A while back, I was testing a small private transfer tied to a tokenized asset position. Nothing special. Just trying to move exposure without advertising it to anyone watching the chain. I had already been through the usual privacy routes on Ethereum. Mixers. ZK add-ons. Custom wrappers. They work, technically, but they never feel smooth. Proofs take longer than you expect. Fees jump at the wrong moment. And even when values are hidden, you still leak intent through timing, size patterns, or retries. You end up wondering who is watching, not whether the transaction will succeed.

That’s the quiet problem with most smart contracts today. They were built for visibility first. Privacy came later. And when privacy is added later, it always costs something. Speed. Simplicity. Predictability. Developers have to juggle compliance rules on one side and cryptographic tricks on the other. Users deal with delays and higher fees exactly when they need things to be calm and boring. That is fine for experiments. It is not fine for finance.

Think about it like handling sensitive paperwork. Doing it encrypted in a shared office still tells people when you are busy, how often you move, and roughly how big the deal is. Doing it inside a secure room removes that noise. Same documents. Very different risk profile.

That is the direction #Dusk is trying to take. Not adding privacy as a feature, but making it the default behavior. The chain is built around confidential execution from the start. Smart contracts run with zero-knowledge proofs baked into how state changes happen. Data stays hidden unless there is a reason to reveal it. That reason might be a regulator. Or an auditor. Or a counterparty. But it is intentional, not accidental.

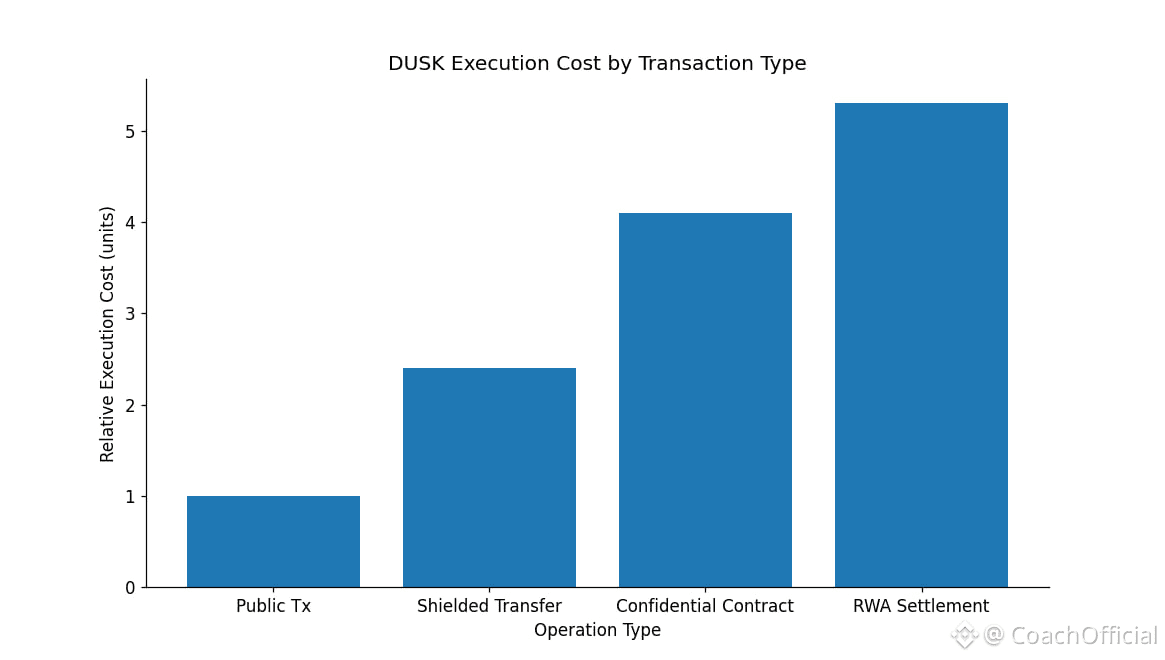

The January 2026 mainnet launch made this real. With DuskEVM live, developers can deploy Solidity contracts without rebuilding everything from scratch, but execution happens through a privacy-aware runtime. Underneath, the Rusk VM generates proofs for each state transition. You do not see balances. You do not see internal logic. You only see that the rules were followed. That is powerful, but it is not cheap. ZK computation is heavy, and Dusk does not pretend otherwise.

