Let’s be honest—stablecoins have always felt like crypto’s sleeping giants, stuck behind a wall of regulations that make true global adoption feel out of reach. But Plasma is changing the game. It’s quietly building a Layer 1 that doesn’t just move fast, it’s built for a world where the rules keep getting tighter. I’ve watched plenty of blockchain projects collapse under regulatory pressure, but Plasma is thriving. Instead of dodging the rules, it leans into them. That’s how it’s turning what should be roadblocks into express lanes for stablecoin movement. This isn’t about hiding from oversight—it’s about building rails that regulators actually want to see. That’s why Plasma looks ready to unlock trillions in compliant value transfer.

At its core, Plasma is all about settling stablecoins. It’s engineered to fit right in with new rules—think the EU’s MiCA legislation. That’s not a lucky accident. Plasma has a Virtual Asset Service Provider (VASP) license, so it can operate in regulated markets for real. They even set up shop in Amsterdam to push into the EU. What does that actually mean? Plasma draws clear lines between different kinds of payment activities, making it easy for regulators to check the right boxes—without sacrificing the speed and efficiency you want from on-chain transfers. By keeping stablecoin transfers separate from the deeper plumbing, Plasma cuts down on settlement risks and headaches like unpredictable fees or network jams that cost the industry billions every year.

You see this regulatory focus right in Plasma’s tech. Everything is built for predictability and auditability, which is exactly what big institutions need if they’re going to play by the rules. Developers can bring over Ethereum smart contracts as-is, thanks to full EVM compatibility through Reth. But Plasma tweaks things for stablecoin use: you get gasless USDT transfers (the protocol pays the fees), sub-second settlement with PlasmaBFT, and the ability to pay fees in USDT for easier accounting. The whole thing is anchored to Bitcoin, so you get neutral, censorship-resistant security too. It’s like building a fast highway on top of Bitcoin’s rock-solid foundation—your transactions go through, even when things get busy, and you don’t have to worry about MEV attacks or wild market swings messing things up.

