When I analyzed why serious financial players keep circling blockchain without fully committing. I realized the real barrier was never technology but trust built into the system itself. Over the past few years I have spent a lot of time studying how institutions actually evaluate blockchain infrastructure. On the surface it looks like adoption is accelerating yet when you dig deeper most capital remains cautious and controlled. My research kept pointing to the same issue is public blockchains were designed for openness first while regulated finance is built on controlled transparency. Dusk Foundation founded in 2018 takes a fundamentally different approach. It is a layer 1 blockchain designed specifically for regulated and privacy focused financial infrastructure not as an afterthought but as a core principle. Instead of asking institutions to adapt their compliance models to crypto. Dusk adapts blockchain architecture to financial reality.

In my assessment this is why Dusk stands out in a crowded field of layer ones. It does not try to compete on hype metrics like raw transaction speed or meme driven activity. It focuses on becoming infrastructure that institutions can actually deploy without compromising regulatory obligations.

Why institutions see privacy differently than crypto users?

One of the biggest misconceptions in crypto is that privacy and transparency are opposites. In traditional finance they coexist every day. Banks disclose information to regulators and auditors while keeping sensitive data hidden from competitors and the public. According to the Bank for International Settlements over 90 percent of central banks exploring digital financial infrastructure list privacy preserving auditability as a mandatory requirement. That single data point explains why many public blockchains struggle to host real institutional activity. Total transparency may work for retail speculation but it fails for regulated capital. Dusk addresses this through cryptographic techniques that allow transactions and asset states to be verified without exposing underlying data. I often explain this like a sealed envelope that proves a contract exists and is valid without revealing its contents unless legally required. This is the kind of logic institutions already understand. The regulatory direction reinforces this need. The European Central Bank has repeatedly emphasized that future digital markets must support confidentiality alongside compliance. Dusk's architecture really fits the current trend especially in Europe, where regulations put a big focus on both data protection and auditability.

Tokenized assets and compliant DeFi are not just buzzwords anymore.

People love to talk about tokenization like it's some distant idea but honestly institutions are already dipping their toes in. My research shows they are not rushing in but they are starting to move carefully and deliberately. A 2023 Boston Consulting Group report estimated that tokenized real world assets could represent up to $16 trillion in value by 2030. However that growth depends entirely on regulatory alignment and infrastructure readiness. Public DeFi platforms face a structural problem here. Issuers cannot place sensitive ownership data settlement logic or investor information on fully transparent ledgers without introducing legal risk. Dusk's design solves this by allowing assets to exist on-chain with privacy controls that mirror traditional financial systems. What really grabs my attention is Dusk's modular setup. Each layer execution privacy compliance does its own thing so institutions can plug into blockchain tech without having to tear apart their whole governance system. Honestly this feels a lot closer to how financial systems actually evolve out in the real world not just on paper.

Efficiency is another often overlooked angle. Deloitte estimated in 2024 that compliant digital asset infrastructure could reduce settlement and reconciliation costs by up to 40 percent. Those savings only materialize when systems are trusted by regulators, counterparties and auditors alike. Dusk is clearly positioning itself to capture this specific efficiency gap.

How Dusk compares within the privacy blockchain landscape?

