There are moments in crypto when a narrative feels obvious only after it matures. Years pass, builders grind in silence, and suddenly the entire space realizes that something fundamental has shifted. Plasma is one of those moments. It is a Layer 1 that took a simple idea and built it with quiet precision. The idea is that stablecoins need their own settlement layer. They need a chain where the entire design works for them, not around them. They need an environment where transfers are fast, stable, final and ready for real financial adoption.

The more time you spend looking at the industry, the clearer this becomes. Every large payment system in the world has its own optimized rails. Banks have SWIFT, card networks have VisaNet, and digital wallets have internal ledgers. But in crypto, stablecoins mostly sit on general purpose blockchains that were never designed for settlement performance, especially when billions of dollars move through them every day. This is where Plasma steps in with a purpose built chain for stablecoin movement, retail volume, institutional payments and global settlement.

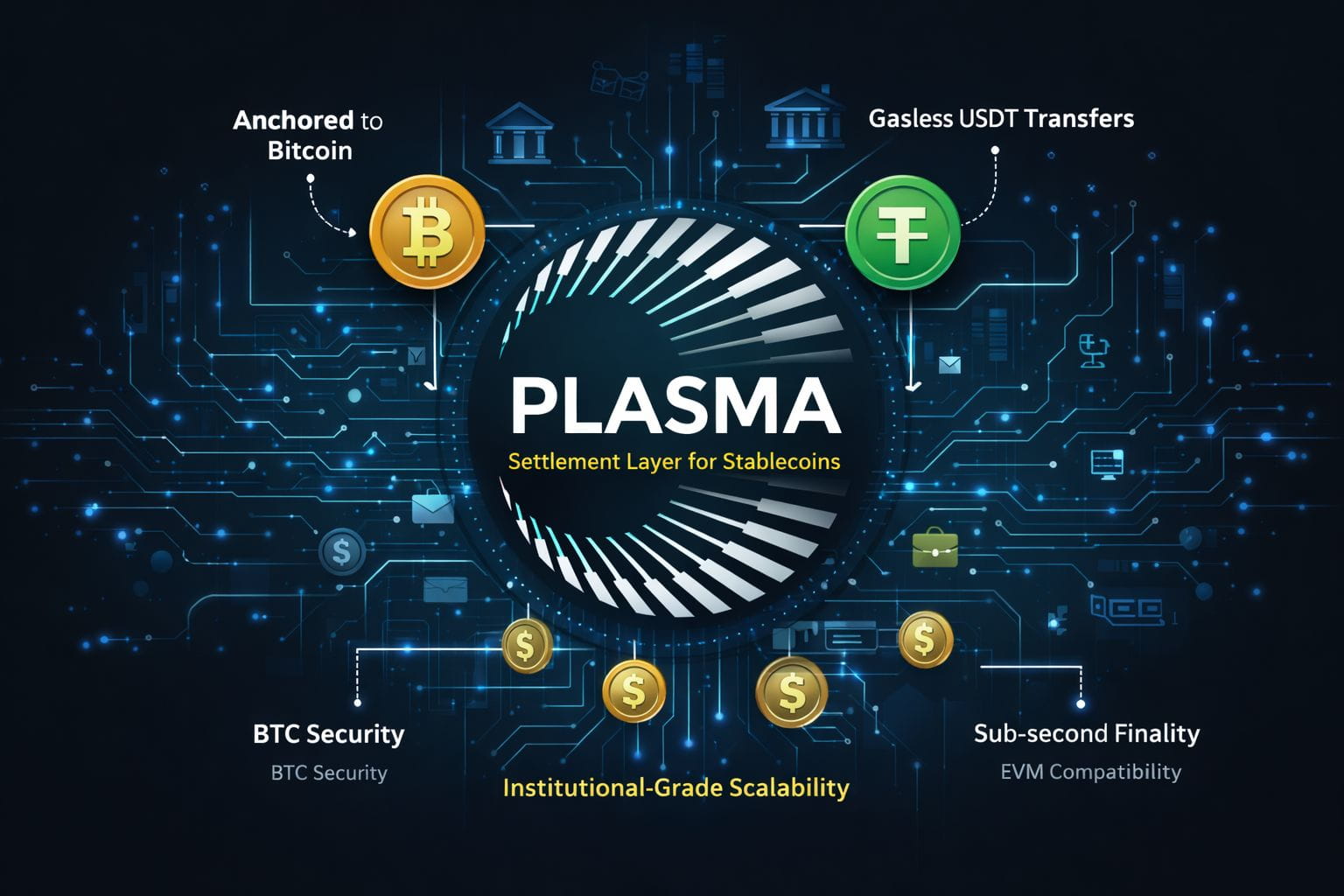

What makes Plasma stand out is not noise, marketing or hype. It is the purity of the problem it wants to solve. It focuses on stablecoin centric design from the base layer, something the broader crypto market has talked about for years but never delivered in a clean way. Most chains try to serve everyone at once. Plasma does not do that. It concentrates on becoming the best home for USDT and other major stablecoins by giving users and institutions exactly what they need. This includes gasless USDT transfers, stablecoin first gas, fast finality and Bitcoin anchored security.

