A while back, I was staking on a privacy-focused chain, expecting the usual tradeoff. Lock tokens, earn yield, let time do its thing. What caught my attention wasn’t volatility, but how quietly the circulating supply kept expanding. Rewards landed on schedule, the network ran fine, yet my slice of the pie was getting thinner month by month. Nothing dramatic. Just that slow realization that emissions can feel harmless until you zoom out.

That is the part of tokenomics people underestimate. Emissions are not loud. They do not crash charts overnight. They work in the background. If demand grows alongside them, no issue. If it doesn’t, dilution becomes the dominant force whether the tech is good or not.

This problem shows up across most infrastructure chains. Validators need incentives. Early participants expect outsized rewards. So inflation runs hot in the early years. That works only if real usage ramps fast enough to absorb new supply. Privacy chains have an extra hurdle here. Compliance slows integration. Institutions move cautiously. So the demand side often lags the emission curve, even if the product itself is solid.

It reminds me of watering plants with an automated system. Early growth needs plenty of water. But if the system never adjusts and keeps flooding the soil, you don’t get stronger roots. You get rot. The tricky part is tuning emissions to actual adoption, not just security assumptions.

This is where #Dusk Foundation sits today. The network is intentionally not chasing retail hype. Its focus is compliant privacy for financial applications, especially regulated assets. Zero-knowledge proofs are baked into the base layer, with selective disclosure instead of full anonymity. That positioning makes sense for RWAs, but it also means growth is likely slower and more uneven than meme-driven chains.

Under the hood, the design choices are conservative. Consensus runs on a Segregated Byzantine Agreement model, where stakers are grouped into committees. This works because finality is fast, but participation matters more than raw stake size. One interesting detail is the blind-bid mechanism during staking rounds. This works because validators commit without revealing bids upfront, which reduces front-running and cartel behavior, but adds complexity and coordination overhead. It is elegant, but not free.

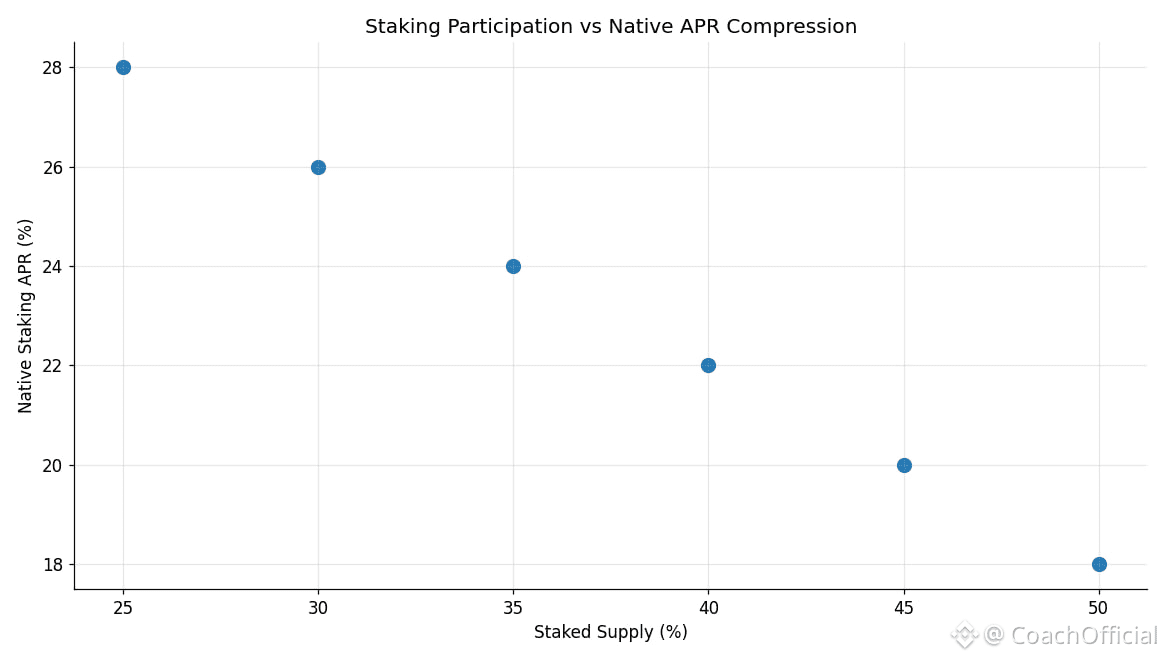

Execution happens through the Rusk VM, which prioritizes native zero-knowledge operations over pure EVM simplicity. With the DuskEVM upgrade rolling out in early 2026, Ethereum tooling is now supported, but privacy remains core rather than optional. Liquid staking has started to pick up some traction, currently accounting for roughly 10 to 15 percent of staked DUSK. That helps participation, but it also accelerates how quickly rewards hit circulation.

