AI-first infrastructure is incomplete without payments because intelligence without settlement cannot become an economy.

AI-first infrastructure is incomplete without payments because intelligence without settlement cannot become an economy.

Most AI + crypto discussions focus on compute, models, data, and agents. Those layers are important, but they’re not enough to create a self-sustaining system.

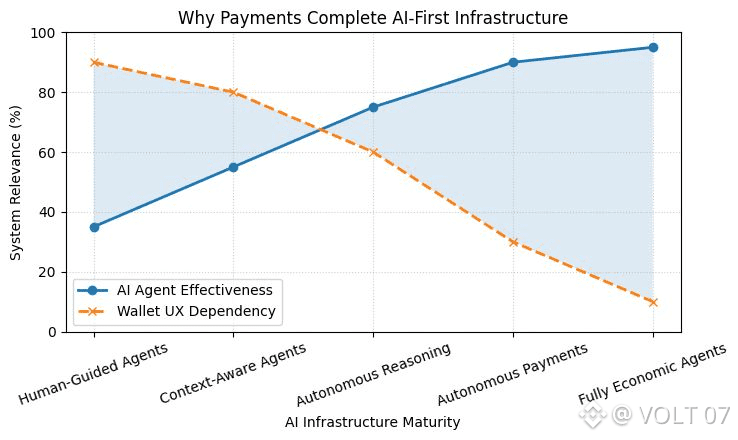

A real AI economy requires one final primitive: payments that work at machine speed, machine frequency, and machine logic. Without that, agents remain “smart tools” controlled by humans instead of independent economic actors.

Payments are the missing piece that turns AI-first infrastructure from capability into commerce.

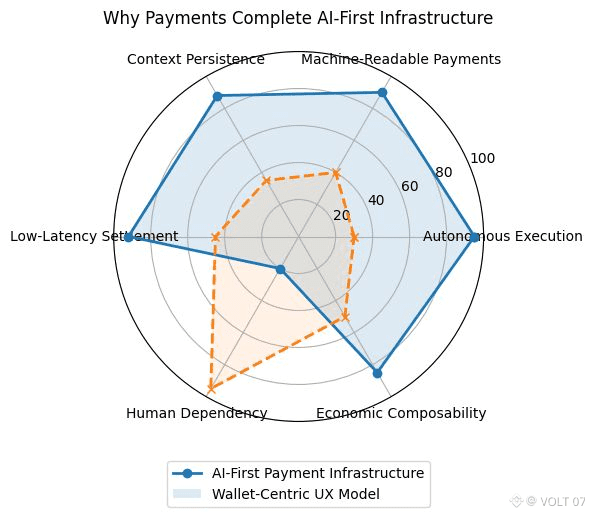

Wallet UX was designed for humans and it breaks the moment machines become the primary users.

Wallets assume a human workflow:

open an interface

review a transaction

approve a signature

manage gas and network selection

confirm execution

That flow is tolerable for humans because humans transact occasionally.

AI agents transact continuously.

If an agent must depend on wallet UX, it becomes impossible to scale because:

signatures require human attention

transaction approval becomes a bottleneck

execution speed collapses

the agent cannot operate autonomously

every workflow becomes fragile and interrupt-driven

Wallet UX is not a payment system for machines. It’s a permission gate for humans.

Agents don’t need “better wallets.” They need programmable payment rails.

A machine-native payment system must support:

autonomous spending under constraints

recurring micro-payments

dynamic pricing based on task demand

conditional execution logic

safe delegation to sub-agents

real-time settlement

predictable fee behavior

Wallets can’t express these rules natively.

They only express ownership.

AI agents need something deeper: policy-based financial autonomy, where intent and constraints define what can happen not UI clicks.

Microtransactions are not optional they are the natural unit of machine commerce.

Human commerce happens in chunks.

Machine commerce happens in streams.

Agents pay for:

data access per query

inference per request

compute per second

routing per task

verification per proof

content generation per output

marketplace fees per completion

This creates a world where thousands of tiny payments are more important than a few large ones.

Wallet UX cannot support this volume without becoming a permanent friction point.

AI-first infrastructure needs a settlement layer designed for microtransactions by default.

Without payments, AI agents remain dependent and dependency kills scale.

If an agent cannot:

earn on-chain

pay for resources

hire other agents

settle tasks autonomously

manage a treasury

budget across workflows

it is not an economic actor.

It is a feature attached to a human-controlled wallet.

This is the difference between:

AI as automation

and

AI as a self-sustaining market participant

Payments complete AI-first infrastructure because they enable closed economic loops.

Payment rails also solve the biggest AI risk problem: uncontrolled autonomy.

The fear of autonomous agents is not that they are intelligent it’s that they can act financially without limits.

A proper agent payment system must enforce:

spending ceilings

category budgets

whitelisted counterparties

time-based restrictions

multi-sig approvals for large spends

kill-switch logic

audit trails for every action

This turns autonomy into something safe, testable, and governable.

Wallet UX cannot do this because it is reactive.

Payment rails can do it because they are architectural.

AI-first payments enable agent-to-agent commerce the foundation of the machine economy.

Once payments are machine-native, agents can trade services like:

research

summarization

trading signals

portfolio optimization

data labeling

risk scoring

content generation

workflow automation

This creates an economy where:

agents specialize

tasks are outsourced

skills are priced dynamically

output quality is rewarded

supply and demand become automated

Without payments, none of this becomes real.

It remains theoretical.

The winners of the AI era will be the networks that make payments invisible and continuous.

The most powerful payment systems are not those users notice they are those users forget exist.

AI-native commerce requires:

seamless settlement

instant execution

predictable costs

minimal friction

built-in constraints

interoperability with stablecoin rails

The infrastructure that achieves this becomes the default foundation for AI economies not because it’s flashy, but because it works.

Conclusion: Wallet UX is the wrong abstraction for autonomous systems payments must become programmable infrastructure.

AI-first infrastructure is not complete when it has:

compute

data

models

agents

It becomes complete when it can support:

earning

spending

budgeting

settling

hiring

routing

microtransaction economies

Wallet UX was built for humans.

AI agents require payment rails built for autonomy.

In the AI era, the most valuable chains and protocols won’t be those that simply host agents but those that let agents participate in commerce safely, continuously, and at scale.

Autonomy becomes real only when it can settle value. In the machine economy, payments aren’t a feature they’re the operating system.