If you look at the way payments actually work outside crypto, the priorities are simple. People want low friction, reliability and trust. They want transfers that settle instantly, behave consistently and never surprise them with high fees or delays. Crypto users want the same thing but rarely get it. Gas fees fluctuate, networks clog under load, and finality can feel unpredictable. Plasma removes the friction by building a structure that behaves like a payments engine, not a speculative playground. Reth powered EVM compatibility, the PlasmaBFT consensus engine and Bitcoin anchoring create a combination that feels purpose built for the next wave of digital money.

Retail adoption is already shifting toward stablecoins. Billions of dollars flow through USDT every day across high adoption markets, including regions with capital restrictions, currency instability or banking limitations. For these users, stablecoins are not speculative assets. They are working money. They are used to buy goods, pay salaries, make transfers and support businesses. But the chains that carry them were never optimized for this level of utility. Plasma steps in with a settlement environment that can scale with real world usage without losing reliability.

Another thing that makes Plasma interesting is how predictable it feels. There is no complexity hidden behind the scenes. Builders can easily understand how transfers flow, how finality works and how fees remain low. This is important because developers who want to build payments or finance applications cannot depend on random congestion, unpredictable spikes or uncertain settlement rules. They need consistency. Plasma has designed its architecture to deliver this consistency at scale, even under heavy usage.

Bitcoin anchored security is one of the most underrated elements of Plasma. In a world where censorship resistance and neutrality matter more than ever, connecting settlement finality to the Bitcoin security layer adds a strong defensive wall. Institutions and financial applications want to rely on chains that have predictable security models. Bitcoin anchoring gives Plasma a foundation that is both neutral and resilient. It increases confidence for builders who want long term safety without sacrificing performance or speed.

When we talk about the next billion users in Web3, most people think of gaming, metaverse or social features. But in reality, the majority of new users will arrive through stablecoin utility. They will come for simple transfers, low cost payments and easy settlement rails. They will not care about gas optimization or complex DeFi strategies. They will care about how quickly their money moves and how easy the system is to use. Plasma speaks directly to this audience with a design that removes friction and behaves like a modern digital payments engine.

Institutions also benefit from this approach. For years, financial firms have tried to integrate stablecoins into their workflows, but they always run into the same issues. High fees, unpredictable performance, and settlement delays make it difficult to rely on general purpose chains. Plasma changes the equation by offering a chain that acts like a specialized settlement rail. Sub second finality gives institutions confidence. Predictable fees simplify accounting. Stablecoin first features allow them to design products without worrying about gas volatility. The entire structure feels aligned with financial grade performance.

One of the most important parts of Plasma is how it treats stablecoins as the core asset of the chain. On most networks, stablecoins are just tokens. They behave like any other ERC20. On Plasma, they become native tools. Gasless USDT transfers are a perfect example. You can move value without thinking about gas or holding a second token. This makes the experience feel natural for everyday users. It removes the barrier that usually stops people from adopting blockchain payments. It is the type of user experience that can scale globally because it feels simple and intuitive.

The PlasmaBFT engine is another highlight. Sub second finality means that transfers settle so quickly that the chain feels instantaneous. This matters for both retail users and institutions. People expect their money to move fast. They do not want to wait. They do not want a pending status. They want a final confirmation that tells them the transaction is complete. Plasma gives them that experience every time.

Developers also benefit from full EVM compatibility. They can migrate applications, build new tools and deploy financial products without learning a new environment. Reth makes everything smoother and more efficient. It is a familiar environment with better performance. This allows builders to focus on innovation instead of worrying about architectural constraints.

The future of crypto is about usability, stability and relevance. Chains that solve real financial problems will lead the next cycle. Plasma positions itself exactly in that direction. It targets the space where adoption is already happening. It builds for the markets that need stablecoins the most. It provides the settlement guarantees that institutions require. It gives developers the environment they need to build global financial applications. It is not a chain trying to do everything. It is a chain doing one thing extremely well.

As adoption grows, the role of Plasma becomes clearer. It will not just process payments. It will power lending, liquidity flow, merchant settlements, payroll, micro transactions, cross border transfers and financial automation. Anything that relies on stable and reliable movement of digital dollars will naturally fit into the Plasma ecosystem. This is how the chain becomes an essential part of Web3 financial infrastructure.

When I look at Plasma, I see a chain with quiet confidence. It does not sell dreams. It delivers design. It delivers clarity. It delivers a stablecoin focused settlement layer that feels like the missing piece of crypto payments. In a world where digital value moves faster every year, settlements matter more than anything else. Plasma is building that foundation with precision.

If you want to understand the future of stablecoins, you need to understand Plasma. This is not just another chain. This is the settlement engine that digital money has been waiting for.