I didn’t start thinking seriously about real-world assets on-chain because of yield or innovation. I started thinking about them because of friction.

A while back, I was looking into how traditional securities actually move behind the scenes. Not trading on a screen, the real process. Settlement cycles, custodians, compliance checks, reporting delays. What surprised me wasn’t how slow it was. It was how many people quietly accepted that slowness as the cost of being regulated.

That’s the problem RWA conversations often skip.

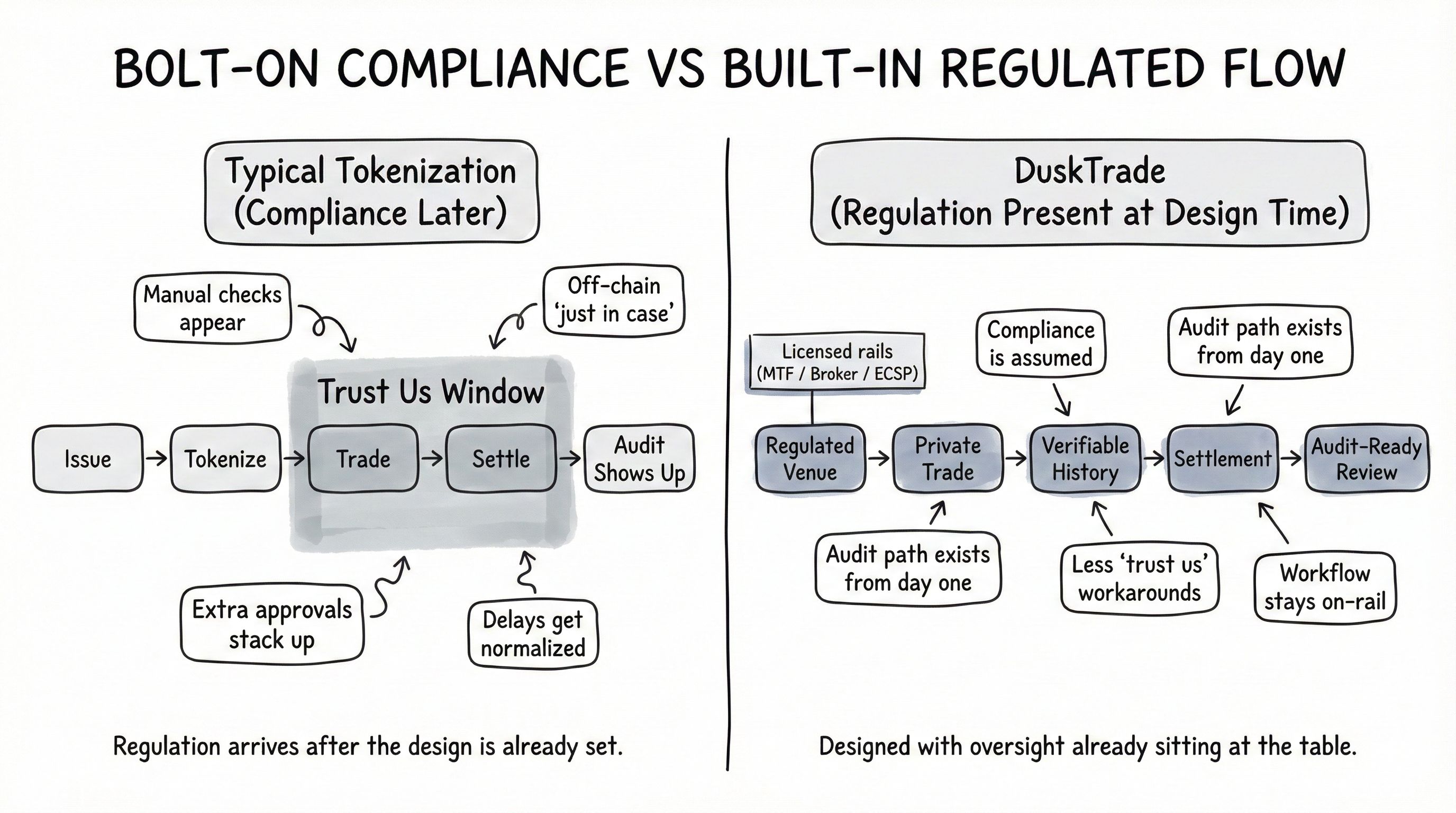

Everyone talks about tokenization as if the hard part is putting assets on a blockchain. It isn’t. The hard part is making those assets live in an environment where regulation doesn’t feel like an afterthought. Where compliance isn’t bolted on later. Where institutions don’t have to choose between privacy and auditability.

That’s where Dusk (@Dusk ) started to feel relevant to me, especially when I looked into DuskTrade, Which launched starting of this month.

The detail that made me pause wasn’t the tech. It was the partnership. DuskTrade is being built with NPEX, a regulated Dutch exchange that already operates with MTF, Broker, and ECSP licenses. That matters, because it shifts the conversation. This isn’t a crypto platform hoping regulators adapt. It’s a platform designed with regulation already sitting at the table.

One number stood out: €300M+ in tokenized securities expected to come on-chain through DuskTrade.

That number isn’t impressive because it’s big. It’s impressive because it represents assets that already exist in regulated markets, with reporting obligations, investor protections, and oversight requirements. Bringing that volume on-chain only works if the infrastructure is built to handle scrutiny without breaking its own rules.

Here’s the core problem as I see it:

Most blockchains are optimized for openness first. Regulation comes later, usually as a compromise. Institutions don’t operate like that. They assume audits will happen. They assume transactions will be reviewed. They assume someone will ask uncomfortable questions months or years down the line.

