The next phase of blockchain competition is not about throughput wars or narrative dominance. It is about stablecoin infrastructure. As crypto matures, value transfer is shifting away from speculative velocity toward predictable, repeatable financial flows. Stablecoin infrastructure is where blockchains are now being stress-tested, and many designs are quietly failing.

Stablecoin infrastructure exposes weaknesses faster than any other workload. Fee volatility, execution variance, and network congestion all become immediately visible when users expect transactions to behave like financial utilities. This is why evaluating blockchains through the lens of stablecoin infrastructure produces very different conclusions than evaluating them through market hype.

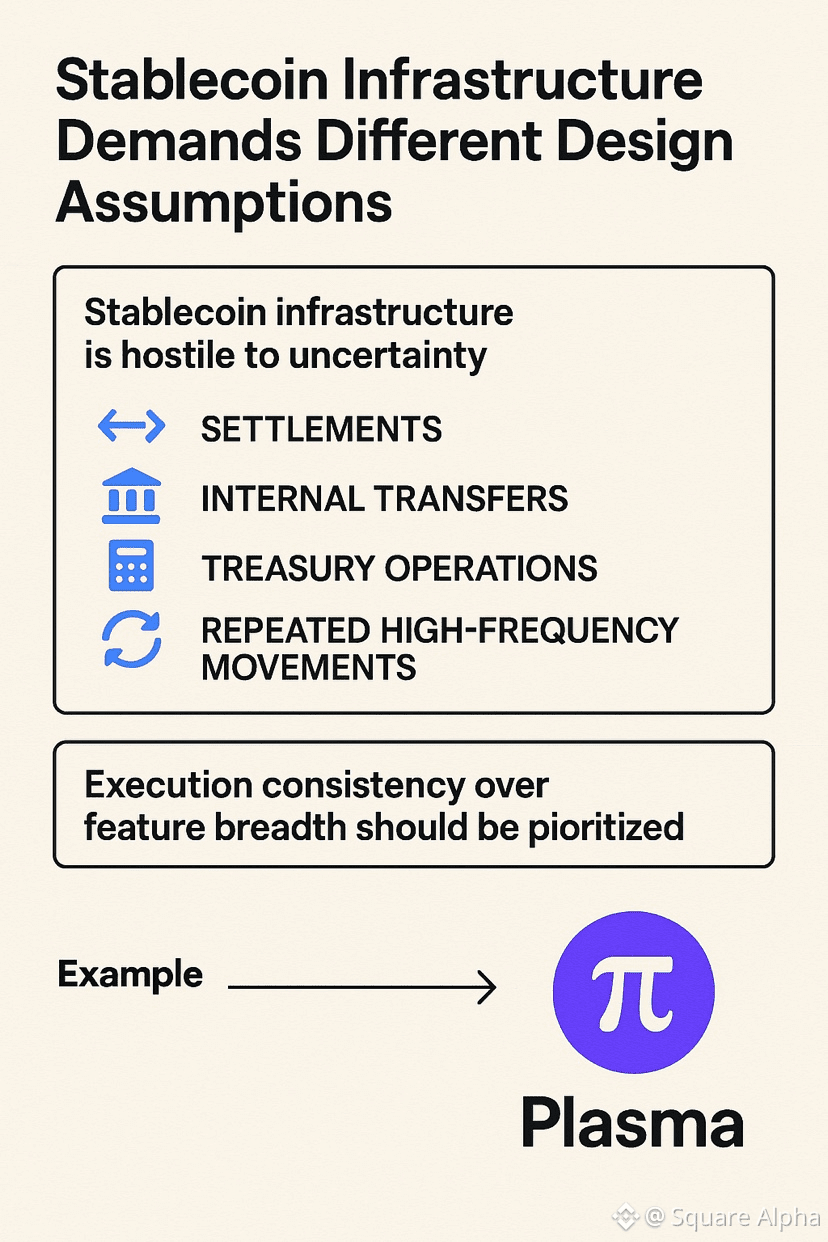

Why Stablecoin Infrastructure Demands Different Design Assumptions

Stablecoin infrastructure is fundamentally hostile to uncertainty. Unlike speculative assets, stablecoins are used for:

settlements

internal transfers

treasury operations

repeated high-frequency movements

These use cases punish unpredictability. Stablecoin infrastructure must therefore prioritize execution consistency over feature breadth. Chains that succeed in speculative markets often struggle here because their architectures were never meant to behave like financial systems.

