Imagine if the next big wave of Web3 users does not show up just for profit or complicated DeFi tools but because they find something that actually feels fun and familiar. That's the bet Vanar Chain is making. When I first began exploring vanar, I wasn’t looking for hype or quick price moves. I was looking for adoption pathways that actually make sense outside crypto circles. Most Layer 1 blockchains still feel like they are built for developers and traders first and general users second. In my assessment, Vanar's ecosystem flips this assumption by focusing on gaming, metaverse engagement and brand solutions real experiences that everyday people can connect with and that's why VANRY is a token tied to participation not just speculation.

My research into adoption data revealed that mainstream users gravitate toward environments they already understand. Look at the numbers is Newzoo’s 2024 global gaming report says over 3.3 billion people play games worldwide. But only a tiny slice of them are into blockchain gaming. Still, things are changing fast. DappRadar's 2025 data shows blockchain gaming transactions shot up by more than 200% in just a year. It's not just developers getting busy people are actually showing up and doing things on-chain. These trends matter. They show where real attention is going, not just where the tech is being built.

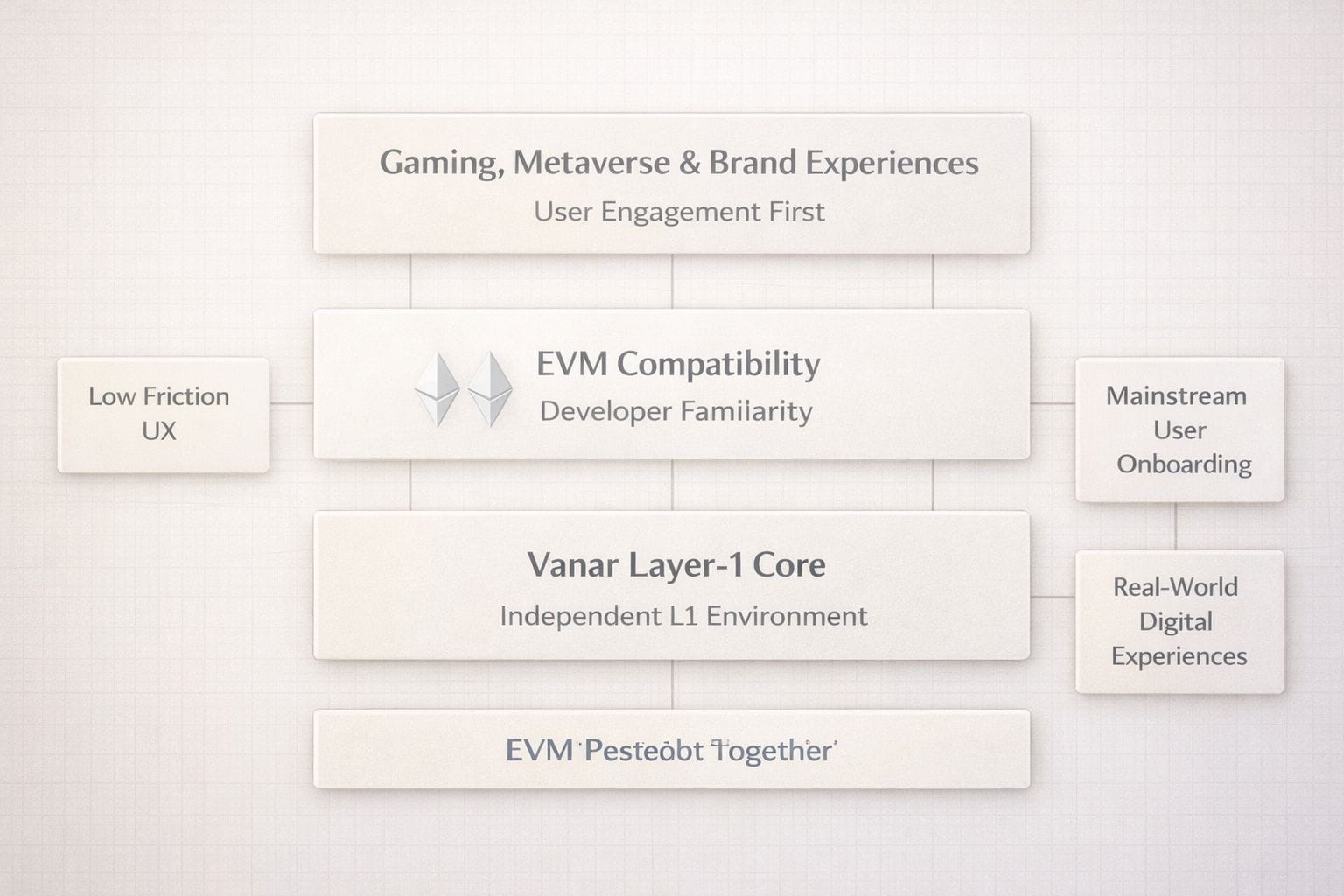

What really pulled me into Vanar’s story is how it’s designed. Vanar runs as an EVM-compatible Layer 1 blockchain, so developers get an environment they already know. But it’s not just about familiarity Vanar focuses on making things engaging and smooth for users. Electric Capitals survey shows over 70% of smart contract developers stick with EVM ecosystems. That’s a big reason why compatibility is such a big deal here. But beyond compatibility Vanar foregrounds UX in ways that most chains overlook. It’s like building a highway and then adding comfortable rest stops with services people actually want to use.

