If you’ve been trading crypto for a while, you’ll know “privacy” and “regulated finance” usually pull in opposite directions. Privacy chains tend to get treated like a compliance headache, while regulated finance tends to mean more disclosure, more paperwork, more friction. Dusk Network sits right in that tension, and that’s exactly why it keeps popping up on traders’ radar lately: it’s trying to make privacy work inside the rules of on-chain finance, not outside them.

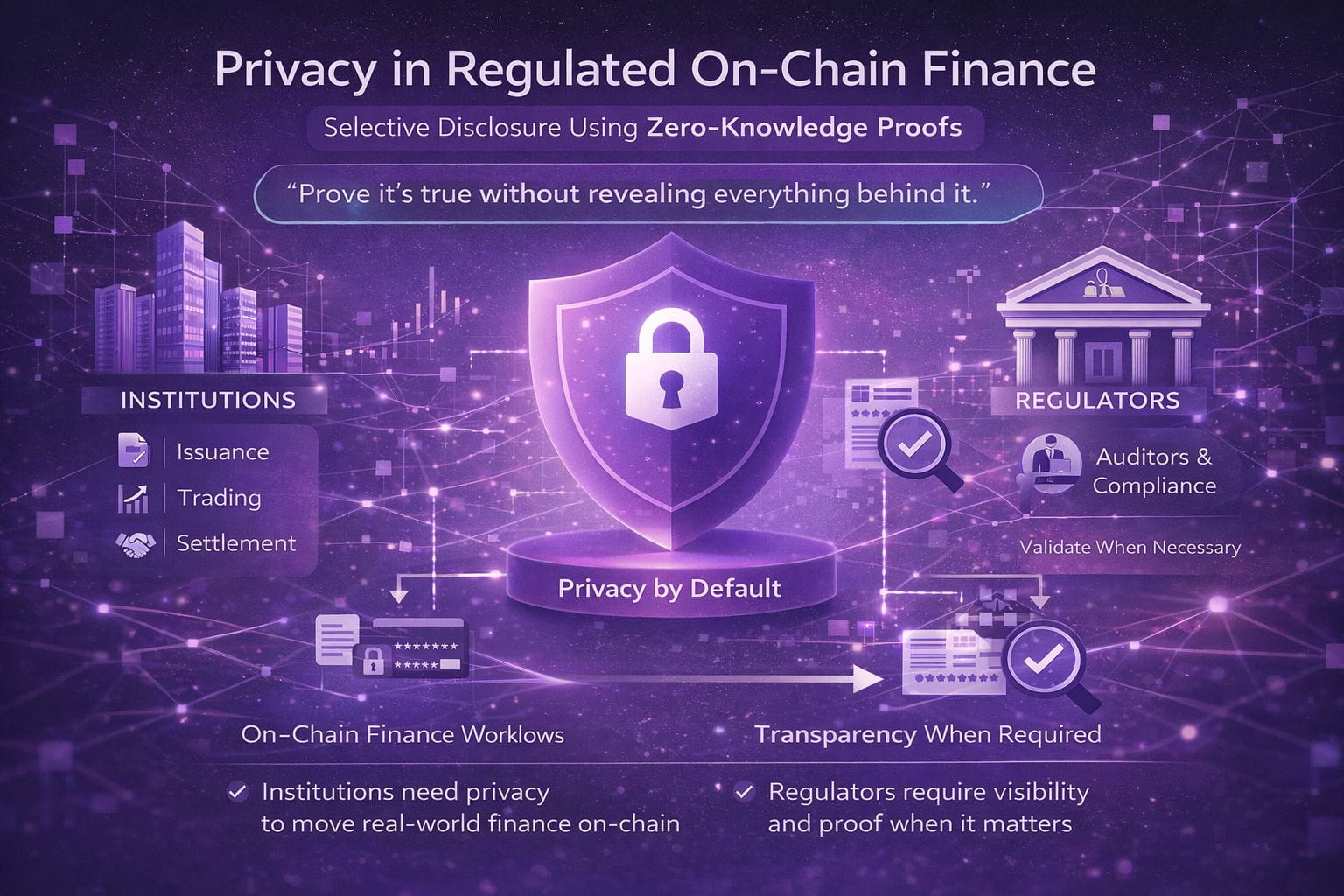

The basic idea is simple: institutions want to move real-world finance workflows on-chain issuance, trading, settlement but they can’t do it if every position, counterparty, and transfer detail is broadcast to the world. At the same time, regulators and auditors still need visibility when it matters. Dusk’s pitch is “privacy by default, transparency when required,” using cryptography to prove something is true without revealing everything behind it. That’s where zero-knowledge proofs come in: you can validate a transaction or a compliance rule without exposing the sensitive data itself. In practice, it’s closer to selective disclosure than total secrecy, which is a big difference from how many traders think about privacy tech.

A lot of the current attention traces back to concrete network progress, not just narrative. Dusk laid out a mainnet timeline starting December 20, 2024, with the first immutable block scheduled for January 7, 2025, plus milestones like early deposits opening January 3. That’s the kind of date-driven catalyst traders actually trade around, because it moves a project from “promises” into “operations.” Not long after, Dusk also shipped practical plumbing, like a two-way bridge that lets users move native DUSK from mainnet to BEP20 DUSK on BSC (and back), with bridging handled through the Dusk Web Wallet and a stated 1 DUSK fee. Those aren’t flashy features, but liquidity access and simpler routing matter when you’re watching flows.

The “regulated” part of the title isn’t marketing fluff either; it’s timed with a real shift in Europe. Dusk explicitly linked its positioning to MiCA, noting that MiCA became enforceable across EU member states on June 30, 2025. Whether you love regulation or hate it, it’s hard to ignore what happens when large pools of capital finally get clearer rules of engagement. In my experience, that’s when niche infrastructure narratives start getting repriced slowly at first, then all at once when a credible bridge to institutions shows up.

