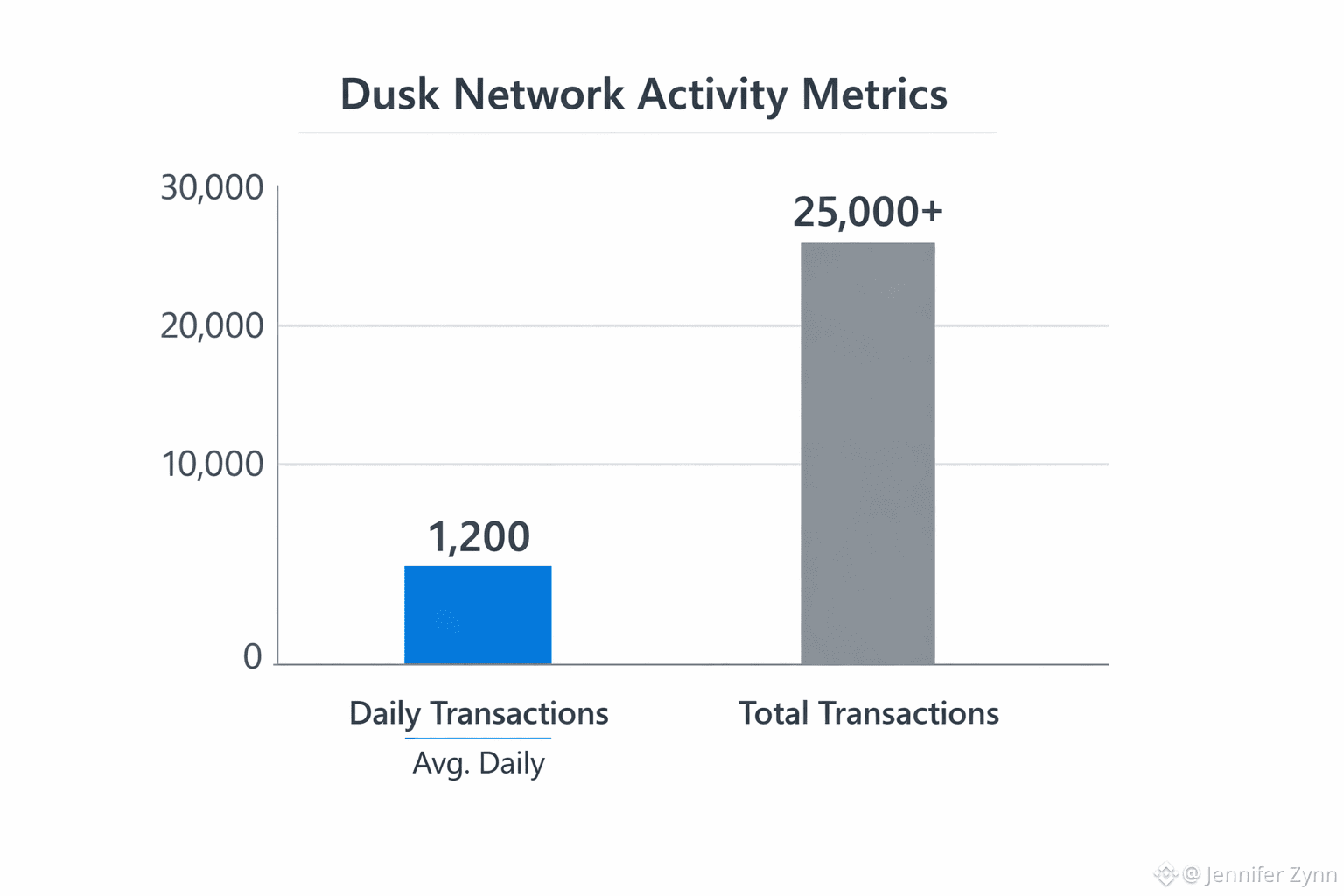

Lately, Dusk’s been on a roll. Their mainnet went live on January 7, 2026. A few days later, the DuskEVM upgrade dropped, letting Solidity devs build in a confidential environment. And it’s not just hype—over 25,000 transactions so far, averaging 1,200 a day, mostly in regulated setups. Their bridges have handled some serious volume, like 26.84 million USDT in a single day, with transfers taking minutes instead of hours. They also teamed up with Chainlink for secure data feeds, which means assets can move across chains with audit trails baked in, all while staying compliant.

If you want to see real-world change, check how Dusk approaches tokenized securities. They’ve partnered with NPEX, a regulated Dutch exchange that manages north of €300 million in assets. Together, they’re tokenizing corporate equity and bonds—keeping full legal recourse. This isn’t just theory. It means businesses can run resource-heavy protocols efficiently and handle asset management or settlements quietly, without giving up privacy. Suddenly, people can self-custody these assets right from their own wallets. The line between traditional finance and crypto? It’s basically gone. With the upcoming EURQ (a euro token that checks all MiCAR boxes), Dusk slides in as the bridge for seamless, regulated payments and trades.

