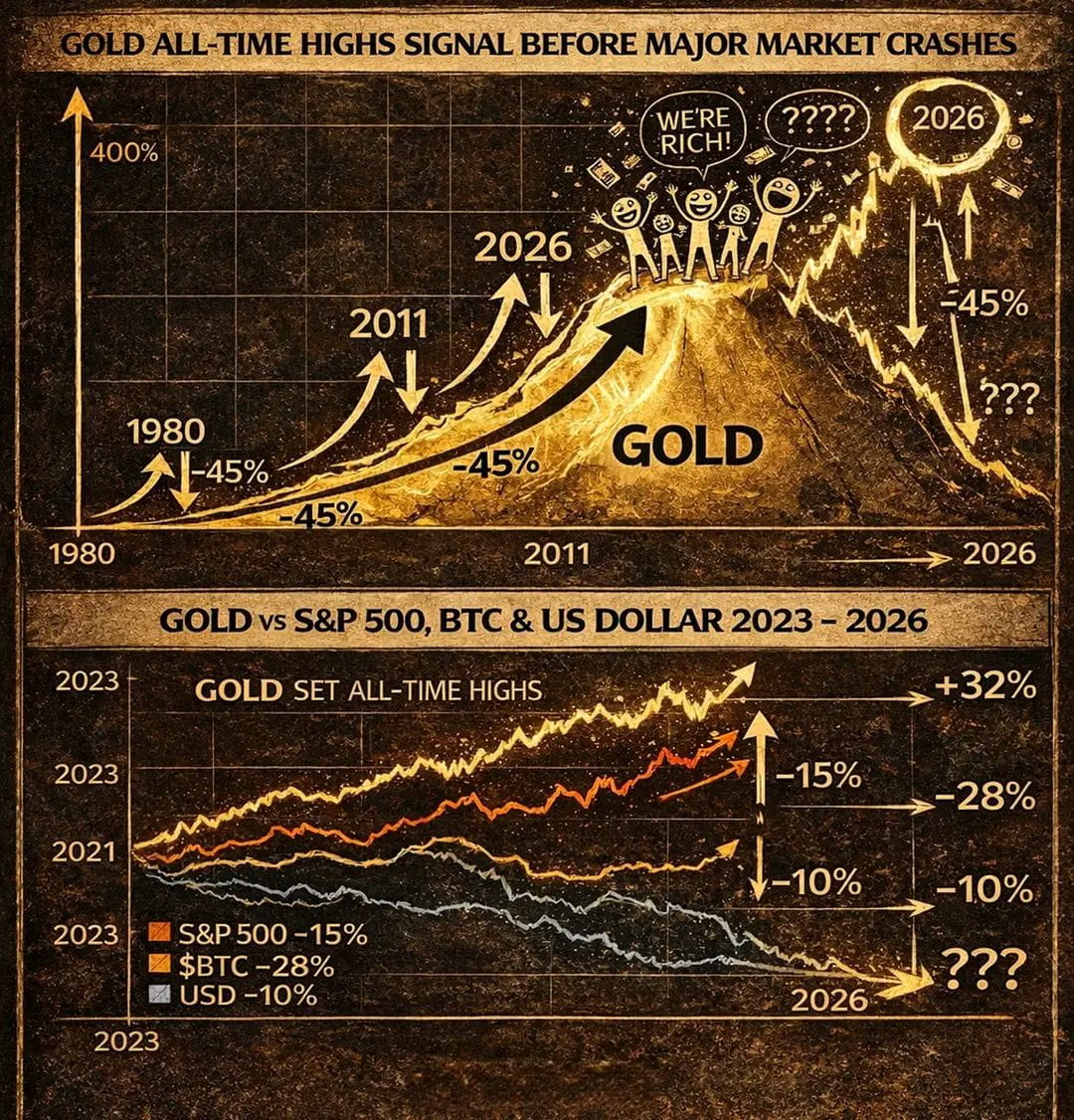

🚨 GOLD WILL CRASH THE MARKET! 🟡

#Gold Has Recently Reached Multiple All-Time Highs Within A Short Timeframe.

At The Same Time, Risk Assets Such As Equities And Digital Assets Have Shown Mixed Momentum,

While Currency Markets Continue To Face Structural Pressure.

This Type Of Market Behavior Is Not New.

History Shows That When Capital Concentrates Heavily In One Defensive Asset,

Broader Market Dynamics Often Begin To Shift.

A Calm Look At Historical Context

→ The 1980 Gold Peak

Gold Reached Record Prices During A Period Of Strong Economic Confidence And Inflation Concerns.

Investor Sentiment Was Largely Optimistic.

What Followed Was A Rapid Repricing Phase That Reset Valuations Across Multiple Asset Classes.

→ The 2011 Gold Cycle High

Gold Traded Near Historic Levels As Monetary Expansion Accelerated

And Sovereign Debt Became A Global Discussion.

Despite Strong Long-Term Narratives,

Gold Entered A Multi-Year Adjustment And Consolidation Phase.

→ The 2020 Liquidity Environment

During Global Uncertainty, Gold Again Moved To Elevated Levels.

Initial Demand Was Driven By Risk-Off Flows,

But Over Time, Momentum Slowed And Capital Rotated Elsewhere,

Creating Opportunity Costs For Many Market Participants.

Why The Current Setup Matters

Several Conditions Today Mirror Past Turning Points:

• Elevated Government Debt Levels

• Persistent Geopolitical And Trade Friction

• Currency Weakness Across Major Pairs

• Liquidity Rotating Toward Capital Preservation

• Investors Prioritizing Safety Over Growth

This Does Not Automatically Mean A Market Decline.

However, It Does Highlight A Period Of Increased Sensitivity,

Where Positioning And Risk Management Become Especially Important.

What Smart Capital Typically Does In These Phases

When Markets Become Crowded On One Side,

Rebalancing Usually Follows — Sometimes Gradually, Sometimes Faster Than Expected.

Historically, Extreme Positioning Has Been A Signal To Review Exposure,

Not To Act Emotionally, But Strategically.

The Key Insight

Markets Do Not Reward Fear Or Blind Optimism.

They Reward Preparation, Patience, And Clear Structure 🔍

After Years Of Observing Market Cycles,

One Principle Remains Consistent:

Capital Preservation Comes Before Capital Expansion.

Stay Observant.

Watch The Flows.

Adjust With Discipline.

More Professional Market Insights Ahead For Those Focused On Long-Term Stability.

#ScrollCoFounderXAccountHacked #GrayscaleBNBETFFiling #ETHMarketWatch #WriteToEarnUpgrade #BTCVSGOLD