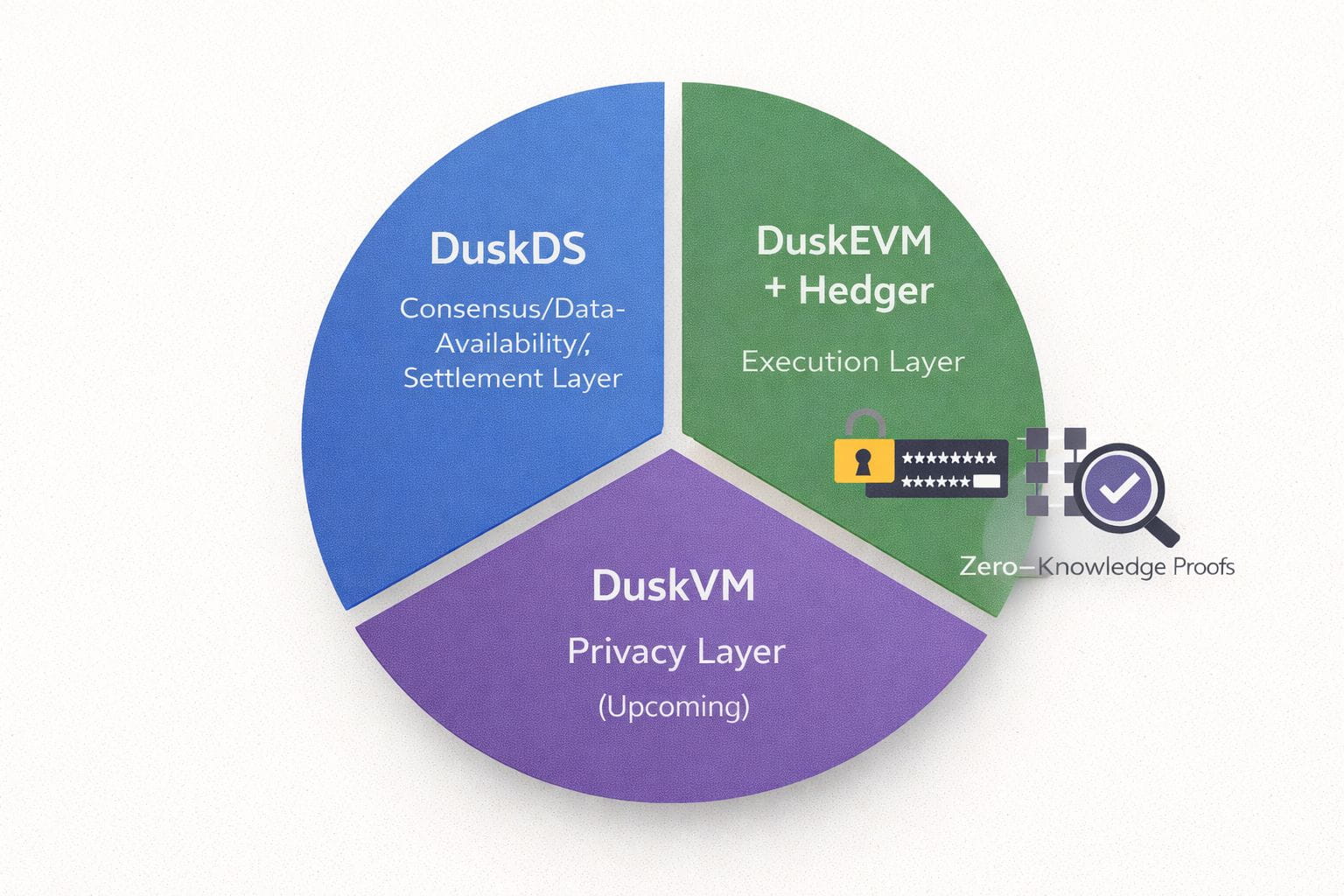

On the tech side, Dusk has been evolving beyond the “single chain does everything” model. In June 2025, the team described a modular, three layer direction: a consensus/data-availability/settlement layer (DuskDS), an EVM execution layer (DuskEVM), and a forthcoming privacy layer (DuskVM). Around the same time, they introduced Hedger as a privacy engine for the EVM layer, combining homomorphic encryption with zero knowledge proofs to enable confidential transactions that can still be audited. If those terms sound intimidating, think of it this way: homomorphic encryption lets certain math happen on encrypted values, and ZK proofs let the chain confirm rules were followed so you can keep amounts or positions private while still proving compliance logic ran correctly.

The other reason it’s trending is the kind of partnership headline that traders recognize as “institutional adjacency.” On November 13, 2025, Dusk and NPEX (a regulated Dutch exchange for private-company securities) announced they’re adopting Chainlink standards framed around bringing regulated, institutional assets on-chain with high integrity data feeds and interoperability. You don’t have to assume instant volume from that, but it does signal the project is trying to plug into real financial data and real issuance pipelines, not just DeFi-native loops.

Finally, there’s the market tape, and it’s hard to pretend that doesn’t matter for “why now.” As of today (January 25, 2026), trackers show DUSK around the ~$0.19–$0.20 range with roughly ~$70M+ in 24h volume, and a circulating supply around ~500M with a 1B max supply. When a mid-cap asset starts printing that kind of turnover, it naturally drags more eyes into the story especially when the story is tied to clear milestones like mainnet, bridges, and compliance-tailored privacy. Personally, I treat that combo as “worth monitoring, not worshipping”: watch liquidity, watch deliverables, watch whether developers actually build on the stack. The chart will tell you the rest.