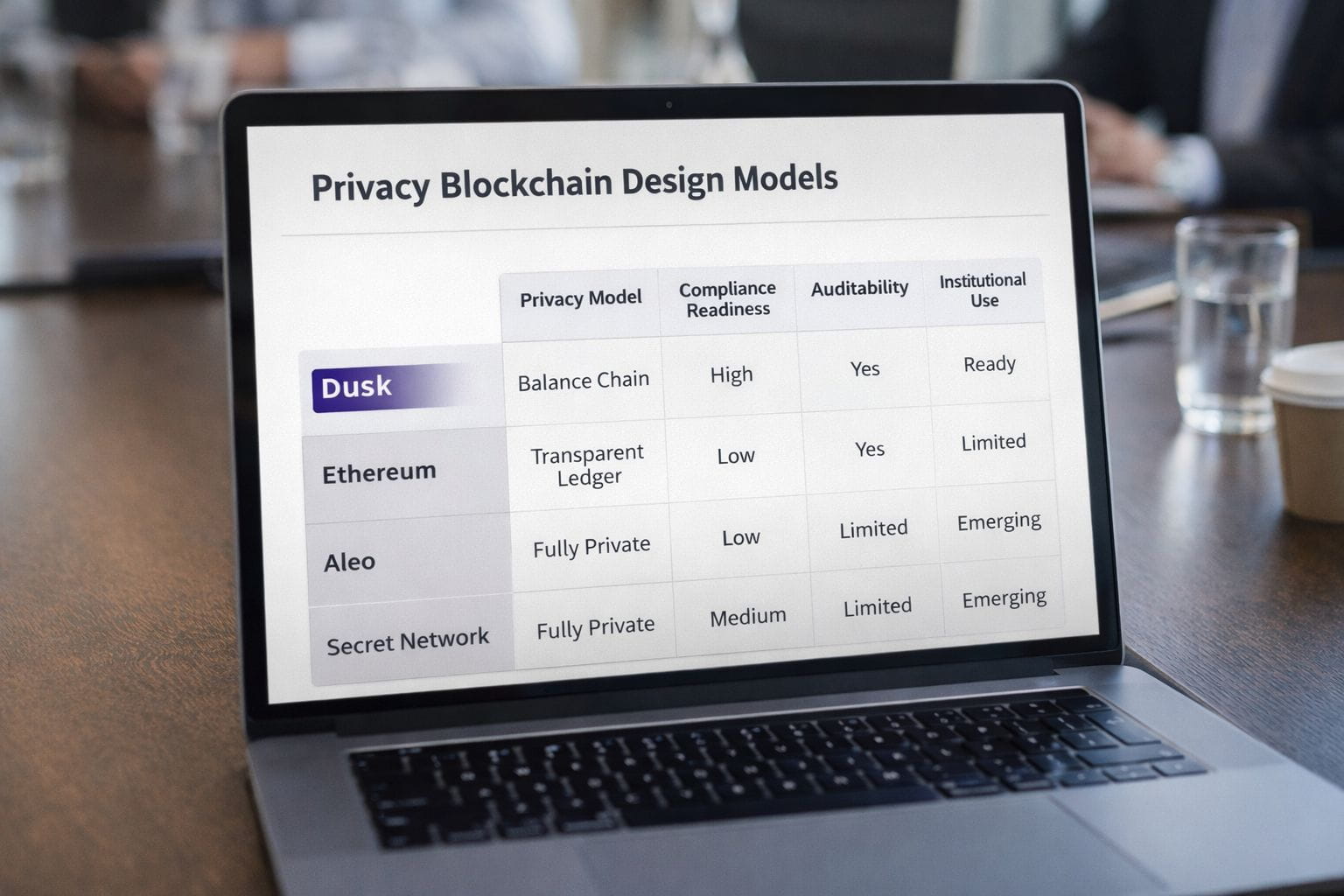

Privacy focused blockchains are often grouped together but my analysis shows their goals differ significantly. Aleo lets developers build apps with privacy built in. Aztec works on making Ethereum more private by adding a new privacy layer. Secret Network takes a different approach it encrypts everything inside smart contracts so user data stays protected. Dusk's objective is narrower and in some ways more ambitious. It is designed for regulated financial use cases where selective disclosure is more important than full anonymity. Institutions do not want invisible transactions. They want controlled visibility. The World Economic Forum's 2023 report on institutional DeFi pointed out something big is regulated markets need selective transparency. That is the real key. Fully public or fully private systems both introduce challenges at scale. Dusk's architecture sits deliberately in the middle where regulatory comfort is highest.

In my assessment this positioning means Dusk is not trying to replace general purpose blockchains. It is building parallel infrastructure for a different class of users namely institutions that move slowly but deploy significant capital once trust is established. You can't really talk about infrastructure without bringing up challenges. For Dusk the big one is how quickly people actually start using it. Institutions just don't move fast getting them onboard takes years not months. If you are looking for quick wins or flashy numbers right away you are probably going to be disappointed. There is also the model piece. Developers usually flock to chains where there is a lot of visible retail action. Institutional platforms like Dusk don't make a lot of noise. They build up slowly working with partners behind closed doors and running pilot projects. Things move forward but if you are watching from the outside you might barely notice. And then of course regulation. Dusk fits well with European rules but globally things are still shifting. If regulators suddenly change their focus it could slow things down even if Dusk's tech is solid. Some visuals would really bring these ideas to life. Picture a chart where Dusk, Ethereum, Aleo and Secret Network sit side by side showing exactly how each one deals with privacy and transparency. Or think about a graph tracking the rise of tokenized assets right next to another line showing how prepared regulators are using numbers straight from BIS and BCG. That kind of comparison makes things a lot clearer. A table that breaks down the different blockchains by compliance, disclosure controls and who they are actually built for could make it clear why Dusk is not just another layer one. It's playing a different game. So after looking at how institutions act what regulators are signaling and where blockchain design is headed one thing stands out. The next phase of blockchain adoption will not be driven by louder narratives or faster blocks. It will be driven by systems that align with how finance actually works. Dusk Foundation is building infrastructure for that reality. By embedding privacy, compliance and auditability directly into its layer 1 design, it addresses problems most blockchains still avoid. In a market that often rewards noise Dusk's quiet focus on institutional trust may turn out to be its strongest long term advantage.