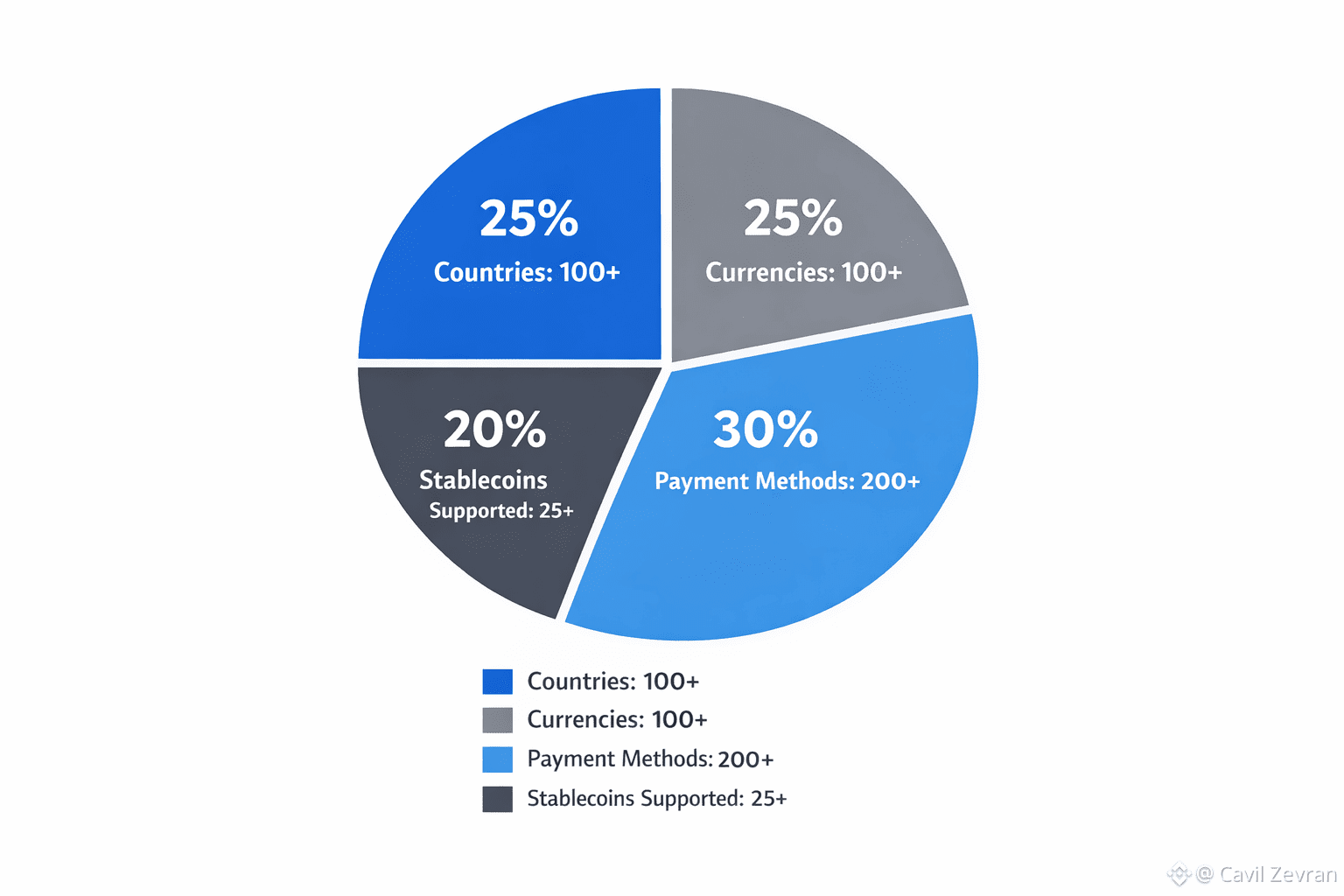

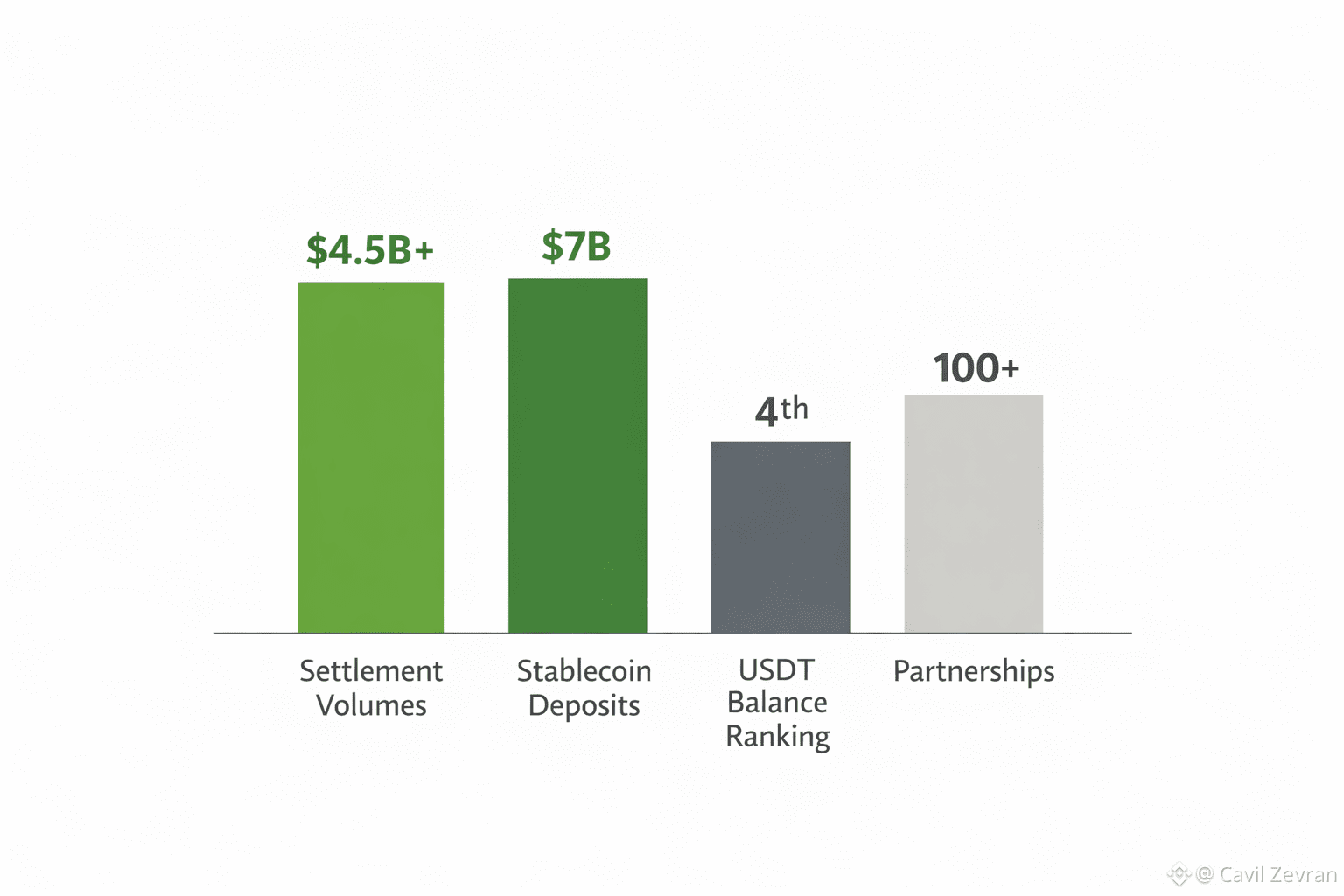

And this compliance-first approach isn’t just talk. Plasma has already settled over $4.5 billion in USD, handled $7 billion in stablecoin deposits, and now ranks fourth in the world by USDT balance. It supports more than 25 stablecoins—big names like USDT and USDS, plus regional options like Argentine Pesos and Indonesian Rupiah. Altogether, we’re talking 100+ currencies and 200 payment methods in 100 countries. That kind of reach makes it perfect for compliant cross-border payments, especially where banks and legacy systems bog down with delays and high fees. Plus, Plasma’s modular setup allows for real-time audits. That’s a major win for enterprises that have to stay transparent under rules like MiCA, which cares a lot about how assets are classified and risks are managed.

The partnerships driving Plasma’s growth show just how serious it is about regulation. Heavyweights like Bitfinex, Founders Fund, Framework, Flow Traders, DRW, and Shine Capital have all backed the project. On day one of the mainnet beta, $2 billion in stablecoins were already in play, spread across 100+ partners. In the MENA region, groups like Yellow Card, Prive, and Walapay are building compliant stablecoin rails, while the VASP license in Europe lets fintechs tap into licensed payment infrastructure. These aren’t just big names for press releases—they actually deliver zero-fee USDT transactions for real users in regulated markets, where holding native gas tokens could cause compliance headaches. Plasma’s Paymaster protocol takes care of those fees behind the scenes, giving businesses the predictability they need.

But what really sets Plasma apart is how it cuts out the extra steps in every transaction. It compresses verifications and keeps irrelevant data from spreading, which helps everything run smoother when volumes spike. That’s key in regulated markets—delays invite unwanted attention or even fines. With over 1,000 transactions per second and block times under a second, Plasma can handle serious scale. It’s built for businesses running payments, remittances, or big treasury flows that all need to comply with AML and KYC standards. If a stablecoin fails, Plasma treats it as a design problem, not just bad luck. The goal is to make the whole system so stable and boring that you only notice it when something actually goes wrong—which, honestly, is exactly how compliant money should move.