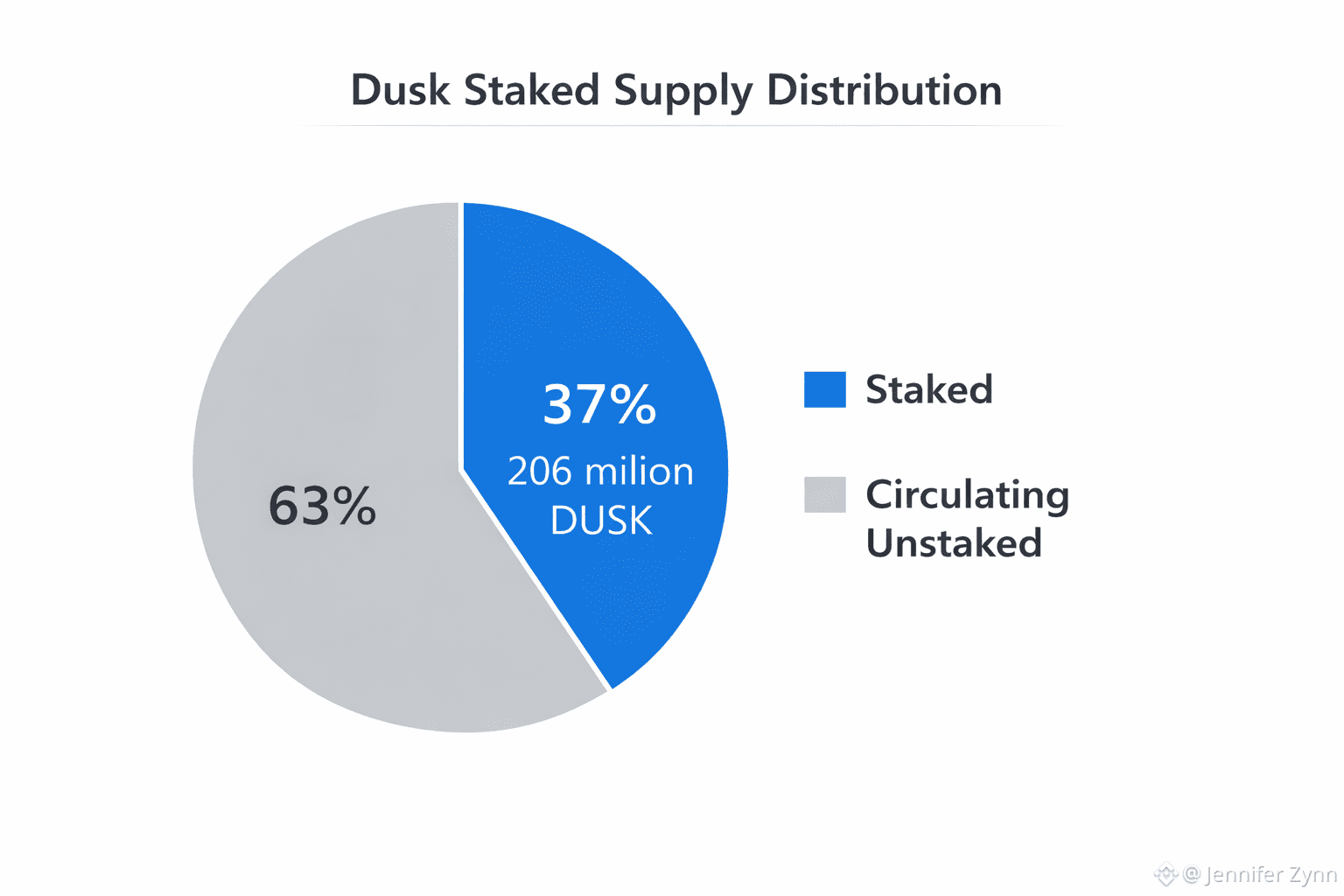

Security is the thread that ties it all together. Dusk uses the Segregated Byzantine Agreement to cap validators at 128, balancing decentralization with performance. Staking numbers look strong: 206 million DUSK locked across 200+ provisioners, which is about 37% of the total supply. The Sozu liquid staking protocol adds more flexibility—25.9 million in TVL—so people can earn rewards without having to unstake. On top of that, governance gives staked holders real control, letting them tweak settings to keep up with regulatory shifts like MiCA, so the network keeps moving forward without a hitch.

Let’s be honest—the crypto world has a trust problem, thanks to constant data leaks. Dusk flips that. With features like selective disclosure and zero-knowledge proofs, people can verify identity or meet rules without handing over private info. That’s the backbone for a digital economy where privacy is the rule, not the exception. At the end of the day, Dusk isn’t just another blockchain. It’s the toolkit for a more trustworthy, global market—one where everyone gets to play.

@Dusk $DUSK #Dusk