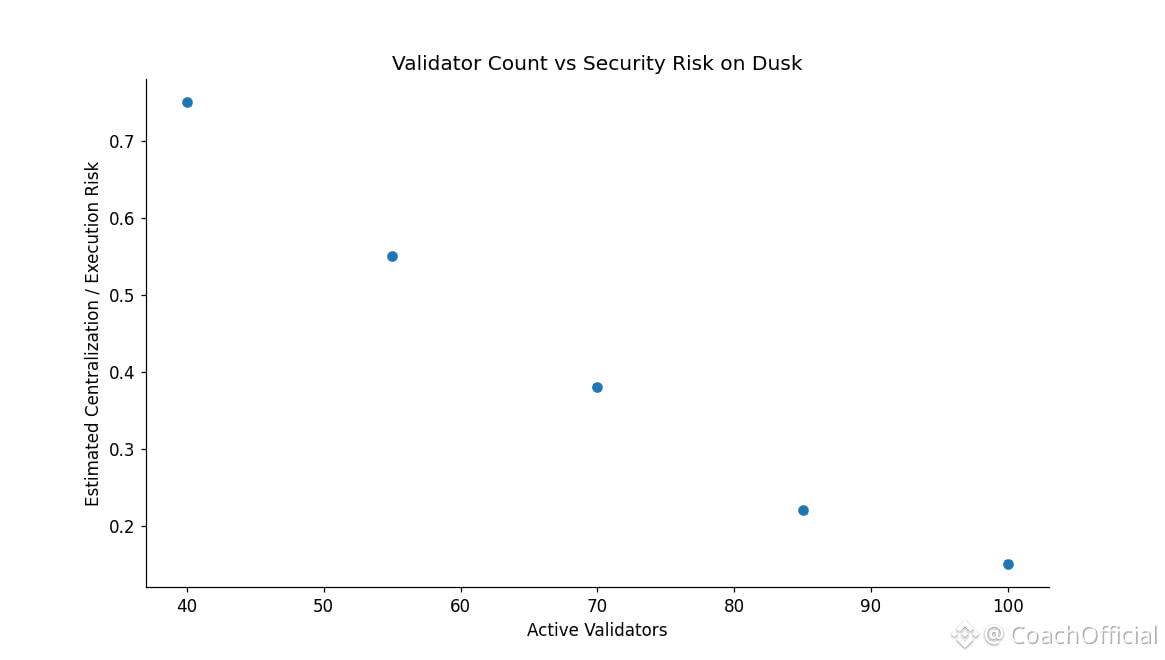

Consensus follows the same mindset. The network uses a committee-based proof-of-stake model designed for fast finality, not massive decentralization. Validator sets are kept tight on purpose. That keeps latency low and execution predictable, which matters when you are settling real assets. The trade-off is obvious. Fewer validators means more responsibility per node. Dusk is choosing reliability over ideological purity.

On top of that, the project leans hard into compliance. Oracles, identity hooks, selective disclosure. The NPEX partnership is not about hype. It is about testing whether regulated securities can actually live on-chain without leaking sensitive information. The upcoming Dusk Trade platform is not aimed at retail traders. It is aimed at institutions that care more about control than speed runs.

The $DUSK token itself stays boring, which is probably a good thing. It pays for execution. Heavier proofs cost more. Validators stake it to secure the network. Governance uses it to vote on upgrades. Emissions taper. There are no tricks here. It exists to keep the system running, not to sell a story.

From the market side, most activity is still narrative-driven. Mainnet launches. Privacy rotations. RWA headlines. Price moves faster than usage. That is normal at this stage. It also means volatility cuts both ways. You can trade it, but you are trading expectations, not cash flow.

The real question is slower. Do confidential contracts get used again after the first test. Do institutions move past pilots. Do developers trust the tooling enough to build something they expect to maintain for years. That is where most privacy projects stumble.

There are real risks. ZK systems are fragile if pushed too hard. A surge in complex proofs during an RWA settlement window could slow finality. If validators struggle under load, confidence drops fast. Regulatory rules can shift, especially around selective disclosure. Competing systems with bigger ecosystems could outpace Dusk even if their privacy model is weaker.

None of that shows up on a price chart right away.

What matters is repetition. The second transaction. The tenth. The moment when privacy stops being a feature you think about and becomes something you assume. If #Dusk gets there, it earns its place quietly. If not, it becomes another technically solid network that never escapes the early phase.

That outcome will not be decided by announcements. It will be decided by whether confidential execution keeps working when no one is paying attention.

@Dusk #Dusk $DUSK