Think about this: a blockchain that handles zero-knowledge proofs in milliseconds, hums along smoothly on your phone without gulping down your battery, and still manages to process regulated financial deals worth hundreds of millions. That’s not some sci-fi wish list. That’s what Dusk Network is actually doing right now. I’ve watched plenty of chains come and go, but Dusk cuts through the noise. It’s efficient, obsessed with privacy, and somehow makes heavyweight tech both practical and scalable for real-world finance.

Dusk isn’t some new kid on the block. It’s a Layer 1 chain that’s been in the works since 2018, built to pull traditional finance into the decentralized age. The whole point is compliant privacy. Your transactions stay confidential, but regulators can still audit them when they need to. The tokenomics? There’s a hard cap of 1 billion tokens, with about half already circulating. They’ve stretched out the release over 36 years, and with a 5% fee burn, they keep inflation in check (node rewards only add about 3% at the start). But for me, the real kicker is performance. With over 206 million DUSK staked across 200+ provisioners, the network already runs about 1,200 transactions a day—and it’s built to scale up from there.

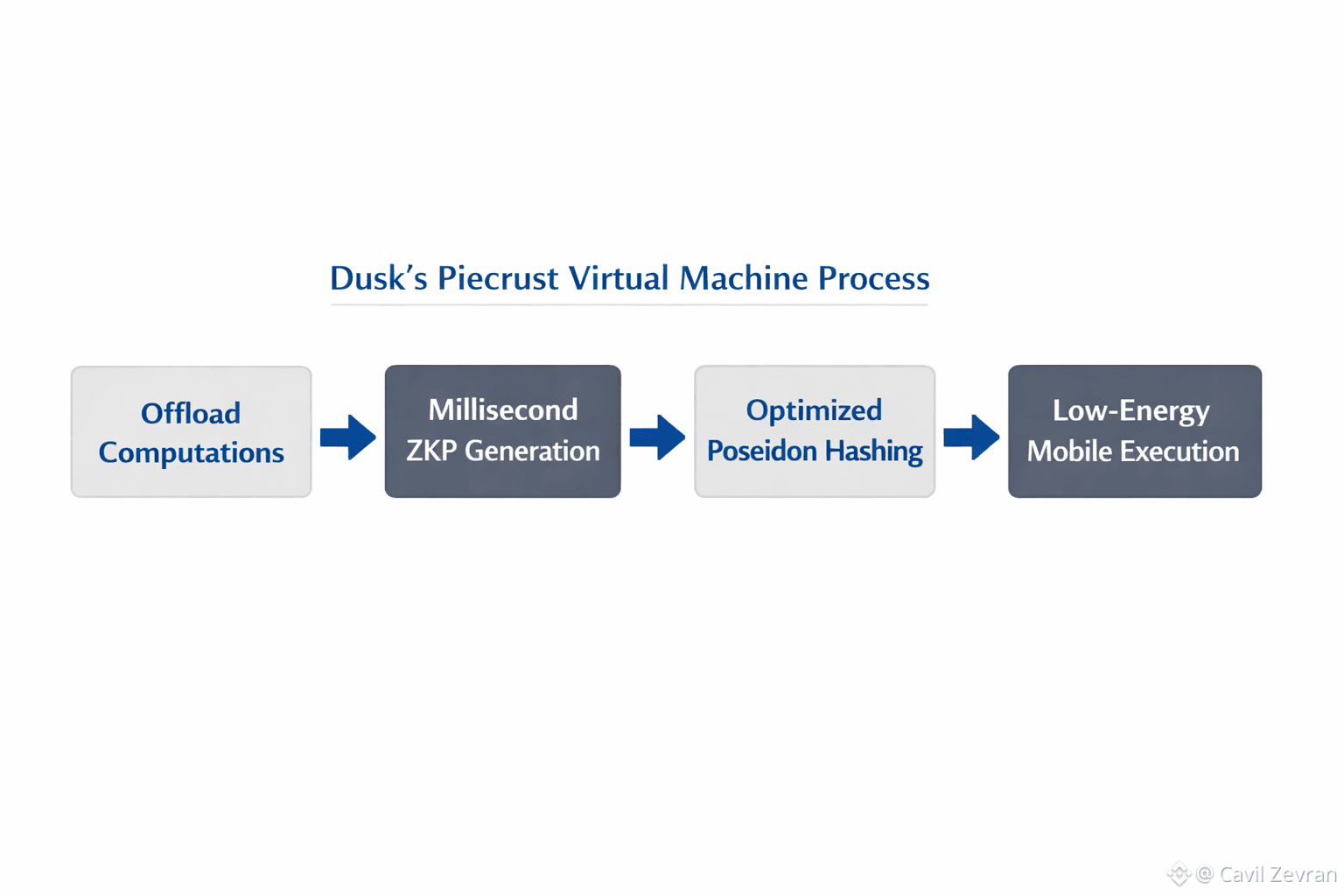

Get into the tech, and you see why devs love building here. The Piecrust virtual machine pulls off something wild: it offloads the heavy math, so zero-knowledge proofs happen in milliseconds. Even on a regular phone. This isn’t just marketing fluff. Dusk uses hashing algorithms like Poseidon to keep CPU use low, so privacy doesn’t come with a nasty energy bill. Most ZK systems drag down hardware, but Dusk makes it all work on devices you use every day. That means you can build mobile-first financial apps that don’t have to trade off speed or security.

The consensus side is just as sharp. Dusk uses an Isolated Byzantine Agreement (SBA) system, with a private leader selection called Proof-of-Blind-Bid. Zero-knowledge proofs run through every stage—verification, reduction, agreement—so the network stays rock-solid against attacks while privacy stays intact. Unlike other blockchains that spill everything for the world to see, SBA keeps things tight. Staking and participation incentives are all tied to the DUSK token. The upshot? Fast, frequent settlements, no energy waste, and none of the centralization headaches you get from some proof-of-stake systems.

