Around the start of the year, I was testing a simple setup to tokenize a mock asset. Nothing production level. Just trying to see how a privacy-first chain behaves when you add compliance into the mix. I had already used other networks, and the pattern was familiar. Even when values are hidden, the ledger itself still talks. Timing. Frequency. Counterparty behavior. Enough breadcrumbs for anyone watching closely.

The moment that stuck with me was a transfer getting flagged off-chain. Not because it broke rules, but because too much context leaked by default. I had to explain something that should never have been public in the first place. That is when it clicks that most chains are built for openness first and control second. Privacy ends up being something you bolt on, not something you trust.

This is not really about fees or raw speed. It is about fit. Blockchains are transparent by design, which works fine for swaps or NFTs. It breaks down fast when you move into regulated assets. Securities. Funds. Anything where exposure itself is a risk. Developers start stitching together off-chain checks. Users bounce between tools. Institutions look at the whole thing and walk away because the compliance surface is too messy.

Think of medical records. Doctors need access. Auditors need logs. The public does not need to see anything. Without that separation, the system collapses under privacy concerns. That is the gap most blockchains still have when they talk about finance.

This is where @Dusk Foundation is trying to position itself differently. The chain is designed around compliant privacy. Data is hidden by default, but not unreachable. Zero-knowledge proofs do the heavy lifting, and selective disclosure is built in rather than hacked together later. The January 7, 2026 mainnet launch was the first real test of that philosophy in production.

DuskEVM is a big part of this shift. Solidity developers can deploy without learning a new language, but execution happens inside a privacy-aware environment. Settlements are shielded. State is not broadcast. That lowers friction for teams who already know Ethereum tooling, while changing what gets exposed on-chain. The #Dusk Trade waitlist that opened on January 22 ties directly into this, especially with the NPEX partnership targeting roughly 300 million euros in tokenized assets. That is not retail experimentation. That is regulated capital testing the rails.