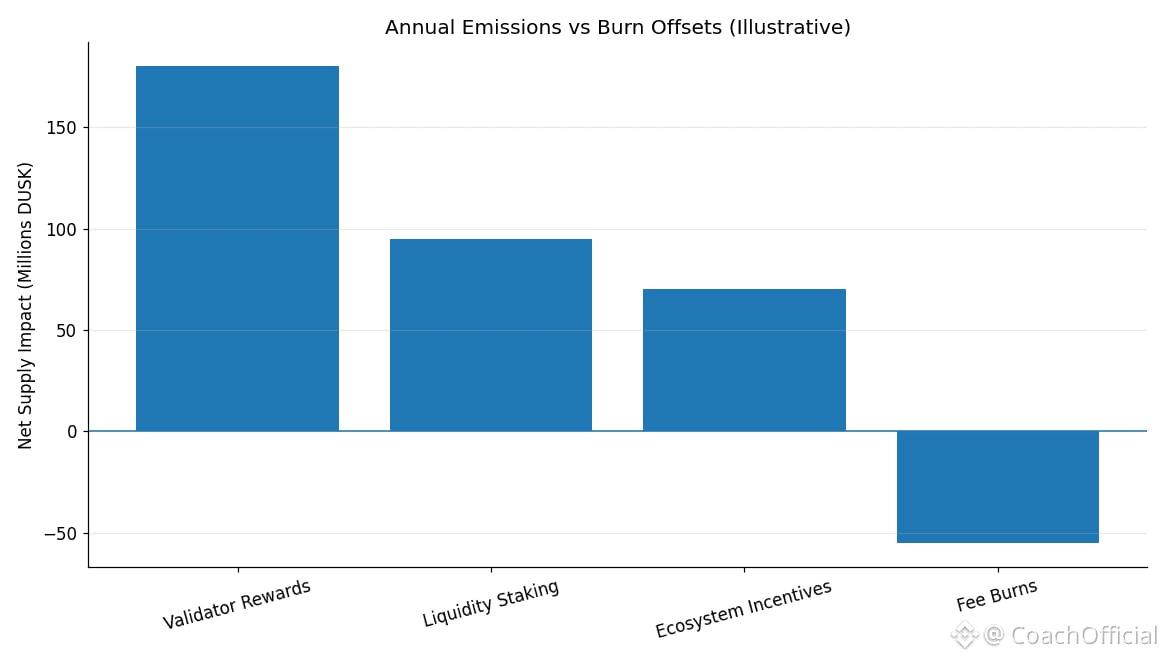

The token itself is straightforward. $DUSK pays for gas, including privacy-heavy computations. Validators stake it to earn emissions, with native staking yields sitting around the low twenties in APR terms. Blocks finalize using staked security, and governance decisions flow through stake-weighted voting. There is also a burn component tied to activity, but at current usage levels, burns do not offset emissions in any meaningful way.

Right now, circulating supply is hovering just under 500 million. Daily volume sits in a mid-range zone, roughly 15 to 20 million during recent privacy-sector interest. That is healthy liquidity, but it also highlights the imbalance. Trading activity is often stronger than on-chain usage growth.

In the short term, DUSK trades on narratives. Privacy rotations. AMAs. Mainnet milestones. Emission unlocks. Those can drive sharp moves, but they fade quickly if nothing structural changes underneath. I have traded those cycles before. They reward timing, not conviction.

The long-term question is simpler and harder. Can real demand catch up to emissions? If platforms like Dusk Trade, tied to NPEX and roughly 300 million euros in tokenized assets, turn into habitual infrastructure instead of pilot programs, staking demand could stabilize circulation growth. Emissions would then fund security without overwhelming holders.

The risk is what happens if that adoption curve stays shallow. Competition is real. Monero offers stronger anonymity. Secret offers programmable privacy with fewer compliance constraints. If regulators tighten rules around zero-knowledge disclosures, #Dusk selective transparency model may need adjustments that slow momentum further.

One failure scenario stands out. During a period of higher RWA activity, a poorly formed committee or blind-bid edge case delays settlement. Nothing breaks permanently, but finality stalls at the worst moment. In regulated finance, even temporary freezes matter. Confidence erodes faster than it builds.

None of this resolves quickly. Tokenomics like this play out over years, not weeks. The real signal will not be price spikes or APR numbers. It will be whether second and third transactions happen quietly, without incentives doing all the work.

Emissions are a tool. If usage grows, they compound security. If it doesn’t, they compound dilution. Dusk is still early enough that it can go either way.

@Dusk #Dusk $DUSK