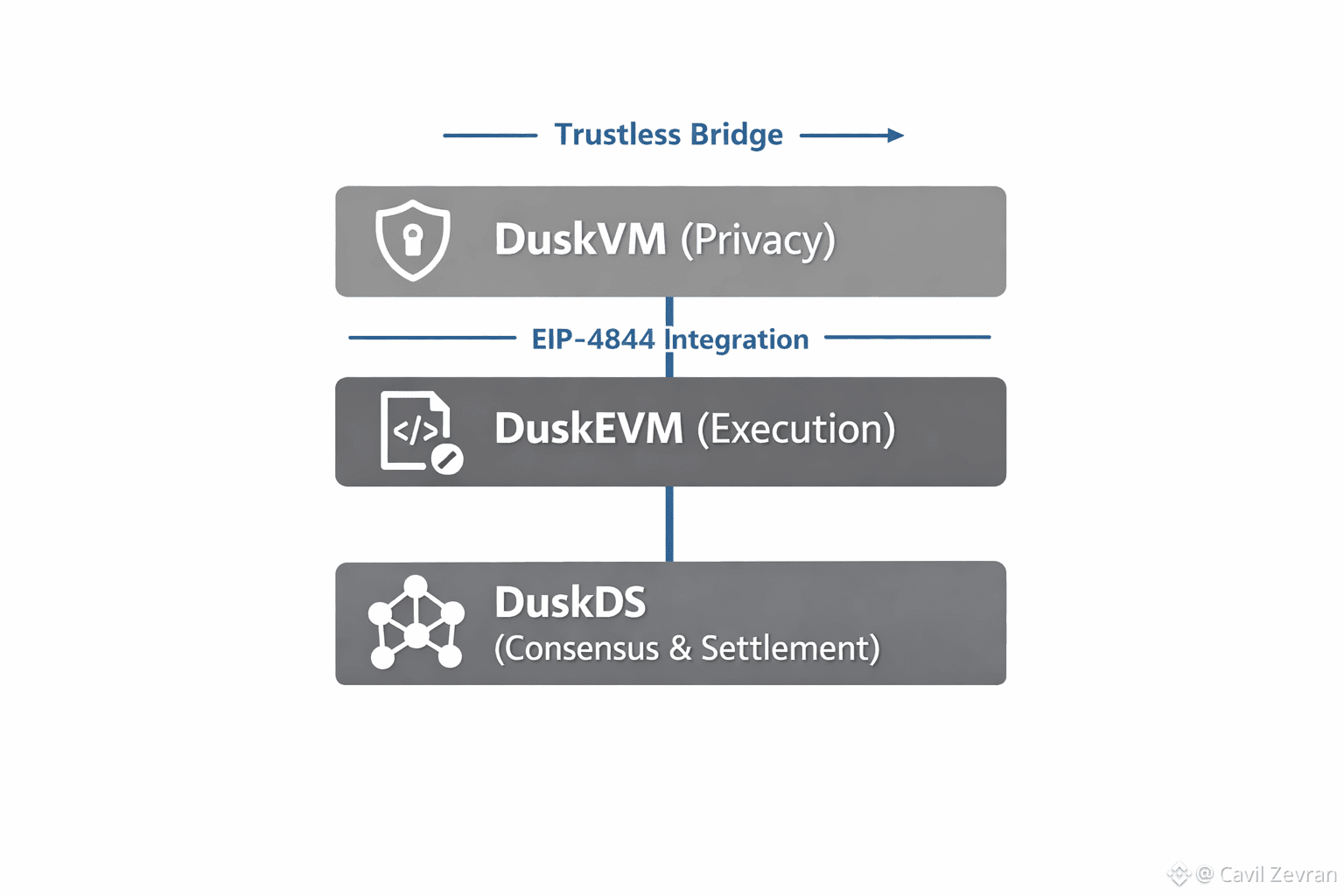

What really pulls it all together is Dusk’s modular architecture. The stack splits into three: DuskDS (handles consensus, data, and settlement), DuskEVM (runs the execution layer), and the soon-to-drop DuskVM for even deeper privacy. DuskEVM speaks Solidity, so you can use tools like Hardhat and MetaMask and settle right onto Dusk’s L1. They’ve baked in lessons from Ethereum’s EIP-4844 and added a MIPS-based pre-verifier, so node requirements stay sane. For institutions, this is gold. Integration drops from months to weeks, and costs plummet—sometimes by a factor of 50, compared to building a custom chain.

Now let’s talk about Hedger, Dusk’s privacy engine, which is already up and running in Alpha. It’s changing the game for how EVM deals with sensitive data. Hedger blends homomorphic encryption (using ElGamal over elliptic curves) with zero-knowledge proofs, making transactions confidential and scrambling order books to shut out front-runners and manipulators. It uses a hybrid UTXO-account model, so you get smooth cross-layer action and end-to-end encryption, with the option to open things up for compliance when needed. Proofs clock in at under two seconds in your browser—totally workable for real-time apps. This isn’t just blanket anonymity, either. It’s targeted privacy that actually satisfies MiCA rules in the EU, which matters when auditability isn’t optional.

All this tech isn’t just for show. Dusk is going after real-world assets, and they’re already working with NPEX, a regulated Dutch exchange, to tokenize over €300 million in securities. Stuff that used to be stuck in old-school financial silos now moves instantly, no custodian needed, through a trustless bridge. The Citadel protocol adds another layer—think ZKP shields between your device and the chain for real data control—while integrations like Chainlink keep settlements reliable. It’s not just theory anymore. This is happening.