DuskTrade feels like a response to that assumption.

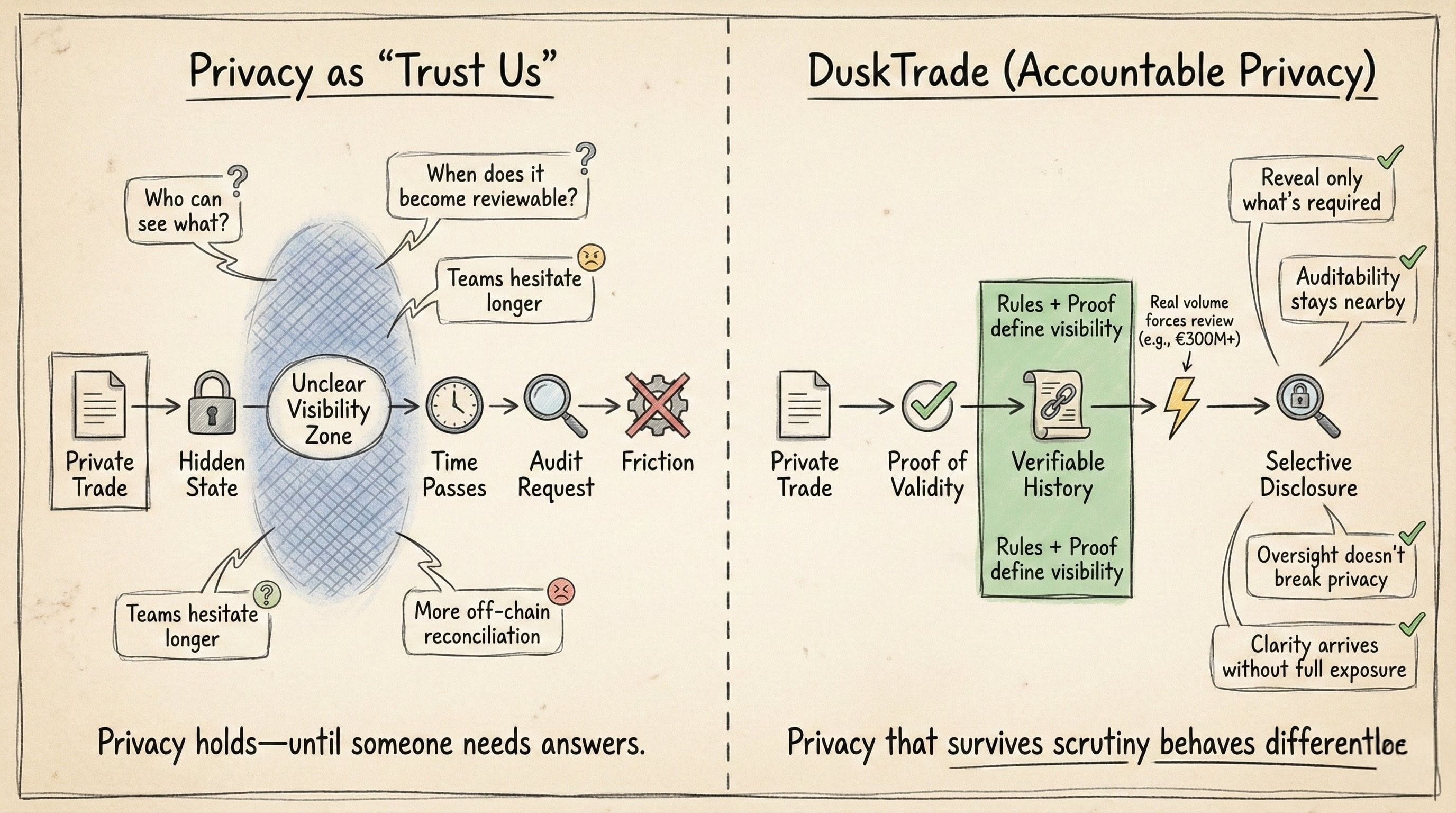

Instead of treating compliance as friction to minimize, it treats it as a constant condition. Trading and investment flows are designed to be private where appropriate, but auditable when required. Not “trust us” privacy, accountable privacy. That’s a subtle difference, but it changes behavior.

I’ve seen how institutions hesitate when systems aren’t built for this. They slow down. They add manual checks. They keep parts of their workflow off-chain “just in case.” That hesitation is a cost, even if no one puts it on a balance sheet.

The solution DuskTrade proposes isn’t speed. It’s alignment.

By building on a regulated, privacy-focused layer-1 blockchain, Dusk is creating an environment where tokenized securities don’t have to pretend they’re something else. They can behave like financial instruments are expected to behave, with clear ownership, verifiable history, and controlled disclosure.

What I find most interesting is how this shifts responsibility. When compliance is built in, there’s no illusion that shortcuts will go unnoticed. Systems become quieter, but stricter in a way that doesn’t announce itself. Decisions take longer. Assumptions are tested earlier.

That’s not exciting in a hype sense. But it’s exactly how real financial infrastructure evolves.

For me, DUSK now represents less of a speculative asset and more of a signal about direction. A direction where blockchain stops trying to outpace regulation and starts coexisting with it. Where real-world assets don’t get “ported” on-chain as an experiment, but integrated as part of a system designed to hold them responsibly.

DuskTrade’s feels like a checkpoint, not a finish line. A moment where we see whether compliant, privacy-aware infrastructure can actually carry real volume without losing its discipline.

If it works, it won’t look dramatic.

It’ll just feel… normal.

And in regulated finance, that’s usually the hardest thing to build.