If you’ve ever wondered why some crypto coins are easy to buy or sell while others feel “stuck,” the answer lies in liquidity. In simple terms, liquidity is how easily an asset can be converted into cash or another asset without affecting its price.

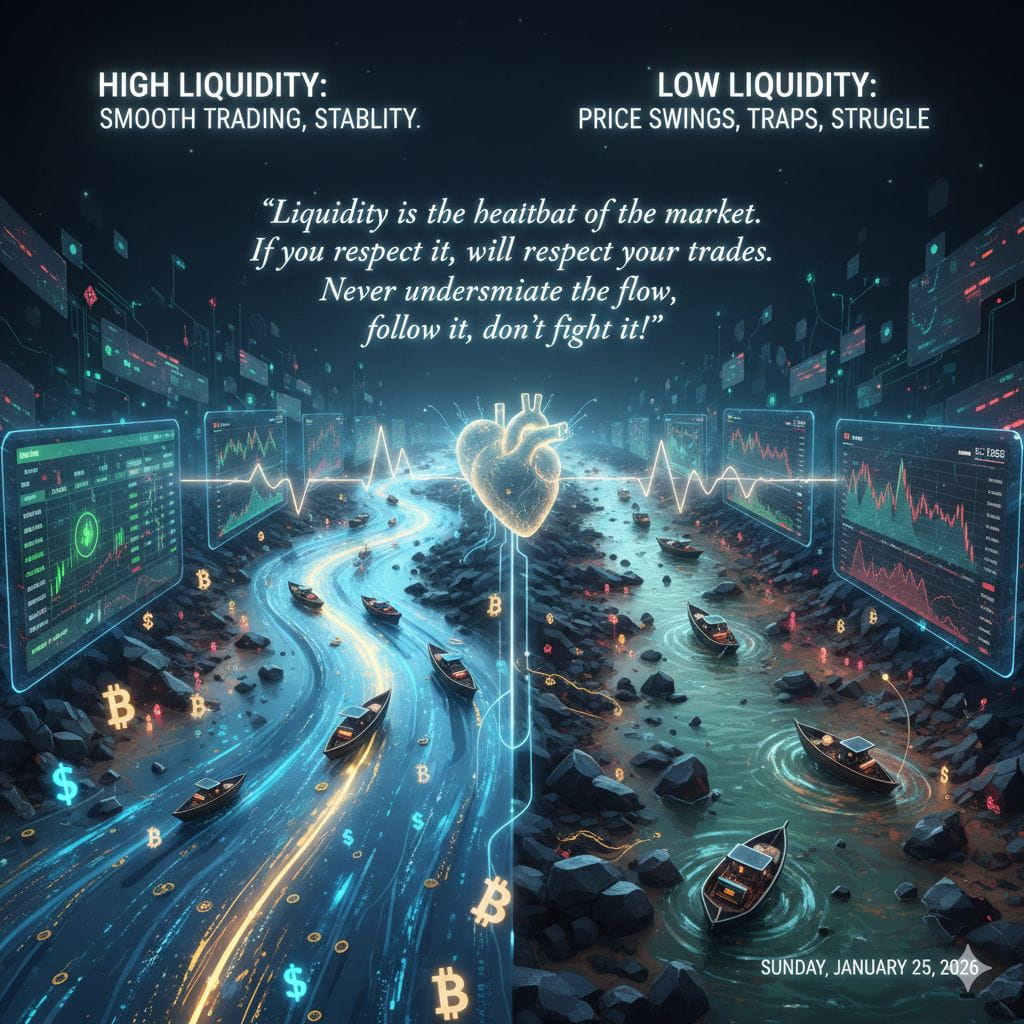

Think of liquidity like water in a river:

The more water (liquidity) flows, the easier it is for boats (traders) to move without obstruction.

Less water means boats struggle, get stuck, or even tip over just like low-liquidity assets that have high price swings.

Why Liquidity Matters in Crypto:

Smooth Trading: High liquidity ensures your trades execute quickly at fair prices.

Lower Slippage: You avoid losing money to price gaps when buying or selling large amounts.

Market Stability: Assets with high liquidity are less likely to experience wild price spikes or crashes.

High vs. Low Liquidity:

High Liquidity: Bitcoin ($BTC ) and Ethereum ($ETH ), you can buy or sell thousands without moving the market.

Low Liquidity: Small altcoins or new tokens, even a small trade can dramatically affect price.

Pro Tip for Traders:

Always check a coin’s 24-hour trading volume and order book depth. High numbers mean high liquidity, which means safer, smoother, and more profitable trading.

In crypto, liquidity is power. The more liquid a market, the more freedom you have to make moves, ride trends, and avoid traps.

“Liquidity is the heartbeat of the market. If you respect it, it will respect your trades. Never underestimate the flow, follow it, don’t fight it!”

#Binance #BinanceSquare #Write2Earn #liquidity #CryptoNews