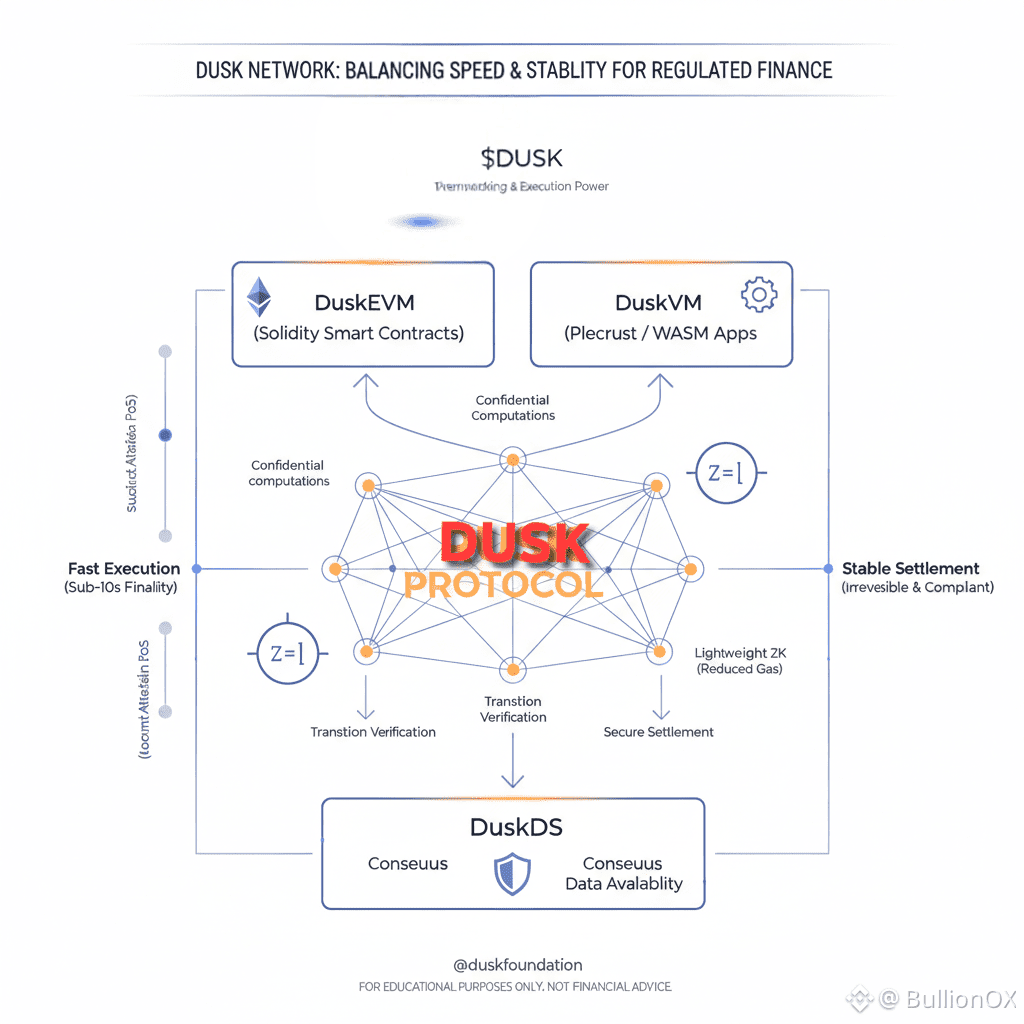

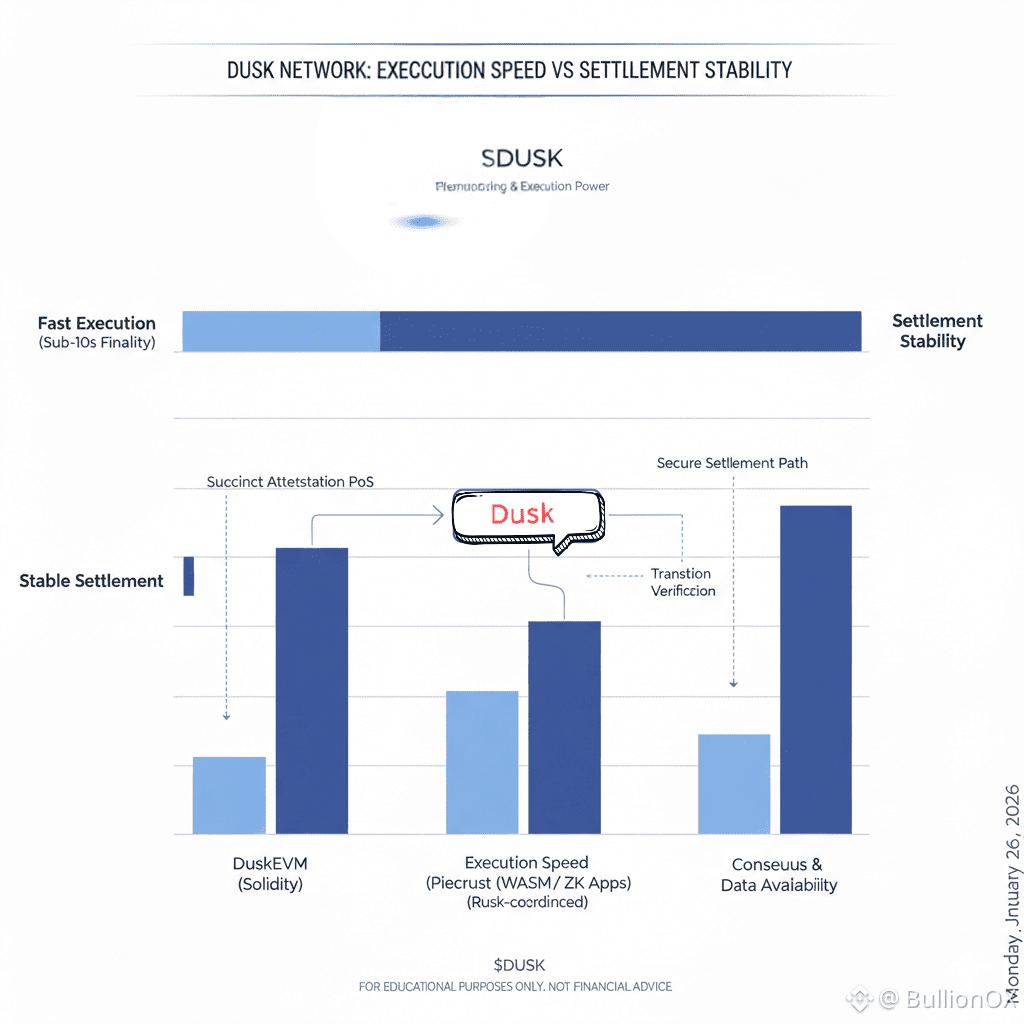

The aspect that interested me the most when I first explored the layered design of Dusk Network was the way DuskDS can be used as the basis to balance between execution speed and rock solid settlement. Efficiency mandates the fast processing of the blockchain in finance, whereas institutional trust requires stable settlement to be reached. DuskDS attains this by holding consensus and data availability and harmonizing with execution layers, such as DuskEVM and DuskVM. The heart of this design is the Rusk protocol and this serves as the state transition mechanism that provides balance on the layers.

Rusk deals with the state transitions between execution and settlement, which includes transitions to avoid instability. DuskDS relies on the Succinct Attestation Proof of Stake to reach a consensus, allowing quick finality of blocks, around ten seconds, with normal conditions, by isolating validation to randomly chosen committees. This containment also enables fast attestations and does not overload the network. Rusk will then confirm such transitions, where DuskEVM and DuskVM end up safely on DuskDS.

The EVM compatible implementation layer, named DuskEVM, aims at rapid Solidity contract execution. Rusk fulfills this speed by applying deterministic state transitions prior to settlement in DuskDS. Contracts might run effectively and the private computations are enclosed in zero knowledge proofs, so that the speed of operations does not affect the stable data availability. This is necessary to real world finance, where quick execution cannot lead to a compliant and irreversible settlement.

Piecrust, which is also called DuskVM, is a complement to this architecture that uses WASM based execution optimized in favor of confidential programs. Rusk aligns Piecrust outputs to DuskDS with low latency zero knowledge operations and verifiable and auditable settlement. DuskDS provides long term settlement guarantees that financial institutions can develop fast user facing applications.

This balance is maintained in lightweight zero knowledge circuits as proposed by Rusk in order to keep the cost of this balance down to gas consumption on transitioning and keeping the computational load enclosed. The DUSK token is one of the tokens that can be used to subscribe to this system by staking DuskDS and enabling the execution of Rusk, which aligns the economic incentive with the speed and stability.

In my view, the combination of these layers has Rusk in a particularly good position to coordinate them, and so Dusk is particularly well matched to regulated finance, where the speed of execution must not be at the cost of settlement certainty. It is a design made towards privacy oriented long term financial infrastructure.

What do you think Are the most appropriate ways to trade off speed and stability in the layered architectures?

What do you consider to be the greatest challenge with zero knowledge integrated settlement systems?