We are at a point in crypto where simply adding "AI" to a project description feels outdated. The pivotal issue is not about which blockchain can operate an AI model, but rather which one is architected at its core for the environments AI will ultimately establish. Much of today's infrastructure approaches AI as a supplementary capability, something to be bolted onto often restrictive, pre-determined systems. This retrofit approach has limits. After examining $VANRY | Vanar Chain's documentation and recent updates, what stands out to me is a design philosophy that flips this model, it starts with the requirements of autonomous intelligence and builds the blockchain up from there. This is the core of being AI first, not AI added.

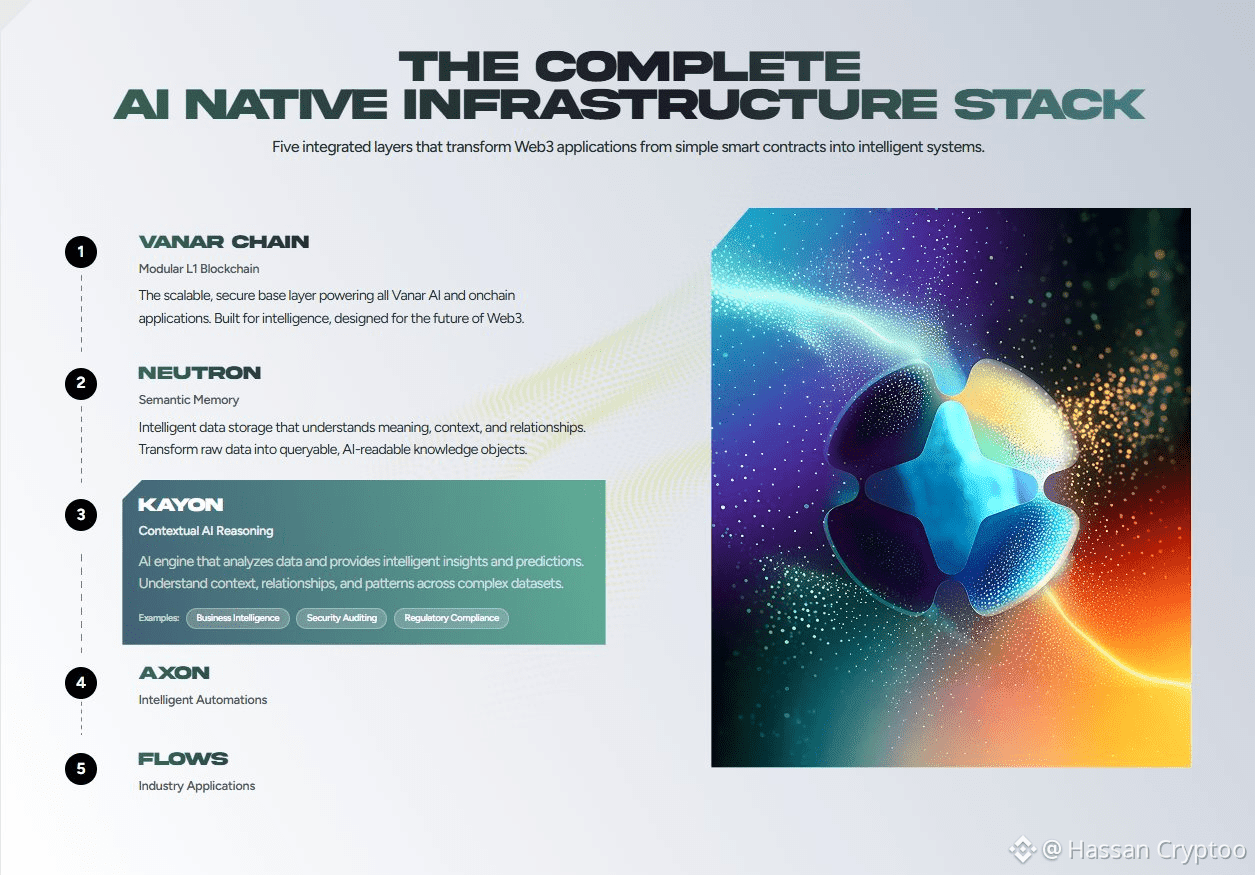

The shift matters because AI agents and systems do not operate like human users. They do not navigate wallets or wait for transaction confirmations in the same way. They require a foundational layer that provides persistent context, verifiable logic, trustless automation, and seamless value transfer. Vanar's architecture, as detailed in its technical materials, targets these four pillars. Let us break down what each one means and how Vanar approaches it, moving past generic speed metrics like TPS to what AI actually needs.

First, native memory. For reliable performance, AI integrated into a blockchain relies on non-stop, stable operation. A blockchain cannot commence from nothing with each additional block. It demands a lasting, progressive condition that recalls prior engagements, user choices, and the context of its operations. This is not just about cheap data storage, it is about memory as a core primitive. Vanar's approach to this is exemplified by a product like myNeutron. My analysis of its described function is that it acts as a persistent memory layer for AI, allowing agents to maintain and recall a dynamic knowledge graph of on chain and off chain events. This is not an external database, it is memory integrated into the chain's state, giving AI a continuous thread of consciousness across interactions.