I remember thinking about this like online platforms in Web2. Early social networks didn’t win because they were technically superior; they won because people found meaning in using them. Vanar’s all about gaming, AI, and letting people really interact with brands. Instead of just showing off what their tech can do, they’re building a place where you can actually play, explore, and mess around without feeling like you’ve left the digital spaces you already know.

They’re not stopping there either. Vanar throws in AI-driven solutions and eco friendly tools, which tells you they see blockchain as way more than just a way to move money around. PwC’s 2025 AI outlook backs this up over half the companies looking into blockchain also plan to blend in AI. Vanar’s take on AI points to a future where blockchain is not just some static ledger. It’s more like a living digital world that responds and adapts to what people do, kind of like your favorite apps that seem to know what you want before you even ask.

When I look at Vanar alongside other crypto adoption strategies, the contrast jumps out. Layer 2 on Ethereum, for example, push over 1.9 million daily transactions thanks to lower fees and better throughput. But they still lean on the main chain for security, and honestly, most users don’t notice much difference same mindset, just faster and cheaper. Solana’s all about speed. It can handle hundreds of thousands of transactions per second when things are humming. Still, it struggles to reach people outside the usual crypto crowd. Getting new folks on board isn’t easy, no matter how fast the tech is.

Vanar by contrast meshes performance with familiarity. It controls its own Layer 1 environment and simultaneously builds products that resemble experiences users already enjoy. Messari’s 2024 infrastructure report notes that the majority of daily active users are still on just a handful of chains, which means distribution and real engagement are more important than raw specs. Vanar’s network encompassing gaming like the Virtua Metaverse and the VGN Games Network is structured around where people spend attention, not just where they deploy capital.

Still, this kind of positioning isn’t without its challengs. Adoption curves can swing all over the place, and there’s no promise that Web2 users will stick with Web3 experiences. DappRadar’s retention numbers say a lot most blockchain games lose people once the initial buzz fades. If Vanar’s main offerings don’t keep people coming back, the whole story about big adoption takes a hit. The VANRY token too needs steady use and activity in the network to hold up its value. When the market turns cautious and Bitcoin starts dominating, mid-cap tokens like this usually just go sideways. All these unknowns make one thing clear is even the best designed models need time, patience and a bit of extra momentum from outside to really take off.

A Strategic Trading Perspective

From a trading standpoint, my approach separates conviction in the ecosystem from tactical execution. If you look at VANRY's price history, you can actually spot where people have been buying in those key support zones. Resistance bands stand out too, showing where sellers have stepped in before. My approach? I like to add to my position when the price hangs around those strong support levels but I always set stops just below them to keep uncertainity in check. When the price pushes up toward resistance, I’ll take some profits off the table, but I don’t close everything. That way, I still stay in the game if momentum keeps going.

To paint a clearer picture, imagine a long-term price chart. I’d mark out those accumulation zones and resistance levels to show where buyers and sellers have clashed over time. Another angle I’d look at: daily active user growth, especially on chains focusing on gaming and the metaverse. That helps put Vanar’s progress next to its rivals. I’d also pull together a table comparing Layer 1 adoption stats like how well users stick around what transactions cost, and how active developers are against Layer 2 options, just to lay out the real differences.

Looking at these visuals and data points helps frame Vanar not just as another technical solution but as a layered network with real engagement potential. When adoption narratives align with where user interest already lies, the probability of organic growth increases and that's reflected in on-chain activity metrics rather than speculative volume alone.

My Final Reflections

After weeks of analyzing Vanar Chain from both a technical and market perspective, I don’t see it as another speculative L1 chase. What I see is a chain purpose-built for experiences that resonate with users outside crypto bubbles. My research suggests that Web3’s next wave won’t come from deeper protocol abstractions or faster numbers it will come from interfaces that feel familiar and rewarding. Vanar’s ecosystem, with its focus on gaming, AI interactivity, and brand applications, positions it close to that emerging future. So here’s the fundamental question I keep asking myself is when the next billion users log into digital environments, will they care that the backend is a blockchain, or will they simply care that the experience feels seamless and engaging? If the latter is true, then vanar and VANRY might well be building the very foundation those users step onto.