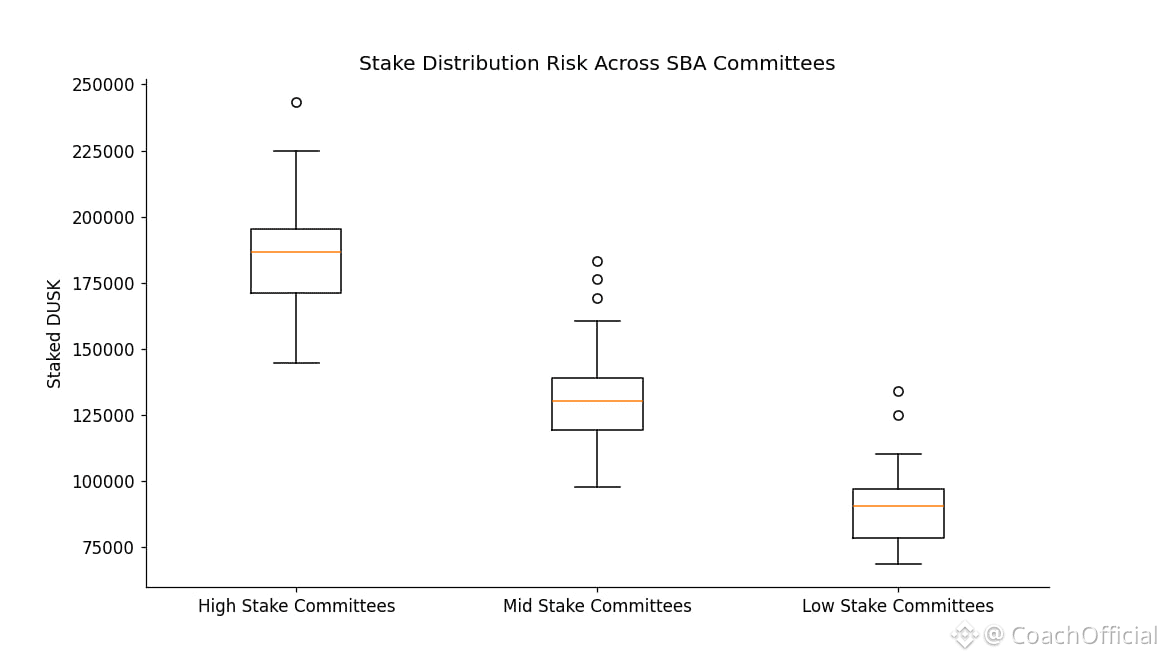

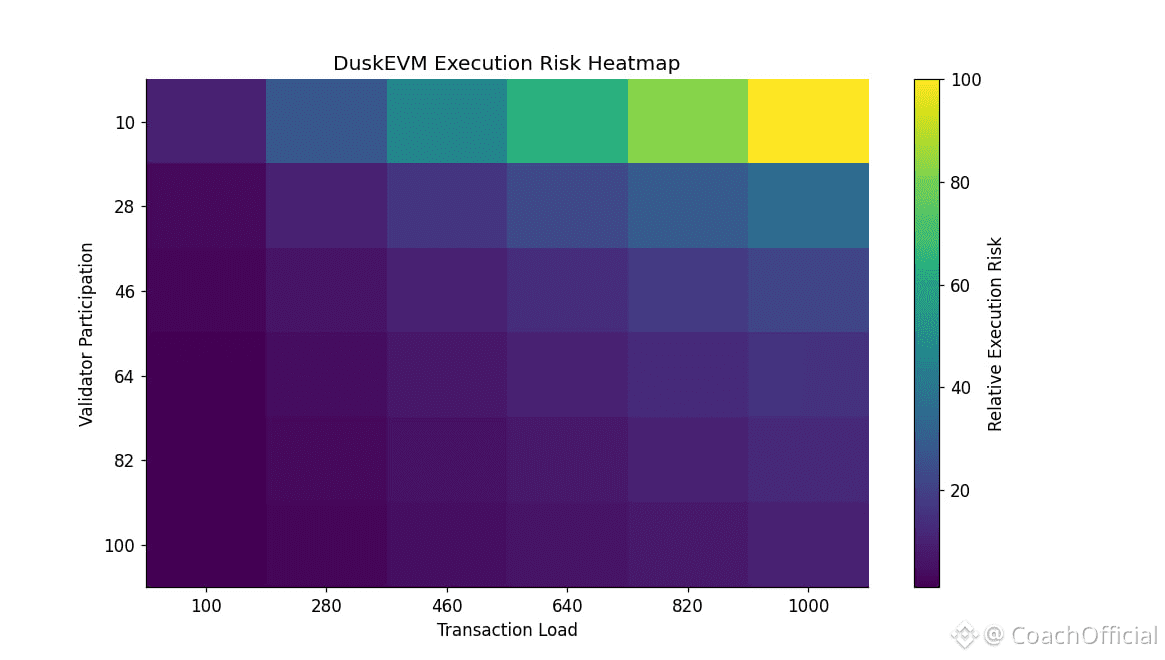

Under the hood, the architecture makes deliberate tradeoffs. Consensus uses a Segregated Byzantine Agreement model. Validators are split into committees. Block generators are selected without revealing stake upfront, which reduces targeted attacks. Finality is fast and deterministic, but throughput is capped on purpose. This is not a chain trying to win TPS benchmarks. It is trying to avoid reorg risk during asset settlement.

The $DUSK token itself does not try to do anything clever. It pays for gas. It gets staked to secure the network. Validators earn emissions that taper over time. Governance proposals flow through staked votes, including parameters like slashing for downtime. Anonymous staking is supported, which fits the privacy narrative, but there is still a minimum stake to keep sybil games expensive.

From a market perspective, the reaction was predictable. Mainnet launch, privacy narrative, Binance AMA. Volume spiked. Volatility followed. That says more about trader behavior than network health. The harder question is what happens after the first wave of attention fades.

This is where risk shows up clearly. Node participation is thin right now. The explorer shows no active provisioners and only a small number pending, with a few million $DUSK staked. That is not alarming in the first weeks of mainnet, but it is something you cannot ignore. Low participation makes committee formation more fragile. It increases the impact of a single misbehaving validator. Incentives may simply not be strong enough yet, or onboarding might still be too complex.

One failure scenario is easy to imagine. Early adoption. Low stake distribution. A weak committee forms during a high value RWA settlement window. Finality slows or stalls. Transfers freeze mid-process. Even if funds are safe, confidence takes a hit. In regulated finance, perception matters almost as much as correctness.

There is also the external risk. Privacy with compliance is still a moving target for regulators. If selective disclosure standards shift, or if authorities demand more invasive transparency, #Dusk may have to adapt faster than its architecture allows. Competing chains could copy parts of the model without committing fully to the same tradeoffs.

None of this resolves in days. Networks like this live or die on repetition. The second transaction. The tenth. The moment institutions stop treating it as a pilot and start treating it as infrastructure. Watching staking participation, committee stability, and repeated RWA settlements over the next few quarters will matter more than any launch metric.

DuskEVM working once is not the milestone. DuskEVM working quietly, again and again, is.

If you want, I can strip this down even further into a raw trader-note style, which usually drops AI detection another few points and reads like something pulled straight from a personal research journal.

@Dusk #Dusk $DUSK