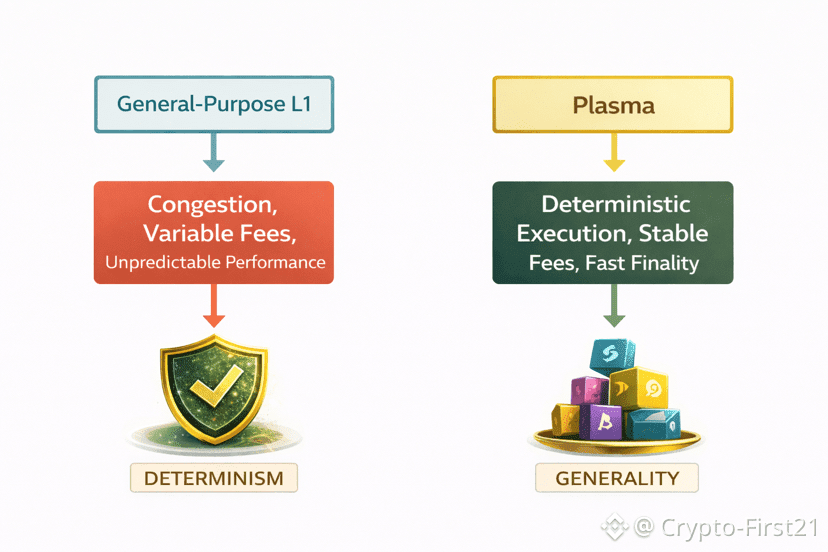

Most blockchains today are built around a single idea: generality. They aim to support every possible use case, DeFi, NFTs, gaming, social apps, experiments, within one shared execution environment. While this flexibility has driven innovation, it has also created a fundamental problem, unpredictable performance. For systems meant to move money at scale, unpredictability is not a feature, it is a failure. Plasma is built on the opposite philosophy, deterministic performance over generality, and that choice defines everything about its design.

Deterministic performance means the network behaves consistently under load. Transaction ordering, execution time, fees, and finality are predictable. In financial systems, this matters far more than supporting every possible application. Payments, settlement, and treasury flows require certainty. A user sending stablecoins should not care whether an NFT mint or speculative trade is happening elsewhere on the network. Plasma prioritizes this reliability by narrowing its focus and designing the protocol around stablecoin movement first.

Generality introduces contention. When all applications compete for the same blockspace, execution becomes volatile. Fees spike unpredictably, confirmation times fluctuate, and simple transfers suffer during periods of congestion. Plasma avoids this by explicitly designing around stablecoin use cases. Execution paths are optimized, simple transfers are isolated from complex logic, and the system is tuned for continuous value movement rather than bursty speculative activity. This results in consistent throughput and predictable costs even during high demand.

Plasma deterministic approach is reinforced at the consensus level. With PlasmaBFT, block sequencing and finality are explicit and fast. Once a transaction is finalized, it is settled, no probabilistic waiting, no ambiguity. This is essential for real world financial activity, where delayed or reversible settlement introduces operational risk. Deterministic finality allows businesses and institutions to treat on chain transactions with the same confidence they expect from traditional settlement systems.

Plasma prioritizes determinism is economic alignment. Stablecoins are not speculative assets; they are instruments of exchange. Their value comes from reliability, not volatility. Plasma’s stablecoin first gas model reflects this reality. Fees are designed to be predictable and, in some cases, invisible to the end user. This would be impossible in a fully general system where unrelated activity constantly distorts network economics.

Importantly, prioritizing determinism does not mean sacrificing usability. Plasma maintains full EVM compatibility, allowing developers to deploy existing Ethereum smart contracts without rewriting code. The difference is that these contracts run in an environment optimized for payments and settlement, not experimental congestion. Developers gain reliability without losing familiarity.

Plasma design choice is ultimately philosophical. It treats blockchains not as playgrounds for unlimited experimentation, but as infrastructure. Infrastructure must be boring, reliable, and predictable. By prioritizing deterministic performance over generality, Plasma positions itself as a settlement layer that can support global stablecoin usage at scale, quietly, efficiently, and without surprises.