This is the context in which @Plasma becomes relevant — not as a general-purpose chain, but as an example of infrastructure built around this constraint.

Execution Predictability as a Stablecoin Infrastructure Requirement

One of the defining traits of viable stablecoin infrastructure is execution predictability. Users must be able to model cost, latency, and transaction outcomes in advance. Systems that rely on dynamic congestion pricing or unpredictable ordering introduce operational risk.

Plasma’s execution model reflects this understanding. Rather than optimizing for maximum composability, Plasma narrows the scope of behavior to reduce edge cases. This conservative execution philosophy aligns closely with how stablecoin infrastructure is actually used in practice.

This is not about innovation theatre. It is about reducing variance.

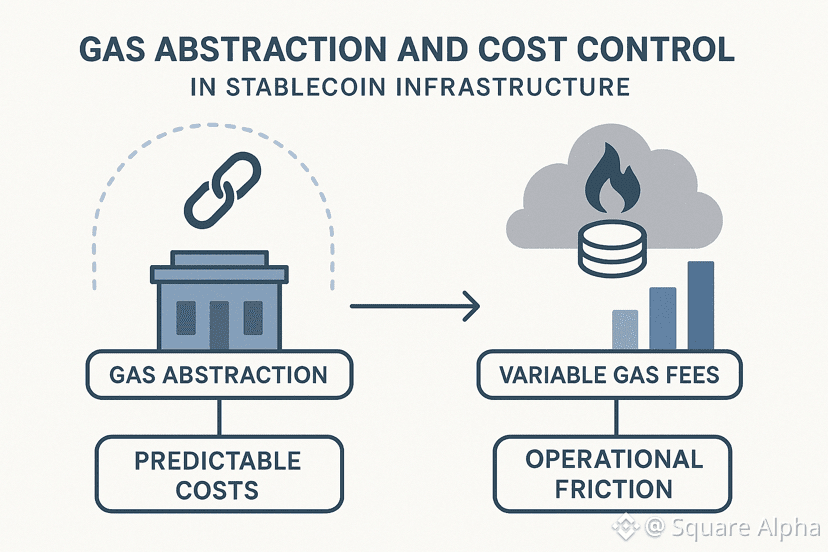

Gas Abstraction and Cost Control in Stablecoin Infrastructure

In stablecoin infrastructure, gas abstraction is not cosmetic. It is a control layer. Financial systems require cost predictability for reconciliation, accounting, and automation. Variable fees create downstream complexity that scales with volume.

Plasma treats gas abstraction as part of infrastructure hygiene. By minimizing fee surprises, it reduces operational friction for stablecoin-heavy workflows. This approach is increasingly necessary as stablecoin infrastructure moves closer to institutional and enterprise use cases.

Chains that treat gas as a user problem rather than a system problem are unlikely to survive this transition.

The Role of Network Tokens Inside Stablecoin Infrastructure

In effective stablecoin infrastructure, native tokens should support the system — not dominate it. Excessive token incentives distort usage and create artificial activity that collapses under real demand.

Within Plasma, $XPL exists primarily as a network-aligned asset rather than a speculative growth driver. This positioning reflects a broader truth about stablecoin infrastructure: sustainability comes from alignment, not emissions.

This is slower to show results, but far more resistant to decay.

Why Stablecoin Infrastructure Rarely Looks “Successful” Early

Stablecoin infrastructure does not produce viral metrics. Its growth is asymmetrical, integration-driven, and often invisible. Systems are adopted quietly, then relied upon heavily. This makes early-stage evaluation difficult and often misleading.

Plasma’s relatively low social signal is not necessarily a weakness — it is consistent with infrastructure that is designed to be depended on rather than discussed. Historically, the most resilient stablecoin infrastructure has emerged this way.

Conclusion: Stablecoin Infrastructure Will Outlast Narratives

As crypto continues to professionalize, stablecoin infrastructure will define which blockchains matter long-term. Reliability, predictability, and execution discipline will outweigh flexibility and hype.

Plasma represents one interpretation of this future — constrained, conservative, and aligned with real financial behavior. Whether @Plasma succeeds depends not on attention, but on whether stablecoin infrastructure demand continues to grow as expected.

If it does, systems built around these principles — and assets like $XPL that support them — will matter long after narratives rotate.