Then comes on chain reasoning and explainability. An AI can make a decision, but for it to be trusted and acted upon on chain, the "why" behind that decision must be transparent and verifiable. This is where Kayon, another product in Vanar's ecosystem, comes into focus based on its described role. It appears designed to provide a framework for AI models to record their reasoning traces directly on the ledger. Think of it as an immutable audit log for an AI's thought process. This creates explainability, allowing anyone to verify the logical steps an agent took before, for example, executing a trade or approving a loan. It moves AI from a black box to a transparent actor.

The third pillar is automated execution, or flows. Once an AI has perceived a condition through memory and reasoned through a decision, it needs to act without requiring a human to sign a transaction. Vanar Chain necessitates secure, self-executing smart contract workflows that an agent can initiate. The offering called Flows, as described by the initiative, appears to be Vanar's solution. Imagine an artificial intelligence tasked with treasury management. Its parameters can be defined to execute portfolio rebalancing autonomously, triggered solely when on-chain oracles confirm specific market criteria. Here, sophisticated analysis directly enables independent operation, with settlement compliance inherently assured. This translation of logic into action is the critical component commonly missing from hypothetical AI-blockchain discourse. Operational viability for such AI agents necessitates mechanisms for service payment, obligation settlement, and value storage. But they will likely do so through non custodial, programmatic methods, not MetaMask. They also need to interface with real world financial rails. Vanar positions its infrastructure to handle payments not as a demo feature but as a core primitive, emphasizing compliance ready rails. This shows an emphasis on constructing linkages between digitized assets on the blockchain and conventional financial networks, guaranteeing that economic operations powered by artificial intelligence can integrate effortlessly into the wider international economic system. The VANRY token sits at the center of this settlement layer.

Why does this integrated approach matter? Because building these capabilities as separate, bolted on solutions creates friction and security gaps. Native memory that is not deeply linked to the execution engine creates latency. Reasoning logs that are not immutably tied to the resulting action break the trust chain. Vanar's proposition, as I interpret their whitepaper and ecosystem product descriptions, is to weave these four requirements memory, reasoning, automation, settlement into a single, coherent protocol layer. This is the essence of AI readiness. It is not about having the highest theoretical throughput, it is about having the architectural design that matches how intelligent systems natively operate.

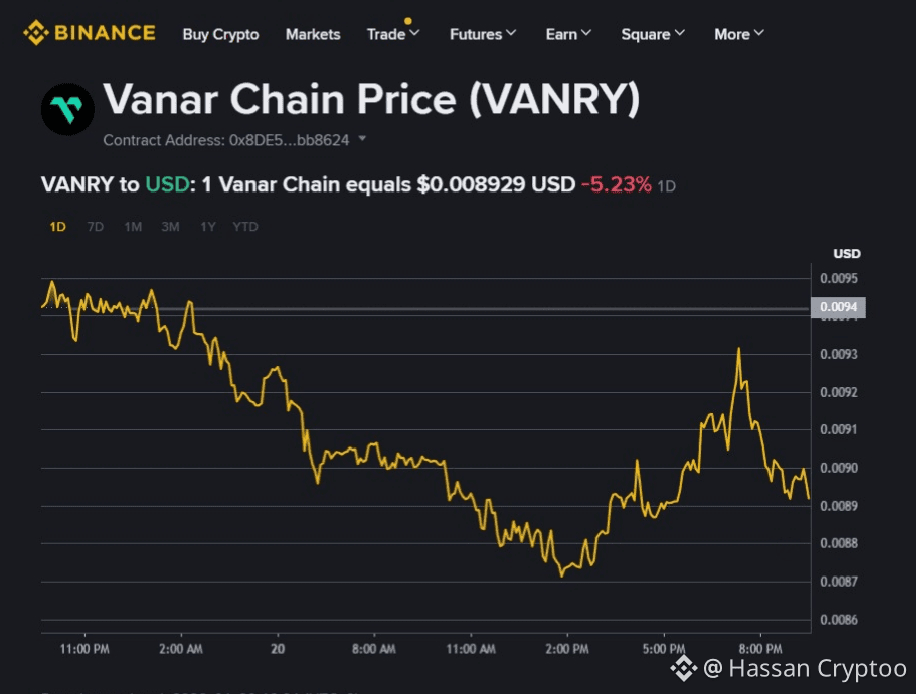

Looking at the current landscape on Binance Spot, $VANRY trades with the volatility expected of a layer 1 token focused on a narrative as potent as AI infrastructure. Consider an AI system tasked with managing a treasury. It could be programmed to independently adjust a portfolio's balance once particular market conditions, verified by on-chain data feeds, are met. This turns smart analysis into self-executing action, guaranteeing proper and rule-following completion. This practical execution is frequently absent from conceptual debates about AI on the blockchain. For effective operation, these AI entities will require the ability to cover service costs, fulfill payments, and store assets.

The broader point is this, the next wave of blockchain utility will not be defined solely by human users transacting faster. It will be defined by autonomous AI agents living and working on chain. For that to work at scale, the underlying chain must speak their language, a language of persistent state, verifiable logic, automatic action, and fluid value transfer. Vanar Chain's entire technical and product thesis appears built around this premise. Whether this focus on deep, integrated AI readiness translates into sustained developer traction and agent adoption is the key variable to watch. It is a long term infrastructure bet on a future where the most active "users" on a blockchain might not be people at all.

by Hassan Cryptoo