Most blockchains talk about incentives as if participation should always feel exciting. High yields, fast rotations, visible rewards. But in practice, systems that demand constant attention tend to burn out the very participants they depend on. Validators chase returns. Smaller operators drift away. The network survives, but only because a narrow group keeps it alive.

Over time, you start to notice a pattern. When incentives are too sharp, behavior becomes reactive. When they’re too generous, commitment becomes temporary. The real test isn’t how many people show up early — it’s who’s still there when nothing interesting is happening.

Dusk’s token design appears to start from that assumption.

Rather than trying to optimize for rapid participation or headline yields, the system is built around long-term predictability. Emissions move slowly. Staking rewards are steady rather than dramatic. Penalties are corrective instead of destructive. The intent isn’t to make participation thrilling — it’s to make it tolerable over years.

That design choice lines up with the kind of activity Dusk is positioning itself for. Regulated assets, private settlement, and institutional-grade infrastructure don’t tolerate volatility well. Validators can’t disappear when rewards dip. Incentives can’t hinge on hype cycles. If platforms like Dusk Trade are going to support real financial flows in 2026 and beyond, the underlying network needs operators who value continuity more than optimization.

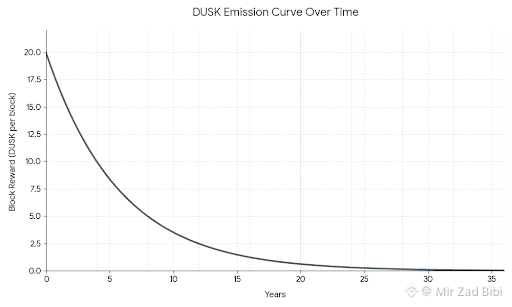

The emission model reflects that mindset. New DUSK enters circulation on a geometric curve that halves roughly every four years, stretched across nine periods spanning about 36 years. Block rewards begin just under 20 DUSK and decline gradually, without sharp cliffs. Because emissions are tied to a fixed number of blocks per phase, future supply is easier to forecast and less sensitive to short-term changes in activity. Nothing sudden. Nothing theatrical.

Validator discipline follows a similar logic. Instead of immediately destroying stake for mistakes, Dusk applies soft slashing. Misbehavior temporarily locks portions of stake, escalating only if issues persist. This shifts the focus from fear-based compliance to long-term alignment. Validators are incentivized to correct behavior and remain active, not to over-engineer setups out of fear of one-off failures.

The DUSK token itself is deliberately narrow in function. It covers transaction fees through its smallest unit, LUX. It secures consensus through staking. It distributes rewards across validators, committees, ratifiers, and a development fund, with unused allocations burned. Governance influence comes from participation and stake, not speculative activity. There’s no attempt to turn the token into a multipurpose abstraction.

From a market lens, the result is muted — and that’s not a flaw. Circulating supply remains below the cap. Liquidity is consistent rather than overheated. Price movements tend to respond to announcements and narrative shifts, then normalize. Traders can find opportunities there, but those movements say little about whether the network is structurally sound.

The more important questions sit further out on the timeline. What happens when emissions become a smaller share of validator income? Does staking still make sense when fees carry more weight than inflation? And does real usage — private transfers, compliant asset issuance, regulated settlement — scale gradually enough to replace subsidies with demand?

There are clear failure modes. Validator counts could thin as rewards decline. Power could concentrate during periods of heavy institutional usage. Adoption could stall at proof-of-concept stages. None of these risks are theoretical.

But tokenomics like this aren’t designed to impress. They’re designed to be forgotten. If Dusk works the way it’s intended, most users won’t think about emissions, staking mechanics, or slashing rules at all. They’ll notice that settlement is reliable, privacy doesn’t break under scrutiny, and the network doesn’t flinch when activity increases.

When incentives fade into the background, that’s usually a sign the system is doing its job.